Target-date funds have become increasingly popular among retirement savers and investors who seek simplicity, diversification, and long-term growth. These funds offer a hands-off investment strategy that adjusts over time to align with your retirement or financial goals. But what exactly are target-date funds, and why should you consider adding them to your portfolio?

Many long-term investors choose to start investing in target-date funds because these funds automatically adjust risk levels as retirement approaches.

What Are Target-Date Funds?

A target-date fund (TDF) is a type of mutual fund that automatically adjusts its asset allocation based on a target retirement date or other financial goal. The fund is typically structured to become more conservative as the target date approaches, shifting from a higher percentage of stocks to a greater portion of bonds and other low-risk assets. You can start investing in target-date funds today with small contributions, making them an easy way to build a disciplined retirement strategy.

For example, if you plan to retire in 2060, you would invest in a target-date fund with the year 2060 in the name, such as “Vanguard Target Retirement 2060 Fund.” This fund would initially have a higher percentage of stocks to capture growth but would gradually reduce stock exposure as the target year nears, ultimately focusing more on bonds and stable investments to protect your savings as you approach retirement.

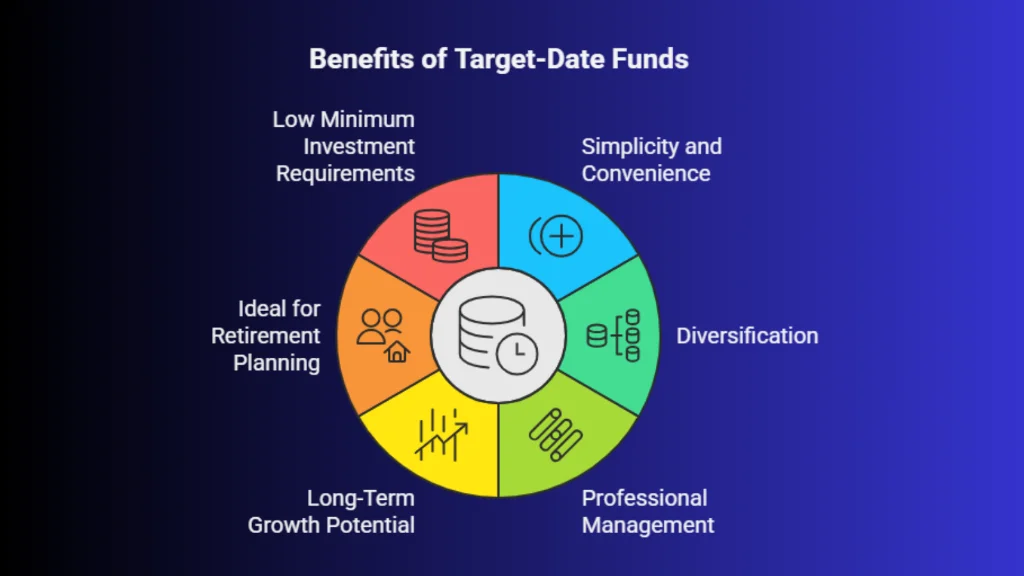

Key Benefits of Target-Date Funds

Target-date funds have become a popular choice for investors who want a simple, automated way to grow their wealth over time. These funds adjust their asset allocation based on your expected retirement year, shifting from higher-risk investments to more conservative ones as the date approaches. Before you start investing in target-date funds, check the fund’s glide path, fees, and target year to ensure it aligns with your financial goals.

This hands-off approach makes them ideal for long-term planners who prefer convenience and diversification. With built-in risk management and professional oversight, target-date funds offer a smart, goal-oriented investment strategy.

This hands-off approach makes them ideal for long-term planners who prefer convenience and diversification. With built-in risk management and professional oversight, target-date funds offer a smart, goal-oriented investment strategy.

1. Simplicity and Convenience

One of the biggest advantages of target-date funds is their simplicity. Investors don’t need to actively manage or adjust their portfolios, the fund automatically rebalances itself as the target date approaches. This is ideal for individuals who want to set up their investment and leave it, without having to worry about making ongoing decisions regarding asset allocation.

Hands-Off Investing: Once you select the appropriate target-date fund for your goal, the fund takes care of the rest, adjusting its holdings based on a pre-determined schedule.

