As cryptocurrencies continue to gain popularity, ensuring the security of your digital assets has never been more critical. With the rise in value and the growing number of crypto enthusiasts, protecting your crypto holdings is vital to prevent theft or loss. Whether you're a long-term holder or a day trader, knowing how to store your crypto assets securely in 2026 is essential for maintaining the safety and integrity of your investments.

In this blog, we’ll explore the best methods to store your crypto assets securely, the types of wallets available, and key security practices to follow in 2026. By understanding these, you can make informed decisions about how to protect your cryptocurrency.

Why Securing Crypto Assets is Crucial in 2026

The growing popularity of cryptocurrencies has attracted both investors and malicious actors. As digital assets become more valuable, hackers and cybercriminals are increasingly targeting crypto users. In 2026, more advanced cyberattacks and phishing techniques make it necessary for crypto holders to adopt robust security measures.

Crypto assets are unique because they are decentralized and typically don’t have the same protective measures as traditional bank accounts. Losing access to your private keys or falling victim to a scam can result in irreversible loss of your holdings. Therefore, the responsibility for securing your crypto assets falls entirely on you, making it crucial to understand the best practices for safe storage.

Best Ways to Store Your Crypto Assets

There are several methods to store your cryptocurrency securely. Each method has its advantages and is suited for different types of users. The first step to store crypto assets securely is to immediately transfer the majority of your holdings from the exchange to a non-custodial wallet where you control the private keys and seed phrase. Below are the most reliable options for storing crypto assets in 2026:

1. Hardware Wallets (Cold Storage)

Hardware wallets are widely regarded as one of the safest ways to store cryptocurrency. These physical devices store your private keys offline, making them immune to online hacks and malware. Examples include the Ledger Nano S, Trezor, and Ledger Nano X.

Why Choose Hardware Wallets?

Since hardware wallets are offline, they provide a high level of security. Even if your computer or phone is compromised, your private keys remain secure on the device. Hardware wallets are perfect for long-term storage of large amounts of cryptocurrency.

How to Use?

To use a hardware wallet, you need to connect it to your computer or smartphone when you want to send or receive funds. When not in use, the wallet is disconnected, ensuring that your crypto assets are offline and protected.

