This method of borrowing has gained massive popularity because it is secured, cost-effective, and incredibly fast. By opting for an instant loan against mutual funds, you can unlock a credit line that stays ready for use whenever a requirement arises. Whether it is for a business expansion, a medical emergency, or an unplanned personal expense, this guide will walk you through everything you need to know to secure the best terms and fastest approvals.

How Loan Against Mutual Funds (LAMF) work?

A loan against mutual funds works on a simple principle of lien marking, where your existing units are pledged to a lender in exchange for a sanctioned limit. You remain the owner of these units, and they continue to earn returns, dividends, and capital appreciation as they would normally. The lender essentially holds a "lien" or a claim on these units, meaning you cannot sell them until the loan is settled.

The beauty of this facility is the overdraft nature of the credit. Unlike a traditional term loan, where you pay interest on the entire disbursed amount from day one, an instant loan against mutual funds allows you to pay interest only on the amount you actually withdraw and use.

Feature | Details |

Loan Type | Secured Credit Line / Overdraft |

Collateral | Equity, Debt, or Hybrid Mutual Fund Units |

Interest Rate | Generally, 9.5% to 11.5% per annum |

LTV Ratio | 50% for Equity, up to 80% for Debt funds |

Processing Time | 15 minutes to 24 hours (Digital process) |

Why You Should Apply for an Instant Loan Against Mutual Funds Over Personal Loans

When comparing borrowing options, the cost of capital is usually the most significant factor for any investor or business owner. If you apply for an instant loan against mutual funds, the interest rate you receive is significantly lower than that of an unsecured personal loan. This is because the lender’s risk is mitigated by your high-quality mutual fund units.

Furthermore, personal loans often come with rigid EMI structures and heavy foreclosure charges. In contrast, an instant loan against mutual funds offers total flexibility. You can choose to pay only the interest every month and repay the principal whenever your cash flow allows, without any penalty for early closure.

Retained Compounding: Your wealth continues to grow even while the units are pledged.

Lower Interest Burden: Rates are typically 4% to 8% lower than personal loans.

No Credit Score Obsession: While a good CIBIL helps, the loan is primarily backed by your assets.

Tax Efficiency: You avoid the tax liability that comes with selling mutual funds for cash.

Eligibility Criteria and Required Documentation

To ensure you get a fast approval when you apply for an instant loan against mutual funds, you must meet specific eligibility benchmarks set by the RBI and individual lenders. Most digital platforms have streamlined this to a point where physical documentation is no longer necessary.

The primary requirement is that your mutual funds must be held with a registrar like CAMS or KFintech, as most lenders are integrated with these systems for real-time lien marking. Additionally, you must have a minimum holding value, which usually starts at 50,000 to 1,00,000, depending on the financial institution.

The primary requirement is that your mutual funds must be held with a registrar like CAMS or KFintech, as most lenders are integrated with these systems for real-time lien marking. Additionally, you must have a minimum holding value, which usually starts at 50,000 to 1,00,000, depending on the financial institution.

1. Residency and Entity Type

The primary requirement is that the applicant must be a resident of India. While most digital platforms cater to individuals, the scope for an instant loan against mutual funds extends to various business structures.

Individual Residents: Indian citizens living in the country with a valid PAN.

Sole Proprietorships: Small business owners can leverage their personal or business mutual fund holdings for working capital.

Non-Individual Entities: Many lenders allow Private Limited companies, Partnership firms, and HUFs (Hindu Undivided Families) to access this credit line, though the documentation for these may require offline board resolutions.

2. Age Brackets for Borrowing

The age criteria are designed to ensure the borrower has the legal standing to enter a financial contract.

Minimum Age: You must be at least 18 years of age at the time of application. Some banks may set this threshold at 21.

Maximum Age: Most lenders allow you to maintain the credit line until the age of 70, provided the collateral value is maintained.

3. Eligible Fund Types and Lock-in Rules

Not all mutual funds can be used to apply for an instant loan against mutual funds. Lenders maintain an "Approved List" of schemes that are liquid and have high trading volumes.

No Lock-in Period: Units must be free of any encumbrances. For example, ELSS (Tax Saving) funds can only be pledged after their 3-year lock-in period is complete.

RTA Integration: The funds must be registered with major Registrars and Transfer Agents (RTAs) like CAMS or KFintech to enable real-time digital lien marking.

