Managing seasonal fluctuations, unexpected operational costs, or sudden expansion opportunities requires a high degree of financial agility. For many business owners, liquidating long-term investments is the default response to a liquidity crunch, yet this often comes at the cost of future growth and heavy tax liabilities. An overdraft against mutual funds offers a more sophisticated alternative, providing a revolving credit line without forcing you to sell your assets.

By choosing to apply for an overdraft against mutual funds, you can leverage your existing portfolio to maintain a healthy cash flow while keeping your long-term wealth strategy intact. This guide explores how this credit facility works and how it can be integrated into your financial operations.

Understanding Overdraft Against Mutual Funds for Liquidity

An overdraft against mutual funds is a secured credit facility where your mutual fund units act as collateral. Unlike a traditional term loan, where you receive a lump sum and pay interest on the entire amount, an overdraft allows you to withdraw funds as needed up to a sanctioned limit. This is particularly beneficial for businesses that experience lumpy cash flows, where income and expenses do not always align perfectly.

The most compelling feature of this facility is the interest structure. You only pay interest on the amount you actually utilize, and only for the duration you use it. For instance, if you have a sanctioned limit of 20 lakhs but only withdraw 5 lakhs to pay a vendor for 15 days, you are charged interest solely on that 5 lakhs for those two weeks. This makes it an incredibly cost-effective tool for bridging short-term gaps.

The Mechanism of Lien Marking

When you apply for an overdraft against mutual funds, the lender places a lien on your units through the Registrar and Transfer Agents (RTAs) like CAMS or KFintech.

Ownership: You remain the legal owner of the units.

Returns: You continue to receive all dividends and benefit from Net Asset Value (NAV) appreciation.

Restriction: You cannot sell or redeem the units until the lien is lifted or the loan is repaid.

What are the Benefits of Using a Credit Line Over Redemption?

Choosing an overdraft against mutual funds over direct redemption offers several strategic advantages for cash flow management. Redemptions often trigger capital gains tax, up to 20% for short-term equity gains, and may involve exit loads. By borrowing against the units instead, you bypass these immediate costs.

Feature | Overdraft Against Mutual Funds | Redeeming Mutual Funds |

Asset Status | Portfolio remains intact and growing | Investment is terminated |

Tax Impact | No immediate capital gains tax | Potential STCG or LTCG tax liability |

Interest Cost | Charged only on the utilized amount | No interest, but opportunity cost is high |

Flexibility | Revolving limit; reuse as you repay | One-time liquidity requires re-investing |

Processing | Fast, digital, and paperless | 1-3 days for funds to hit the account |

How to apply for an overdraft against mutual funds

The digital transformation of the Indian fintech landscape has made it remarkably easy to apply for an overdraft against mutual funds. Most platforms now offer a completely paperless journey that can be completed in under 15 minutes.

The digital transformation of the Indian fintech landscape has made it remarkably easy to apply for an overdraft against mutual funds. Most platforms now offer a completely paperless journey that can be completed in under 15 minutes.

1. Pledge Your Portfolio via RTA Integration

The first step is to consolidate your holdings to determine your borrowing power. By connecting your portfolio through an RTA like CAMS or KFintech, the lending platform fetches real-time data on your Net Asset Value (NAV). This integration is crucial because it verifies that the units are not already lien-marked and are eligible for pledging. You simply provide your registered mobile number and PAN, and the system pulls a fetching of your consolidated account statement (CAS), showing exactly how much credit you can access.

2. Strategic Selection of Fund Units

Once your portfolio is visible, you have the autonomy to choose which specific equity or debt funds you wish to use as collateral. This is a critical decision for cash flow management; for instance, you might choose to pledge your stable debt funds first to secure a higher LTV of up to 80%. Alternatively, if you have a large equity portfolio, you might pledge a portion of it to keep your debt assets free for other purposes. The platform will dynamically show you how your total limit changes based on the units you select to lien-mark.

3. Completing Digital KYC and E-Mandate

To ensure compliance and security, a paperless KYC process is initiated. This typically involves an Aadhaar-based OTP authentication, which verifies your identity in seconds. Alongside this, you will set up an E-mandate (NACH). This is a vital component of an overdraft against mutual funds as it automates the monthly interest servicing from your linked bank account. This automation ensures that your credit line remains in good standing without you having to manually track interest payment dates every month.

