Managing cash flow effectively is a cornerstone of financial success for any individual or entity. When a temporary liquidity gap arises, the immediate reflex is often to seek external funding. However, the choice of instrument can significantly impact your long-term wealth. Two of the most common contenders in this space are the overdraft against mutual funds and the traditional term loan.

While both provide capital, their structures are fundamentally different, especially when you need to apply for an overdraft against mutual funds to address immediate, fluctuating requirements.

A term loan is a lump-sum disbursement where you receive the entire amount upfront and start paying interest on the full principal from day one. In contrast, an overdraft against mutual funds functions as a revolving credit line.

Here, your portfolio acts as collateral, and you are granted a limit. The primary distinction lies in the interest application: you only pay for what you use. If you have a sanctioned limit of 10 lakh but only withdraw 2 lakh for 15 days, your interest liability is restricted to that specific amount and duration.

Understanding the Mechanics of Overdraft Against Mutual Funds

An overdraft against mutual funds is a secured credit facility where you lien-mark your units in favor of a lender. This process allows you to unlock the value of your investments without actually selling them. This is particularly beneficial for those who do not want to disrupt their power of compounding or trigger capital gains taxes. When you apply for an overdraft against mutual funds, the lender sets a limit based on the Net Asset Value (NAV) of your holdings.

Typically, equity funds attract a Loan-to-Value (LTV) of up to 50%, while debt funds can command a higher LTV of up to 80%. Once the facility is active, it sits in your account like a secondary balance. You can use it for business working capital, medical emergencies, or even to bridge a gap before a planned receipt. Because you can apply for an overdraft against mutual funds through digital platforms, the turnaround time is often measured in minutes rather than days.

1. Interest Calculated on Actual Utilization

The most compelling reason to apply for overdraft against mutual funds is the significant cost savings on interest. In a standard term loan, interest begins accruing on the total principal from the second the money hits your account. With an overdraft against mutual funds, the interest is only levied on the amount you actually move out of the credit line.

Daily Reducing Balance: Interest is typically calculated daily. If you withdraw funds on Monday and pay them back on Friday, you only pay for those five days.

Zero Interest on Idle Limits: Simply having an active limit does not cost you anything. You can apply for overdraft against mutual funds just to have a safety net, and if you never withdraw the money, you never pay interest.

Calculated on Outstanding Amount: If your limit is 10 lakh and you use 1 lakh, your interest is calculated on 1 lakh, not the 10 lakh sanctioned limit.

2. Uninterrupted Asset Continuity

A common fear when people apply for overdraft against mutual funds is that they will lose out on market gains. This is a misconception. Even when your units are lien-marked (pledged) to the lender, they remain in your folio. This ensures that your wealth continues to work for you even while it acts as security for your credit.

Compounding Remains Intact: Since you aren't selling the units, the power of compounding continues to grow your principal investment.

Compounding Remains Intact: Since you aren't selling the units, the power of compounding continues to grow your principal investment.Corporate Actions Benefit You: You continue to receive all dividends, bonuses, and rights issues directly into your linked bank account.

SIP Integration: You do not need to stop your Systematic Investment Plans. You can continue to buy more units even while you have an active overdraft against mutual funds.

3. Flexibility with No Prepayment Penalties

Traditional loans often penalize you for being financially responsible. If you try to pay off a term loan early, banks frequently charge a "foreclosure fee." When you apply for an overdraft against mutual funds, these restrictive practices are discarded. The facility is designed to be treated like a flexible extension of your bank account.

No Lock-in Periods: You can pay back the utilized amount within a day, a month, or a year without any "early payment" charges.

Parking Surplus Cash: If you have temporary surplus cash, you can park it in your overdraft against a mutual funds account to effectively "stop" the interest on that portion.

Freedom of Repayment: There are no fixed EMIs. You can pay back in small fragments or one large lump sum whenever your cash flow permits.

4. The Power of a Revolving Credit Line

The overdraft against mutual funds is a revolving facility, meaning it is not a "one-and-done" transaction. Once you apply for overdraft against mutual funds and set up the limit, it remains available to you as long as the underlying collateral (your mutual funds) meets the lender's value requirements.

Automatic Limit Restoration: As soon as you repay a portion of what you borrowed, that same amount becomes immediately available for withdrawal again.

Long-term Utility: You only need to apply for overdraft against mutual funds once to have a permanent liquidity partner for years.

Dynamic Limits: Many lenders periodically refresh the limit based on the current NAV of your funds. If your fund value grows, your available credit limit might also increase automatically.

Term Loans: The Traditional Lump Sum Approach

Term loans are the "set it and forget it" version of borrowing. You apply for a specific amount, it gets credited to your bank account, and you repay it through fixed Equated Monthly Installments (EMIs) over a predetermined tenure. While this provides predictability for large, one-time expenses like home renovations or plant machinery, it lacks the surgical precision required for short-term, uncertain needs.