Fund Categories: Equity, Debt, and Hybrid funds are generally eligible, whereas niche sectoral funds with very low AUM might be excluded by certain lenders.

4. KYC and Digital Documentation

A "Verified" KYC status is the backbone of the digital approval process. Without updated KYC, the automated system cannot verify your identity with the RTA.

Aadhaar-Linked Mobile: Your mobile number must be linked to your Aadhaar to perform e-signatures and OTP-based lien marking.

PAN Validation: A valid Permanent Account Number is mandatory for all tax and lien-related reporting.

KYC Status: Your status in the KRA (KYC Registration Agency) records should be "KYC Validated" or "KYC Registered" to ensure you can apply for an instant loan against mutual funds without physical paperwork.

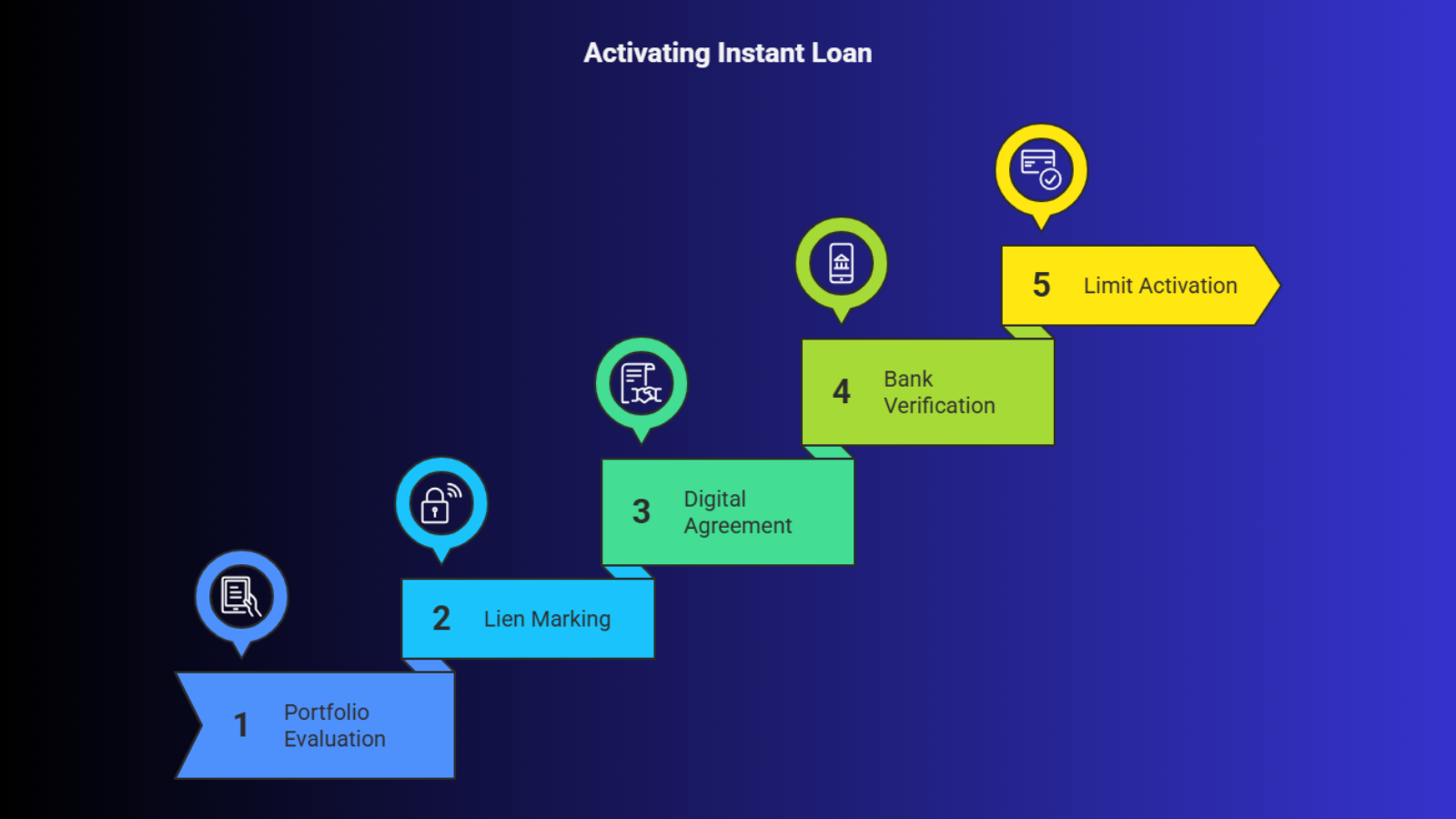

Step-by-Step Process for Fast Approvals

The digital era has reduced the turnaround time for an instant loan against mutual funds from days to mere minutes. To get the fastest disbursal, you should follow a structured path that starts with verifying your portfolio and ends with setting up an e-mandate for automated interest payments.

