Student loans have been a crucial tool for financing higher education for decades. In 2026, they continue to play a central role in helping students pursue their academic and professional goals. However, with the rising cost of education and changes in the economic landscape, it's important for borrowers to stay informed about their loan options, repayment plans, and strategies for managing student debt.

In this blog, we’ll cover what you need to know about student loans in 2026, including the different types of loans available, repayment options, and tips for managing student debt effectively.

Types of Student Loans in 2026

When it comes to student loans, there are two primary types: federal student loans and private student loans. Both come with their own advantages and drawbacks, and understanding the difference is crucial for making informed borrowing decisions.

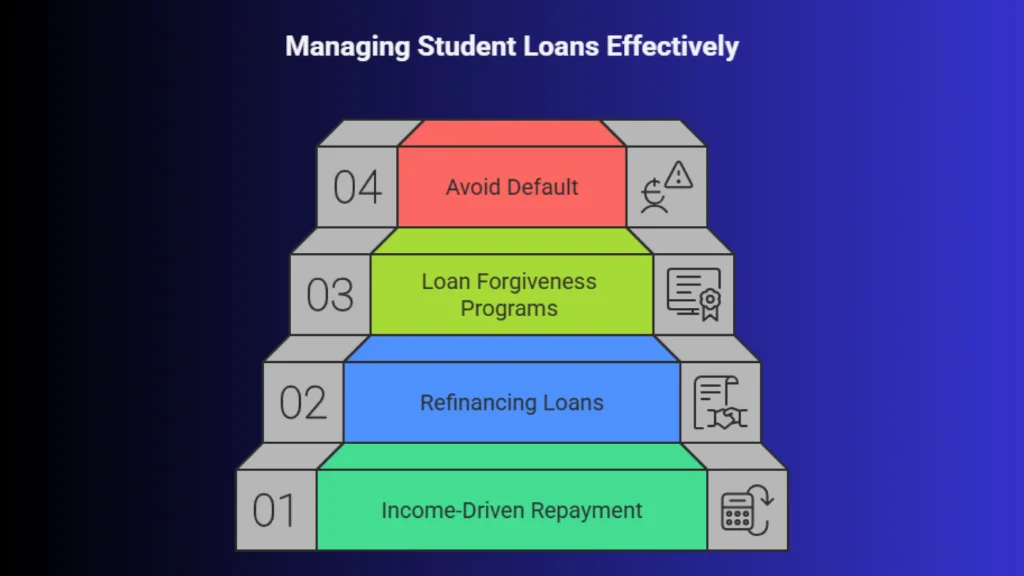

Learning how to manage student loans effectively can help borrowers reduce long-term interest costs and stay financially secure.

1. Federal Student Loans

Federal student loans are funded by the U.S. government, and they come with a number of benefits, including fixed interest rates, flexible repayment options, and the possibility of loan forgiveness.

Subsidized vs. Unsubsidized Loans: Subsidized loans are based on financial need and do not accrue interest while you’re in school. Unsubsidized loans are available to all students, and interest starts accruing as soon as the loan is disbursed.

Income-Driven Repayment Plans: Federal loans offer income-driven repayment plans, which base your monthly payments on your income and family size. This can be a great option for borrowers who may not be able to afford standard repayment amounts.

Public Service Loan Forgiveness (PSLF): For those working in qualifying public service jobs, federal loans may be eligible for forgiveness after 10 years of qualifying payments.

Federal loans are generally considered the best option for most students due to their borrower protections and favorable terms.

2. Private Student Loans

Private student loans are offered by banks, credit unions, and online lenders. These loans are not backed by the government, and their terms can vary significantly from lender to lender.

Variable vs. Fixed Interest Rates: Private loans often come with variable interest rates, which can change over time, leading to fluctuating monthly payments. Fixed-rate loans provide more stability with predictable payments.

Creditworthiness: Private lenders typically assess your credit history and financial standing when determining loan eligibility and terms. Borrowers with strong credit may secure better interest rates, while those with weaker credit may face higher rates.

