Dividend growth stocks are a popular investment choice for those seeking a steady income stream, especially during times of market volatility. These stocks provide regular dividend payouts and have a track record of increasing their dividends over time. In 2026, the focus on dividend growth is expected to continue as investors look for reliable sources of income while maintaining exposure to potential stock price appreciation.

Many long-term investors choose to invest in dividend growth stocks because they provide a combination of steady income and compounding wealth over time. We’ll also discuss why dividend growth investing remains a solid strategy and how you can identify top dividend-paying companies.

Why Dividend Growth Stocks Matter

Dividend growth stocks are an attractive option for investors who prioritize consistent income generation. If you want to build a reliable passive income portfolio, now may be a great time to invest in dividend growth stocks with consistent payout histories. These stocks offer the following advantages:

Stable Income: Dividend payments provide a reliable income stream, which can be especially important for retirees or conservative investors seeking less volatility.

Capital Appreciation: In addition to regular dividends, these stocks may also appreciate in value over time, giving you the benefit of both income and potential growth.

Reinvestment Opportunities: Dividends can be reinvested to purchase additional shares, helping you grow your position and compound your returns over time.

Lower Volatility: Dividend-paying companies are often more established and less volatile than non-dividend-paying stocks. This can make them a good option for long-term investors.

In 2026, dividend growth stocks remain one of the best ways to build wealth steadily, especially as inflation and interest rates fluctuate.

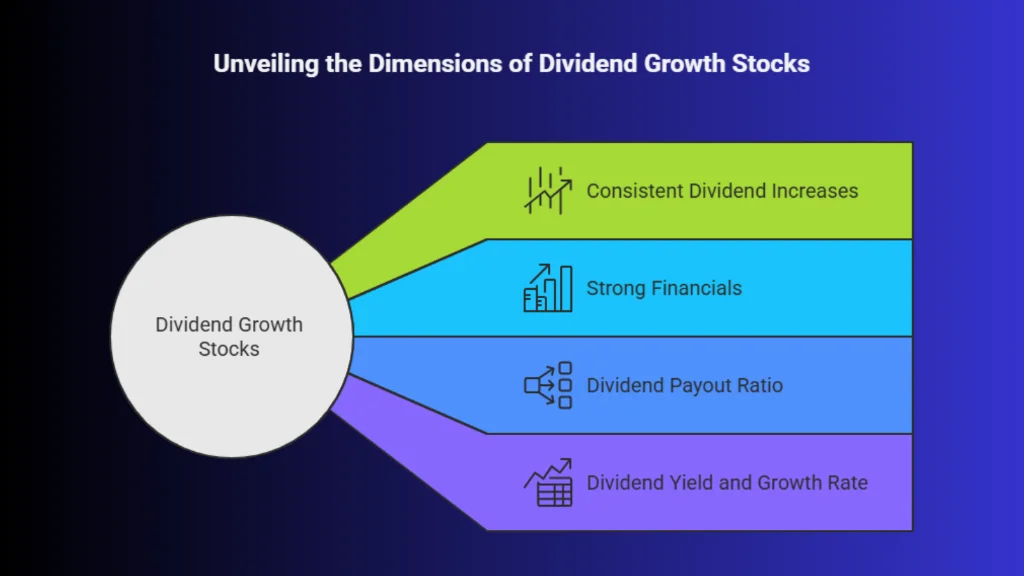

Key Characteristics of the Best Dividend Growth Stocks

Before you invest in dividend growth stocks, review each company’s dividend growth record, payout ratio, and financial stability to ensure sustainable long-term returns. When selecting dividend growth stocks, there are several important characteristics to consider:

Before you invest in dividend growth stocks, review each company’s dividend growth record, payout ratio, and financial stability to ensure sustainable long-term returns. When selecting dividend growth stocks, there are several important characteristics to consider:

1. Consistent Dividend Increases

Look for companies with a strong history of increasing their dividends over time. A company that consistently raises its dividend shows financial strength and a commitment to returning capital to shareholders.

2. Strong Financials

Dividend growth stocks should come from companies with stable earnings, strong cash flow, and manageable debt levels. These companies are more likely to continue paying and increasing dividends, even during tough economic periods.

3. Dividend Payout Ratio

The payout ratio is the percentage of earnings a company pays out in dividends. A healthy payout ratio is typically between 40% and 60%. A higher payout ratio may indicate the company is paying out too much of its earnings, leaving less room for growth.

4. Dividend Yield and Growth Rate

Look for a combination of an attractive dividend yield and a strong growth rate. A high dividend yield is great, but it’s equally important to ensure the company’s dividend growth is sustainable over the long term.

The Best Dividend Growth Stocks for 2026

Dividend growth investing focuses on companies that consistently increase their payouts year after year, offering both stability and long-term wealth creation. The stocks below belong to sectors with durable demand, strong cash flows, and decades-long dividend track records. These industry leaders are widely considered reliable choices for investors seeking sustainable and growing passive income.

Company | Sector | Dividend Yield | Dividend Growth History | Summary |

Johnson & Johnson (JNJ) | Healthcare | ~2.5% | 59 consecutive years | A diversified healthcare leader with strong cash flow from pharmaceuticals, medical devices, and consumer products, supporting decades of consistent dividend growth. |

Procter & Gamble (PG) | Consumer Goods | ~2.4% | 65 consecutive years | A global consumer goods powerhouse with iconic brands and steady cash generation, making it one of the most reliable long-term dividend growers. |

Coca-Cola (KO) | Consumer Staples | ~3.1% | 59 consecutive years | A dominant global beverage brand with resilient cash flow and long-term stability, allowing consistent dividend increases through market cycles. |

McDonald’s (MCD) | Consumer Discretionary | ~2.3% | 45 consecutive years | A global fast-food leader with a strong franchising model that delivers stable income and supports ongoing dividend growth. |

3M Company (MMM) | Industrial | ~3.4% | 63 consecutive years | A diversified industrial innovator with strong financial health and a long history of uninterrupted dividend increases. |

How to Invest in Dividend Growth Stocks

Investing in dividend growth stocks can be done through individual stock purchases or via mutual funds and ETFs that focus on dividend-paying companies. Here are some steps to consider:

Investing in dividend growth stocks can be done through individual stock purchases or via mutual funds and ETFs that focus on dividend-paying companies. Here are some steps to consider:

Research: Evaluate potential dividend growth stocks based on the criteria discussed above.

Diversify: Diversifying your portfolio across sectors and industries will help reduce risk.

Reinvest Dividends: Consider enrolling in a dividend reinvestment plan (DRIP) to automatically reinvest your dividends into additional shares, helping compound your returns.

Monitor Your Investments: Regularly review your dividend stocks to ensure they continue to meet your investment goals.

Conclusion

Dividend growth stocks offer a reliable source of income and long-term capital appreciation, making them an attractive choice for investors looking to build wealth steadily. Companies like Johnson & Johnson, Procter & Gamble, and Coca-Cola have consistently raised their dividends and show strong potential for future growth.

As you plan for 2026, dividend growth stocks should be a key component of your investment strategy, providing stability and income even in uncertain market conditions. Log in today to explore the best dividend growth stocks and start building your income-focused portfolio for the future.