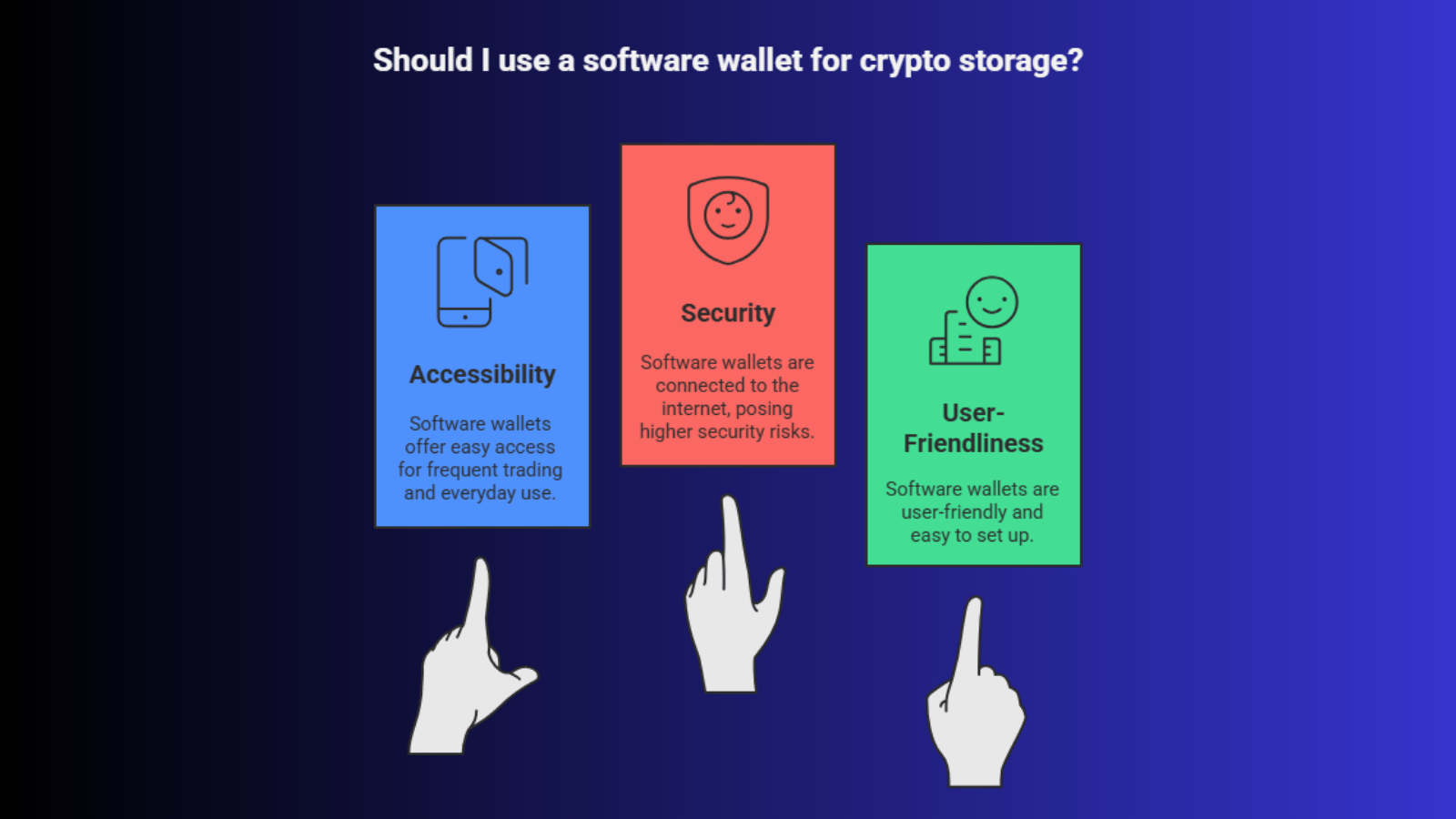

2. Software Wallets (Hot Storage)

Software wallets are digital wallets stored on your computer, smartphone, or online platform. They are easier to access than hardware wallets but come with a higher security risk because they are connected to the internet. Popular examples include Exodus, Electrum, and Trust Wallet.

Software wallets are digital wallets stored on your computer, smartphone, or online platform. They are easier to access than hardware wallets but come with a higher security risk because they are connected to the internet. Popular examples include Exodus, Electrum, and Trust Wallet.

Why Choose Software Wallets?

Software wallets are ideal for frequent trading or accessing your crypto assets. They are user-friendly and offer a good balance between accessibility and security for everyday use.

How to Use?

After downloading and setting up your software wallet, you can store, send, and receive cryptocurrency directly from your device. However, always ensure that your software wallet is protected with strong passwords and two-factor authentication.

3. Paper Wallets (Cold Storage)

A paper wallet is simply a physical document that contains your public and private keys printed on it. Since paper wallets are offline, they are highly secure against hacking attempts. However, the key risk lies in physical damage or loss of the paper.

Why Choose Paper Wallets?

Paper wallets are inexpensive and easy to set up. They are ideal for long-term storage of cryptocurrency that you don’t need to access frequently.

How to Use?

You generate a paper wallet by creating public and private keys using a trusted online service (like bitaddress.org) and then printing the information. Store this paper wallet in a secure location, such as a safe, to avoid physical damage or theft.

4. Custodial Wallets (Exchange Wallets)

Custodial wallets are offered by cryptocurrency exchanges like Coinbase, Binance, or Kraken. With these wallets, the exchange holds your private keys, meaning they are responsible for the security of your assets.

Why Choose Custodial Wallets?

Custodial wallets are convenient for active traders and those who want to quickly buy, sell, and trade cryptocurrencies. Since exchanges manage your assets, they often provide insurance in case of hacks, which gives users some level of security.

How to Use?

After creating an account with an exchange, you can deposit and withdraw funds into your custodial wallet. However, it's crucial to remember that with custodial wallets, you don’t have full control over your private keys, making them more vulnerable than other storage options.