Limited Repayment Flexibility: Unlike federal loans, private loans generally offer fewer repayment options, and they may not have the same protections in place, such as deferment or forbearance.

While private loans can be useful to fill the gap after federal loans, they often come with less favorable terms and fewer borrower protections.

Repayment Strategies for Student Loans in 2026

Once you’ve taken out student loans, managing them effectively is key to avoiding financial strain. You can take control of your finances when you actively manage student loans through budgeting, refinancing, or structured repayment plans. Here are some repayment strategies to consider:

Once you’ve taken out student loans, managing them effectively is key to avoiding financial strain. You can take control of your finances when you actively manage student loans through budgeting, refinancing, or structured repayment plans. Here are some repayment strategies to consider:

1. Income-Driven Repayment Plans

As mentioned earlier, federal student loans offer income-driven repayment plans. These plans are designed to make monthly payments more affordable by tying them to your income. In 2026, income-driven repayment options may become more streamlined and accessible, making them a popular choice for borrowers.

Pay As You Earn (PAYE) and Revised Pay As You Earn (REPAYE) are two common income-driven plans that cap your payments at a percentage of your discretionary income.

Income-Based Repayment (IBR) and Income-Contingent Repayment (ICR) also offer affordable repayment options based on your income.

If you’re struggling with high monthly payments, exploring income-driven repayment plans can help you lower your payments and make them more manageable.

2. Refinancing Your Student Loans

For borrowers with private loans or federal loans after graduation, refinancing can be an option to reduce interest rates and potentially lower monthly payments. Refinancing involves consolidating your loans with a private lender at a new interest rate, usually based on your credit score and financial situation.

Lower Interest Rates: Refinancing could result in a lower interest rate, which can save you money over the life of the loan.

Considerations: Refinancing federal student loans into private loans may result in the loss of federal protections, such as income-driven repayment plans or forgiveness programs, so weigh the pros and cons before making this decision.

Refinancing is a good option if you have strong credit and are looking to reduce your interest rate, but it’s not for everyone.

3. Loan Forgiveness Programs

In 2026, public service loan forgiveness (PSLF) programs remain a significant opportunity for borrowers working in qualifying public service jobs, such as government, education, or non-profit sectors. If you work in a public service job and make qualifying monthly payments under a qualifying repayment plan for 10 years, your remaining federal student loan balance may be forgiven.

Before choosing a repayment strategy to manage student loans, compare interest rates, loan terms, and forgiveness options to make an informed decision. Additionally, certain teachers, doctors, and other professionals may be eligible for state or industry-specific loan forgiveness programs.

Before choosing a repayment strategy to manage student loans, compare interest rates, loan terms, and forgiveness options to make an informed decision. Additionally, certain teachers, doctors, and other professionals may be eligible for state or industry-specific loan forgiveness programs.

4. Avoid Default and Delinquency

One of the biggest pitfalls in student loan repayment is defaulting on your loans. Defaulting can lead to serious consequences, including wage garnishment and a damaged credit score. To avoid default:

Make Payments on Time: Set up automatic payments to ensure you never miss a due date.

Explore Forbearance or Deferment: If you can’t afford your payments temporarily, consider forbearance or deferment options to delay payments without going into default.

Consider Consolidation: If you have multiple federal loans, consolidation can simplify your payments by combining them into one loan.

Conclusion

In 2026, understanding your student loan options and repayment strategies is more important than ever. Federal loans offer flexibility, protections, and forgiveness programs that private loans do not, while private loans may provide more competitive interest rates for those with strong credit.

No matter the type of student loan, it’s crucial to develop a repayment strategy that works for your financial situation. With options like income-driven repayment plans, refinancing, and loan forgiveness, there are multiple ways to manage your debt and build a path toward financial security.

Many borrowers use online tools and financial apps to manage student loans more efficiently, automate payments, and avoid late fees. Log in today to explore student loan repayment options and start building a plan to manage your student debt effectively.