When you take a term loan, the "cost of carry" is high. Even if the money stays in your bank account unused for the first month, you are still paying interest on it. For short-term needs where the exact requirement might fluctuate, this leads to unnecessary interest leakage. Furthermore, term loans often come with rigid foreclosure charges if you decide to close the loan early, making them less "liquid" as a debt instrument.

When you take a term loan, the "cost of carry" is high. Even if the money stays in your bank account unused for the first month, you are still paying interest on it. For short-term needs where the exact requirement might fluctuate, this leads to unnecessary interest leakage. Furthermore, term loans often come with rigid foreclosure charges if you decide to close the loan early, making them less "liquid" as a debt instrument.

Comparison Table: Overdraft vs Term Loan

Feature | Overdraft Against Mutual Funds | Traditional Term Loan |

Interest Calculation | Only on the amount utilized | On the entire sanctioned principle |

Repayment Structure | Flexible; no fixed EMIs | Fixed Monthly EMIs |

Collateral Requirement | Pledged Mutual Fund units | Often unsecured (for personal loans) |

Prepayment Charges | Usually Zero | Often 2% to 5% of the balance |

Disbursal Speed | Instant (Digital Process) | 2 to 7 working days |

Impact on Investments | Portfolio remains intact | No direct link to investments |

Why You Should apply for an overdraft against mutual funds for Short-Term Gaps?

For short-term needs, the overdraft against mutual funds is almost always more cost-effective. Consider a scenario where a business owner needs 5 lakh for 20 days to settle a vendor invoice. If they take a term loan, they might have to take it for a minimum of 12 months, pay a processing fee, and then pay interest for the full month (or more). If they apply for an overdraft against mutual funds, they simply withdraw the 5 lakh, pay interest for exactly 20 days, and then move on.

The ability to apply for an overdraft against mutual funds also serves as a robust emergency fund. Since there is no cost to keeping the limit active (other than a nominal annual maintenance fee in some cases), having this facility ready ensures that you never have to sell your units during a market downturn. It provides a safety net that protects your long-term wealth-creation journey from short-term volatility.

Benefits of Choosing the Overdraft Route

Tax Efficiency: Avoids the Long-Term Capital Gains (LTCG) or Short-Term Capital Gains (STCG) tax triggered by selling units.

Lower Interest Rates: Being a secured loan, the rates are significantly lower than unsecured personal term loans.

Minimal Paperwork: Modern fintechs allow you to apply for an overdraft against mutual funds using just your PAN and an OTP-based lien marking.

Credit Score Independence: Since the loan is backed by an asset, it is accessible even to those with a developing credit history.

What are the Benefits of LAMF for Business Owners?

Business owners often face seasonal demands or delayed receivables. In such cases, a term loan is too rigid. When you apply for an overdraft against mutual funds, you gain a dynamic partner for your working capital. You can apply for an overdraft against mutual funds to handle a sudden bulk order and repay it the moment the client clears your invoice. This "on-demand" nature of the overdraft against mutual funds prevents the business from being over-leveraged.

Furthermore, the process to apply for an overdraft against mutual funds is now 100% paperless. You don't need to visit a branch or submit physical documents. By choosing to apply for an overdraft against mutual funds, you leverage your existing success (your investments) to fund your future growth. It is a sophisticated way to manage money that separates the "wealthy" from the "merely high-earning."