No Need for Frequent Monitoring: Unlike other investment strategies, where you must constantly monitor and adjust your portfolio, target-date funds make it easier to stay on track toward your financial goal.

2. Diversification

Target-date funds offer built-in diversification by investing across a mix of asset classes, including stocks, bonds, and sometimes alternative investments. This diversification helps manage risk and increase the likelihood of positive returns over time.

Exposure to Different Markets: By investing in a variety of assets, target-date funds allow you to gain exposure to multiple sectors, geographic regions, and asset classes, reducing your reliance on any single investment.

Balanced Risk: As you approach the target date, the fund gradually shifts to more conservative investments, providing a balance between risk and reward that aligns with your evolving financial needs.

3. Professional Management

Another key benefit of target-date funds is that they are professionally managed by experienced fund managers. These managers adjust the asset allocation, monitor the fund’s performance, and make changes based on market conditions and the approaching target date. This eliminates the need for you to be actively involved in making decisions about your investments.

Expert Fund Managers: With a target-date fund, you get access to the expertise of professional managers who are responsible for making the investment decisions, saving you time and effort.

Ongoing Adjustments: As the market and economic conditions change, the fund managers can make adjustments to the asset allocation to keep the fund on track with your target date.

4. Long-Term Growth Potential

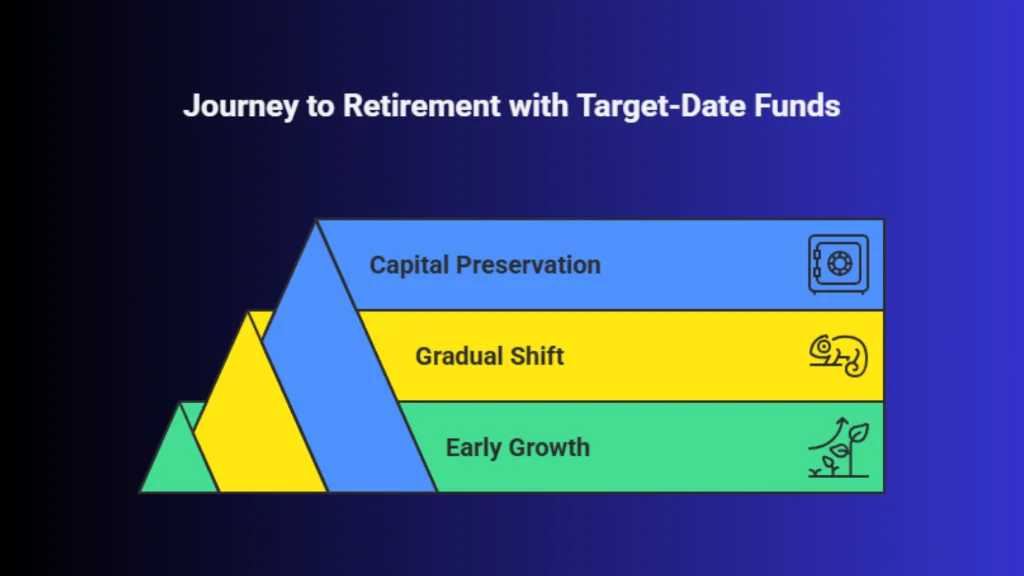

For younger investors, target-date funds offer a simple way to benefit from long-term growth. By starting with a more aggressive investment strategy that leans heavily on stocks, you can capture higher returns over time. As you approach your target date, the fund gradually shifts to a more conservative allocation, reducing exposure to volatility while preserving your accumulated wealth.

For younger investors, target-date funds offer a simple way to benefit from long-term growth. By starting with a more aggressive investment strategy that leans heavily on stocks, you can capture higher returns over time. As you approach your target date, the fund gradually shifts to a more conservative allocation, reducing exposure to volatility while preserving your accumulated wealth.

Growth During the Early Years: The early years of the target-date fund are focused on growth, taking advantage of the stock market's potential to increase value.

Capital Preservation in the Later Years: As you get closer to retirement, the fund begins focusing on capital preservation by shifting toward safer, more stable investments like bonds.