4. Formal Lien Approval by the RTA

After you submit your request to apply for an overdraft against mutual funds, the lender sends a digital request to the RTA to "mark a lien" on the selected units. This process acts as a digital lock; the units remain in your account, and you continue to earn all market gains, but the RTA ensures they cannot be sold until the loan is settled. This step is usually handled in the background and is completed within a few minutes to a couple of hours, depending on the fund house and the RTA's processing speed.

5. Limit Activation and Fund Withdrawal

Once the lien is successfully marked, the lender finalizes the approval and activates your overdraft limit. This limit is typically reflected in a dedicated account or a mobile app interface. The beauty of this system is that the money is not forced into your bank account all at once. You can withdraw 1 lakh today for a vendor payment and 5 lakhs next month for inventory, directly transferring the required amount to your primary business account. The interest calculation starts only from the moment the funds are moved.

To apply for an overdraft against mutual funds effectively, ensure your portfolio consists of approved schemes. Most lenders maintain a list of 5,000+ eligible funds, though ELSS (Equity Linked Savings Schemes) cannot be pledged during their 3-year lock-in period.

Interest Rates and Loan-to-Value (LTV) Ratios

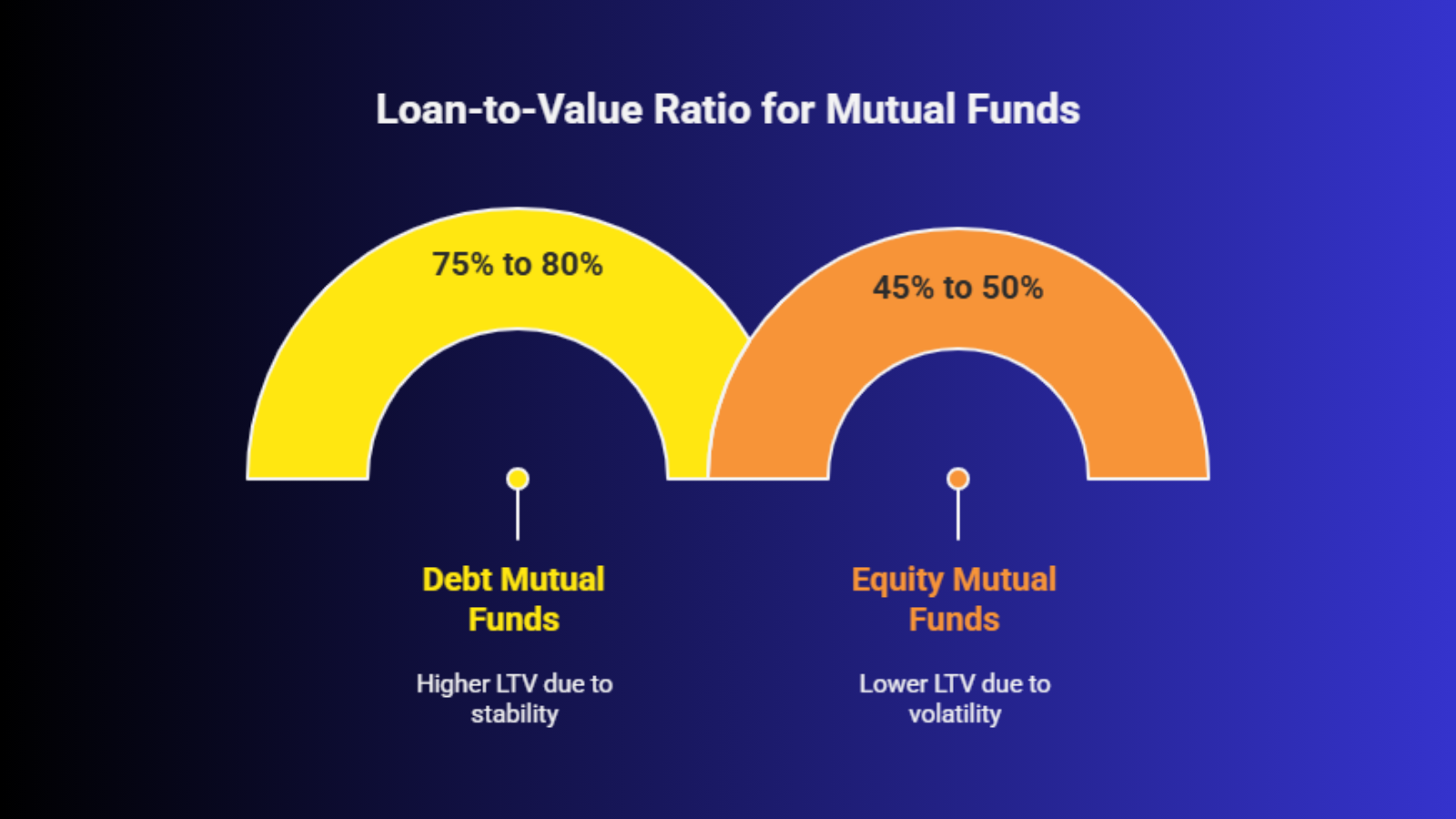

When you apply for an overdraft against mutual funds, the amount you can borrow depends on the type of funds you hold. This is governed by the Loan-to-Value (LTV) ratio, which represents the percentage of the current market value of your funds that the lender is willing to provide as credit.

LTV Categorization

LTV Categorization

Equity Mutual Funds: Generally offer an LTV of 45% to 50%. This lower limit accounts for market volatility.

Debt Mutual Funds: Usually offer a higher LTV of 75% to 80% because debt instruments are considered more stable.

Cost of Borrowing