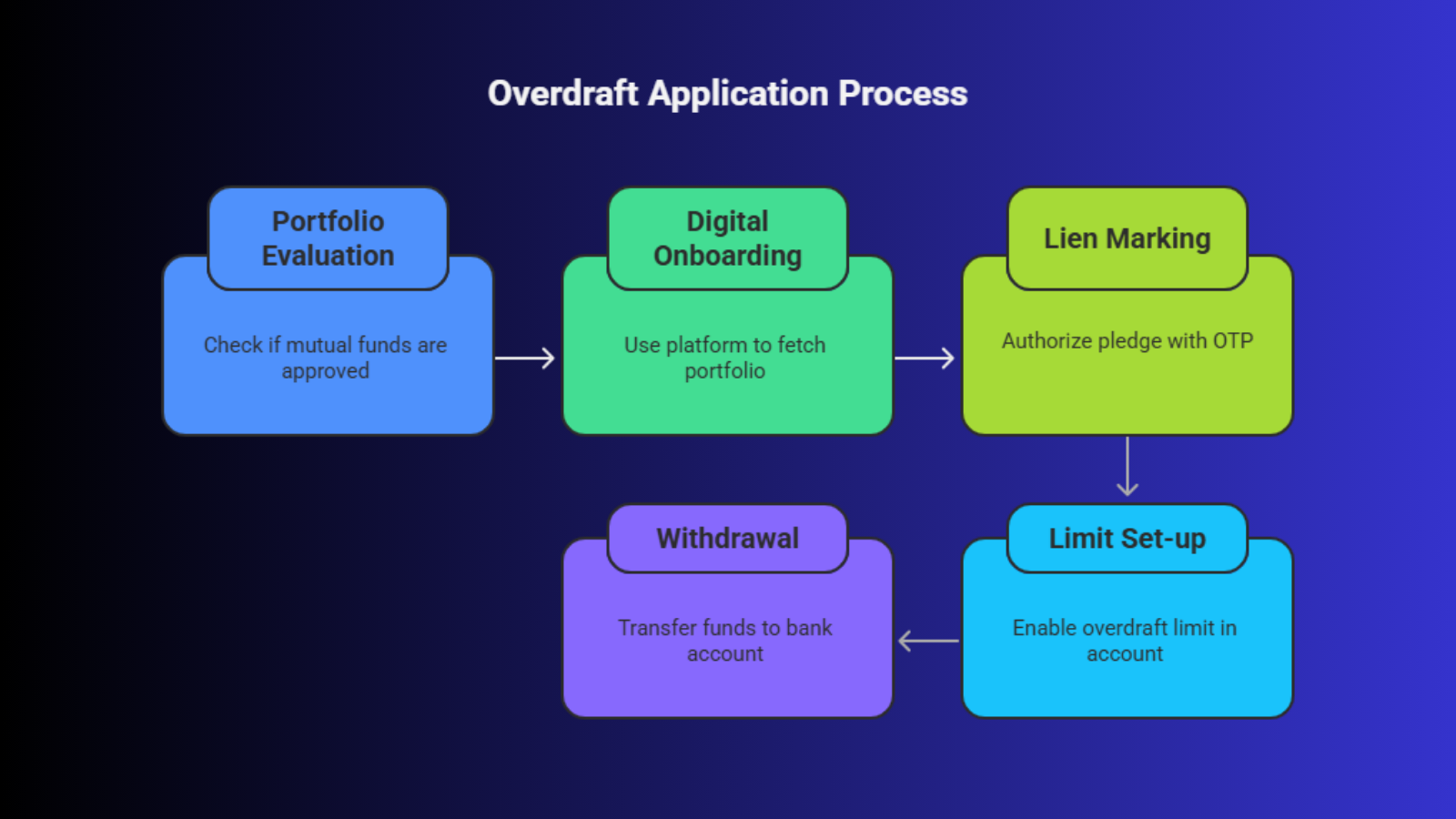

How to apply for an overdraft against mutual funds

Portfolio Evaluation: Check if your mutual fund schemes are on the lender's approved list.

Portfolio Evaluation: Check if your mutual fund schemes are on the lender's approved list.Digital Onboarding: Use a platform like discvr.ai to fetch your portfolio via CAMS or KFintech.

Lien Marking: Authorize the pledge through a secure OTP sent to your registered mobile number.

Limit Set-up: Once the lien is confirmed, the overdraft against mutual funds limit is enabled in your account.

Withdrawal: Transfer funds to your bank account as and when required.

Critical Factors to Consider Before You Apply

While the benefits are numerous, it is vital to understand the risks. The most significant is the "Margin Call." Since your overdraft against mutual funds is linked to market-linked assets, a sharp decline in the NAV can lead to a shortfall in the required collateral. If the value drops below a certain threshold, the lender will ask you to either pledge more units or repay a portion of the utilized amount to bring the LTV back in line.

However, for short-term needs, this risk is often manageable. Most investors who apply for an overdraft against mutual funds only utilize a small fraction of their total limit, providing a cushion against market volatility. When you apply for an overdraft against mutual funds, ensure you are not maxing out your limit unless necessary. This disciplined approach ensures that your overdraft against mutual funds remains a tool for growth rather than a source of stress.

Conclusion: Making the Right Move

When choosing between an overdraft against mutual funds and a term loan, the decision hinges on the nature of your requirement. If your need is for a specific, long-term purpose with a fixed repayment capacity, a term loan might suffice. However, for the vast majority of short-term liquidity needs, the flexibility and cost-efficiency of an overdraft against mutual funds are unparalleled.

Don't let your capital sit idle or disrupt your investment strategy for temporary needs. You can apply for an overdraft against mutual funds today and enjoy the peace of mind that comes with a ready-to-use credit line.

Ready to unlock the power of your portfolio? Visit discvr.ai to explore our Loan Against Mutual Funds (LAMF) product and see how easy it is to apply for an overdraft against mutual funds with instant approvals and zero hidden costs.