In times of market volatility, investors often seek safe-haven assets that can preserve wealth and hedge against economic uncertainty. While gold has long been a preferred choice for such protection, digital silver is gaining popularity as an alternative investment. Like gold, silver has historically been seen as a store of value, but with the added benefits of being more affordable and accessible, digital silver is emerging as an appealing option for modern investors.

If you want to diversify beyond stocks and gold, it may be a good time to start investing in silver due to its growing industrial demand and price potential.

What is Digital Silver?

Digital silver is a form of silver investment that allows individuals to buy, store, and trade silver digitally. Similar to digital gold, digital silver is backed by physical silver held in secure vaults. Investors purchase units of digital silver, which represent ownership of the physical silver, and can buy or sell the units through online platforms.

The key advantage of digital silver over physical silver is that it eliminates the need for storage and security concerns. With digital silver, you can invest in silver without having to worry about the logistics of purchasing and storing physical bars or coins. This makes it an accessible and convenient option for both seasoned investors and newcomers.

Why Digital Silver is a Hedge Against Market Volatility

Market volatility often results from factors such as economic downturns, political instability, or global crises. In such times, traditional investment assets like stocks and bonds can experience significant price fluctuations, leading to potential losses. Investors seeking to protect their wealth may turn to assets that have a history of retaining value during periods of economic uncertainty. Digital silver is one such asset. Many platforms now allow you to start investing in silver with small amounts through digital silver, ETFs, or physical coins.

1. Silver’s Historical Role as a Safe-Haven Asset

Like gold, silver has been a store of value for centuries. In times of economic instability or inflation, silver often holds its value or even appreciates, making it a reliable asset during market downturns. While silver may not always perform as well as gold, its affordability and accessibility make it an attractive alternative for diversifying risk and safeguarding wealth.

During the 2008 global financial crisis, both gold and silver saw increases in value as investors sought safer investments. While digital silver is a relatively new form of silver investment, it shares the same historical properties of physical silver in terms of market protection.

During the 2008 global financial crisis, both gold and silver saw increases in value as investors sought safer investments. While digital silver is a relatively new form of silver investment, it shares the same historical properties of physical silver in terms of market protection.

2. Diversification Benefits

Investors seeking to hedge against volatility often turn to diversification as a strategy. By spreading investments across different asset classes - such as stocks, bonds, real estate, and commodities - investors can mitigate the risk of significant losses. Silver, especially in its digital form, offers an excellent way to diversify a portfolio.

Incorporating digital silver into a diversified investment strategy can help reduce overall risk. As silver tends to perform differently from stocks and bonds, it can act as a counterbalance when other investments are underperforming due to market volatility.

3. Inflation Hedge

Silver has long been considered a hedge against inflation, as its value tends to rise when inflation erodes the purchasing power of fiat currencies. In times of high inflation, the value of paper currency decreases, but tangible assets like silver retain their purchasing power. This makes digital silver an effective way to protect against inflationary pressures, especially when inflation is high or unpredictable.

Unlike traditional fiat currencies, which are subject to central bank policies, silver’s intrinsic value is largely unaffected by changes in monetary policy. As a result, digital silver provides a stable store of value that can safeguard wealth during inflationary periods.

4. Increased Demand in Turbulent Markets

During times of economic uncertainty or market downturns, the demand for precious metals like silver often increases. Investors flock to silver because of its relatively low price compared to gold and its historical performance during financial crises. This increased demand can drive up the price of silver, offering potential gains for those who hold digital silver during market turbulence.

Digital silver investors benefit from this surge in demand without the need to physically purchase or store silver. Instead, they can trade digital silver units on secure platforms, capitalizing on market movements with minimal effort.

How to Invest in Digital Silver

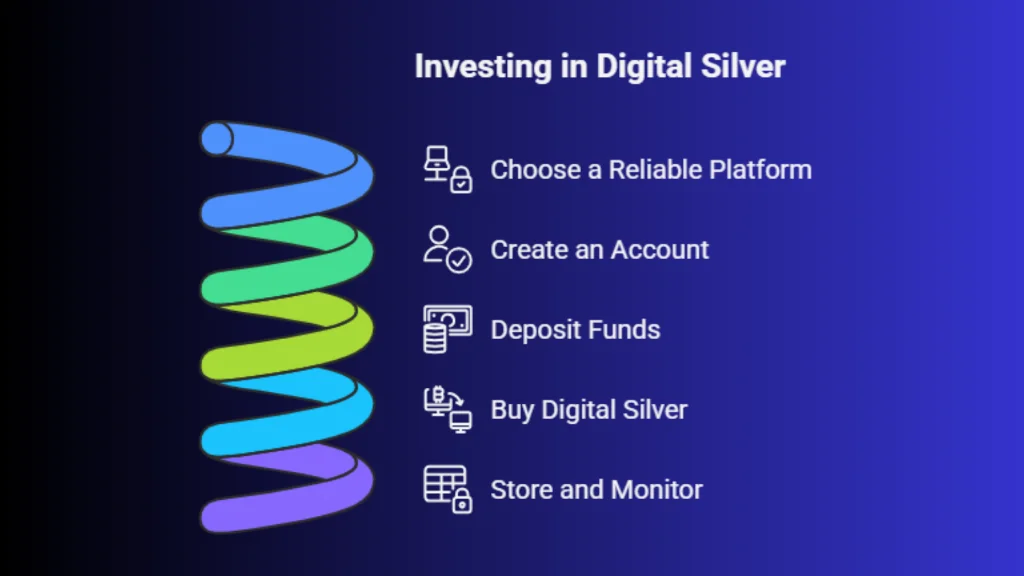

Investing in digital silver is straightforward. Here are the steps to get started:

Investing in digital silver is straightforward. Here are the steps to get started:

Choose a Reliable Platform: Select an online platform or app that offers digital silver investments. Ensure the platform is reputable, secure, and transparent about how it stores and insures the silver.

Create an Account: Sign up on the platform and complete any necessary verification processes.

Deposit Funds: Fund your account using your preferred payment method, such as a bank transfer or credit card.

Buy Digital Silver: Once your account is funded, you can purchase digital silver. You can buy in small quantities, allowing you to gradually build your investment portfolio.

Store and Monitor: After purchasing, your digital silver is securely stored on the platform. You can monitor its value and decide when to sell or hold, based on market conditions and your financial goals.

Conclusion

Digital silver offers a unique and accessible way to hedge against market volatility and protect your wealth. With its historical role as a safe-haven asset, diversification benefits, and ability to act as an inflation hedge, digital silver is a powerful addition to any investment portfolio, especially during periods of economic uncertainty.

With rising inflation and global uncertainty, more investors are choosing to start investing in silver as a smart long-term hedge. By incorporating digital silver into your financial strategy, you can better safeguard your assets against market swings and inflation, ensuring long-term wealth preservation. Log in to your investment platform today to explore digital silver and take the first step toward securing your financial future.