Interest rates for an overdraft against mutual funds typically range between 9% and 11% per annum. This is significantly lower than unsecured personal loans or business credit cards, which can charge anywhere from 16% to 36%. Additionally, there are no fixed EMIs; you can repay the principal at your convenience as long as the interest is serviced monthly.

Managing Market Risks and Margin Calls

While an overdraft against mutual funds is a powerful tool, it is tied to market performance. If the NAV of your pledged funds drops significantly, your LTV ratio might exceed the lender’s permissible limits. This triggers a margin call.

In a margin call scenario, the lender may ask you to:

Pledge more units: Add more mutual fund units to restore the required collateral value.

Partial Repayment: Pay back a portion of the utilized amount to bring the loan-to-value ratio back into balance.

Failure to address a margin call could lead to the lender liquidating some of your units to recover the gap. Therefore, it is a prudent cash flow management strategy to only utilize 60-70% of your sanctioned limit, leaving a buffer for market fluctuations.

Use Cases for Business Cash Flow Management

Strategic use of an overdraft against mutual funds can solve various operational hurdles. Since there are no end-use restrictions, the funds can be deployed wherever the business needs them most.

1. Managing Working Capital Gaps

If you have high-value invoices pending but need to pay staff or suppliers immediately, an overdraft against mutual funds provides the necessary bridge. You can apply for an overdraft against mutual funds once and keep the limit active for years, drawing from it only when your receivables are delayed.

2. Tax Payments and Statutory Dues

Quarterly advance tax payments or GST liabilities can sometimes strain monthly liquidity. Instead of dipping into operational reserves, businesses use the overdraft facility to clear dues and repay the amount once the next sales cycle completes.

3. Inventory Stocking

For businesses with seasonal demand, purchasing bulk inventory at a discount is often hindered by a lack of ready cash. By using an overdraft against mutual funds, you can fund these purchases, benefit from the bulk discount, and settle the credit once the stock is sold.