When you apply for an instant loan against mutual funds, ensure you are using a platform that allows for "Direct-to-Bank" transfers. This ensures that once the lien is marked digitally through an OTP-based process, the funds are available in your account almost instantly.

When you apply for an instant loan against mutual funds, ensure you are using a platform that allows for "Direct-to-Bank" transfers. This ensures that once the lien is marked digitally through an OTP-based process, the funds are available in your account almost instantly.

Portfolio Evaluation: Connect your portfolio via CAMS/KFintech to see your eligible loan limit.

Lien Marking: Select the schemes and units you wish to pledge and authorize the lien via OTP.

Digital Agreement: Sign the loan agreement using an e-sign facility (Aadhaar-based).

Bank Verification: Link your bank account and set up the e-NACH/e-mandate for interest.

Limit Activation: Your credit line is activated, and you can withdraw funds to your bank.

Understanding LTV: How Much Can You Borrow?

The Loan-to-Value (LTV) ratio determines the maximum amount you can borrow against your portfolio. Lenders apply a "haircut" to the current Net Asset Value (NAV) to protect themselves against market volatility. For instance, if you apply for an instant loan against mutual funds backed by equity, you can usually get up to 50% of the value.

For less volatile debt funds, the LTV is much higher. This makes debt funds an excellent collateral for larger capital requirements. It is important to monitor your portfolio value, as a sharp market dip might lead to a "margin call," where you may need to either pledge more units or repay a portion of the loan to maintain the required LTV.

Comparison of LTV Across Fund Categories

Mutual Fund Category | Typical LTV | Max Loan Limit (Sample) |

Equity Funds | 45% - 50% | Up to 20 Lakhs (Digital) |

Debt / Liquid Funds | 75% - 85% | Up to 5 Crores |

Hybrid Funds | 50% - 60% | Varies by Lender |

ELSS (Post-Lock-in) | 50% | Based on NAV |

Strategic Use Cases for Investors

Smart investors don't just use an instant loan against mutual funds for emergencies. They use it as a strategic tool for wealth management. For example, if you are a business owner and your payments are stuck for 30 days, instead of stopping your SIPs or selling your long-term holdings, you can apply for an instant loan against mutual funds to manage your working capital.

Another use case is taking advantage of market opportunities. If there is a sudden dip in the market and you want to invest more but don't have ready cash, a loan against your existing funds can provide the liquidity needed to buy the dip. This keeps your original portfolio intact while allowing you to grow your wealth further.