5. Ideal for Retirement Planning

Target-date funds are especially popular for retirement planning because they align perfectly with the needs of retirement savers. They automatically become more conservative as you approach your retirement age, so you don’t have to worry about making adjustments to your investment strategy as you get older.

Retirement Focused: The goal of a target-date fund is to help you grow your money during your working years and then protect that wealth as you near retirement.

Ease of Use for Retirement Accounts: Many retirement plans, like 401(k)s and IRAs, offer target-date funds as an investment option, making them easy to use for retirement savings.

6. Low Minimum Investment Requirements

Target-date funds often have low minimum investment requirements, making them accessible for investors of all experience levels. This allows you to start investing with a small amount of money and build your investment over time.

Accessible for Beginners: Even if you’re just starting to invest, target-date funds provide an affordable way to begin building your retirement savings.

Regular Contributions: You can set up automatic contributions, allowing you to regularly invest in the fund and take advantage of dollar-cost averaging.

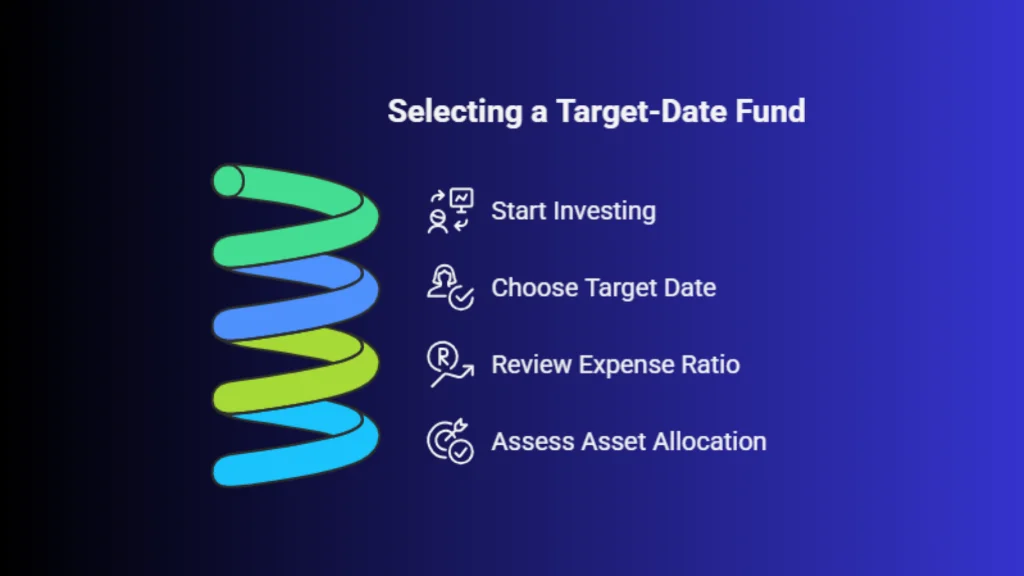

How to Choose the Right Target-Date Fund

Most investment platforms now allow users to start investing in target-date funds instantly through SIPs or one-time purchases, offering a seamless onboarding process. When selecting a target-date fund, you need to choose one that aligns with your retirement or financial goals. Consider these factors:

Most investment platforms now allow users to start investing in target-date funds instantly through SIPs or one-time purchases, offering a seamless onboarding process. When selecting a target-date fund, you need to choose one that aligns with your retirement or financial goals. Consider these factors:

Target Date: Choose a fund with a target date that matches your anticipated retirement year or financial milestone.

Expense Ratio: Review the expense ratio of the fund. A lower expense ratio means fewer fees, which can help improve your overall returns.

Fund’s Asset Allocation: Make sure the fund's asset allocation matches your risk tolerance and goals. Funds with more aggressive allocations focus on growth, while more conservative funds focus on capital preservation.

Final Thoughts

Target-date funds offer a convenient, diversified, and professionally managed investment solution, especially for long-term goals like retirement. They simplify investing by automatically adjusting the asset allocation as the target date approaches, providing you with the growth potential you need in the early years and stability as you near retirement.

If you’re looking for a hands-off investment strategy that allows you to focus on your long-term goals, target-date funds can be an excellent choice. Log in today to explore target-date funds and start building your retirement savings in 2026.