Why LAMF is Better Than Traditional Loans

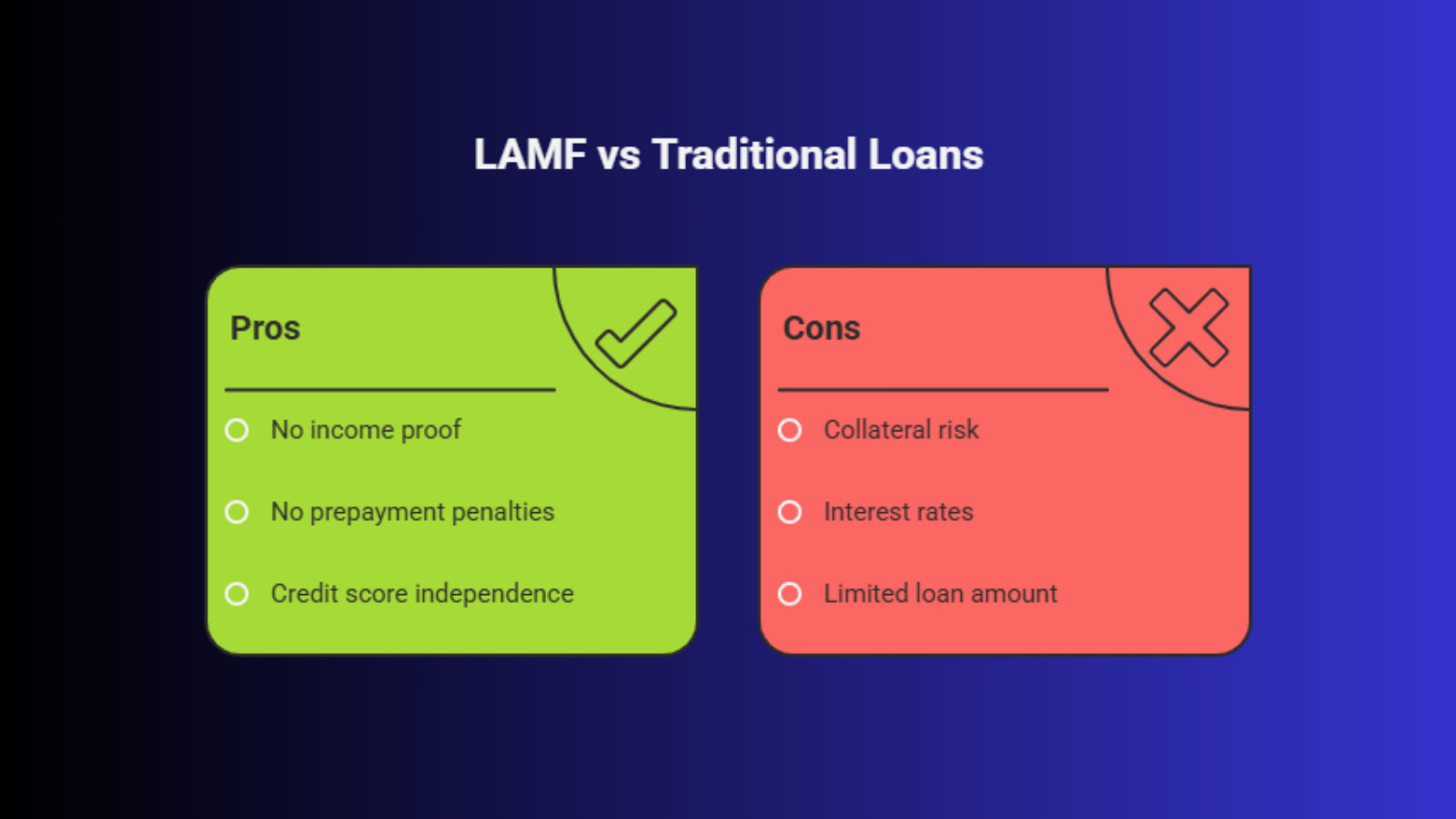

The flexibility of a Loan Against Mutual Funds (LAMF) makes it a superior choice for modern enterprises. Traditional business loans involve rigorous documentation, including income tax returns, balance sheets, and profit & loss statements.

When you apply for an overdraft against mutual funds, the security is the asset itself. This often means:

When you apply for an overdraft against mutual funds, the security is the asset itself. This often means:

No Income Proof Required: Lenders focus on the value of the collateral rather than your monthly turnover.

No Prepayment Penalties: You can close the overdraft at any time without paying foreclosure fees.

Credit Score Independence: Approval is based on your investment, not just your CIBIL score, making it accessible even if your credit history is limited.

Maximizing the Value of Your Portfolio

To make the most of an overdraft against mutual funds, it is essential to view your investments and your credit line as parts of a single ecosystem. A well-diversified portfolio containing both equity for growth and debt for higher LTV ensures that you always have access to a substantial credit limit.

By choosing to apply for an overdraft against mutual funds, you transform your stagnant investments into a dynamic source of capital. It allows you to participate in market rallies while simultaneously solving real-world business challenges. This dual benefit is what makes it a premier choice for sophisticated cash flow management.

Conclusion

Managing cash flow should not feel like a choice between your current operations and your future wealth. An overdraft against mutual funds provides the perfect middle ground, offering low-cost, flexible, and instant liquidity. By leveraging your existing assets, you can navigate business uncertainties with confidence.

Ready to unlock the power of your investments without selling a single unit? Experience the most seamless way to manage your liquidity on discvr.ai.

Discover how you can apply for an overdraft against mutual funds through discvr.ai and transform your portfolio into a powerful cash flow tool today.