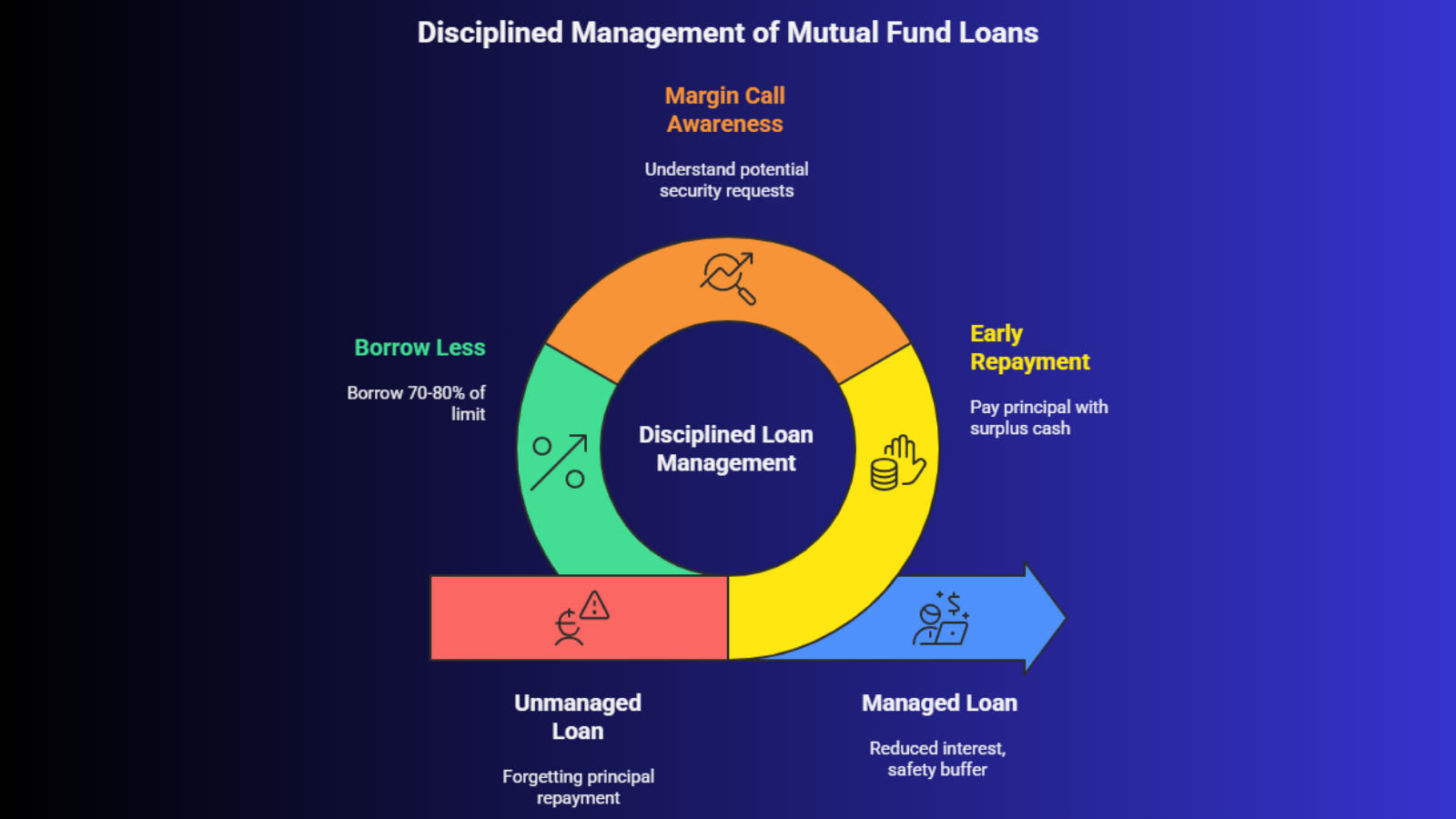

Managing Your Loan and Avoiding Pitfalls

While an instant loan against mutual funds is a powerful tool, it must be managed with discipline. Since there are no fixed EMIs, it is easy to forget about the principal repayment. You should aim to pay back the principal as soon as you have surplus cash to reduce your interest outgo over time.

Also, be aware of the "margin call" scenario. If the market falls by 20%, your collateral value drops, and the lender might ask for additional security. When you apply for an instant loan against mutual funds, it is always wise to borrow only 70% to 80% of your maximum eligible limit. This provides a safety buffer against market fluctuations and ensures your units aren't liquidated by the lender.

Also, be aware of the "margin call" scenario. If the market falls by 20%, your collateral value drops, and the lender might ask for additional security. When you apply for an instant loan against mutual funds, it is always wise to borrow only 70% to 80% of your maximum eligible limit. This provides a safety buffer against market fluctuations and ensures your units aren't liquidated by the lender.

Conclusion

Leveraging your investments through an instant loan against mutual funds is one of the most sophisticated ways to manage liquidity in today’s market. It offers a unique combination of low interest rates, digital speed, and repayment flexibility that traditional loans simply cannot match. By keeping your investments active and compounding, you ensure that your future financial goals remain on track even while you meet your present-day needs.

If you are looking for a seamless, transparent, and technology-driven way to apply for an instant loan against mutual funds, it is time to look at modern solutions. With the right platform, you can convert your idle mutual fund units into an active credit line in less than 15 minutes.

Ready to unlock the hidden potential of your portfolio? Experience the future of borrowing with discvr.ai and get your LAMF approved today!