Key Security Practices for Crypto Storage in 2026

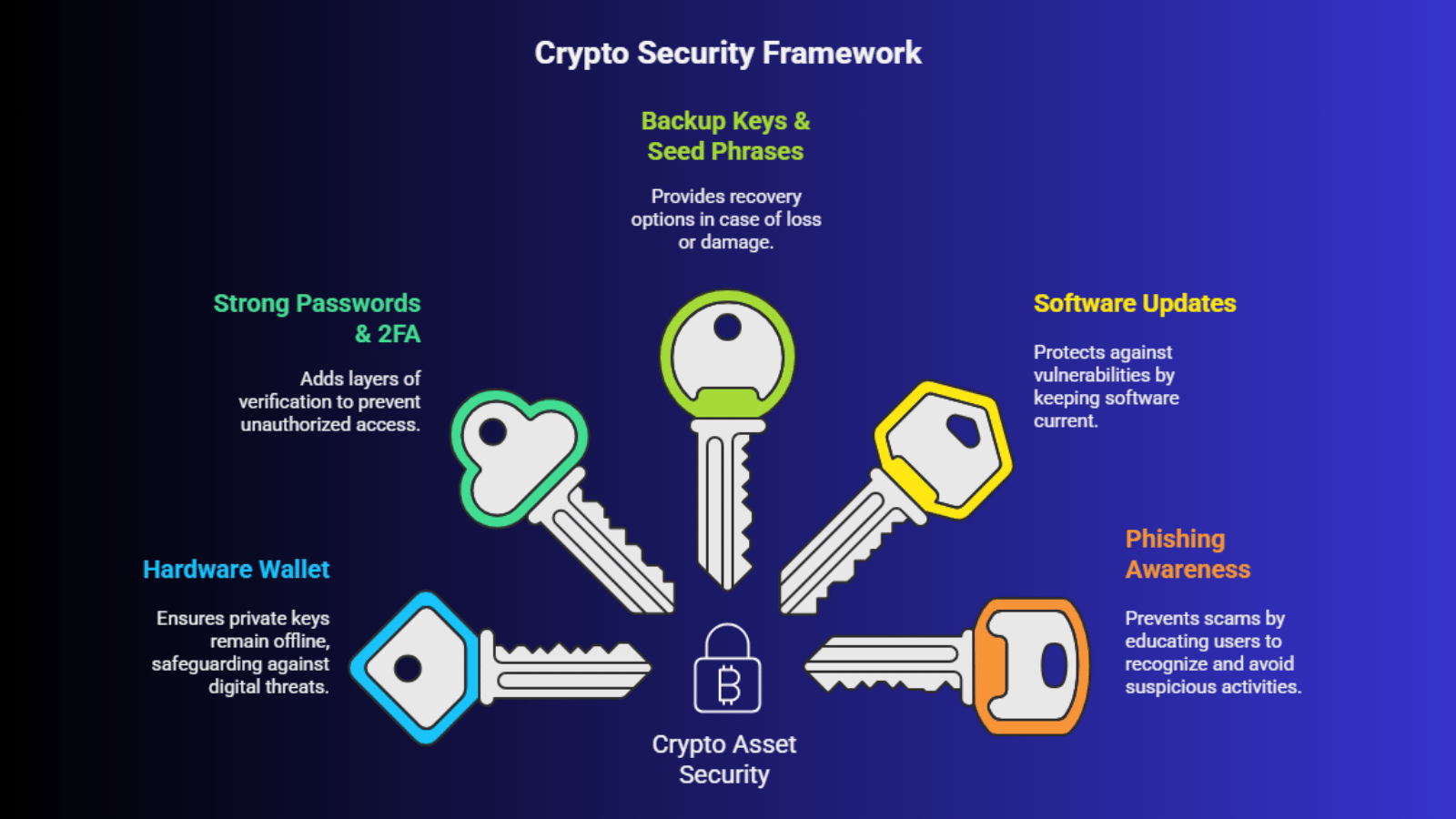

To store crypto assets securely for the long term, you must use a hardware wallet (cold storage), ensuring your private keys never touch an internet-connected device, which is the gold standard for large holdings. Along with choosing the right storage method, it’s essential to follow best practices to further protect your crypto assets:

To store crypto assets securely for the long term, you must use a hardware wallet (cold storage), ensuring your private keys never touch an internet-connected device, which is the gold standard for large holdings. Along with choosing the right storage method, it’s essential to follow best practices to further protect your crypto assets:

Use Strong Passwords and Two-Factor Authentication (2FA)

Always enable 2FA on your crypto wallets and exchange accounts. This adds an extra layer of security by requiring a second form of verification (like a code from your phone) before granting access.

Backup Your Private Keys and Seed Phrases

Always back up your private keys and seed phrases in multiple secure locations. This ensures you can restore access to your funds if your hardware wallet is lost or damaged.

Keep Software Up to Date

Regularly update the software of your wallets and devices to protect against newly discovered vulnerabilities. Make sure to download updates from trusted sources.

Avoid Phishing Scams

Be cautious of unsolicited emails, messages, or links that claim to offer crypto-related deals or rewards. Always double-check website URLs and avoid clicking on suspicious links.

Final Thoughts

Storing your crypto assets securely is crucial in 2026, as the landscape of digital assets evolves and cyber threats become more sophisticated. Whether you use hardware wallets for long-term storage, software wallets for daily use, or custodial wallets for active trading, always prioritize security.

Always store crypto assets securely by backing up your 12-to-24-word seed phrase offline in multiple, physically separate, and durable locations (e.g., engraved metal plates) to guarantee recovery if your primary device is lost or destroyed.

By following the best practices for crypto storage and keeping your private keys and backup phrases secure, you can protect your digital wealth and avoid unnecessary risks. Log in to your wallet or exchange platform today to review your storage options and ensure your crypto assets are safely protected.