Ethereum, the second-largest cryptocurrency by market capitalization, has experienced significant growth since its launch in 2015. With its foundation in decentralized applications (dApps), smart contracts, and decentralized finance (DeFi), Ethereum remains a cornerstone of the blockchain ecosystem. However, as the cryptocurrency landscape evolves, many investors are asking, "Is Ethereum still a good investment in 2026?"

Before making a decision, some traders review Ethereum investment predictions alongside technical charts and on-chain data.

Why Ethereum Remains Relevant in 2026

Ethereum has continuously proven its value as more than just a cryptocurrency. It powers a vast ecosystem of decentralized applications, finance protocols, and tokenized assets. This versatility and the vast number of projects built on Ethereum’s platform help keep it relevant in the cryptocurrency space.

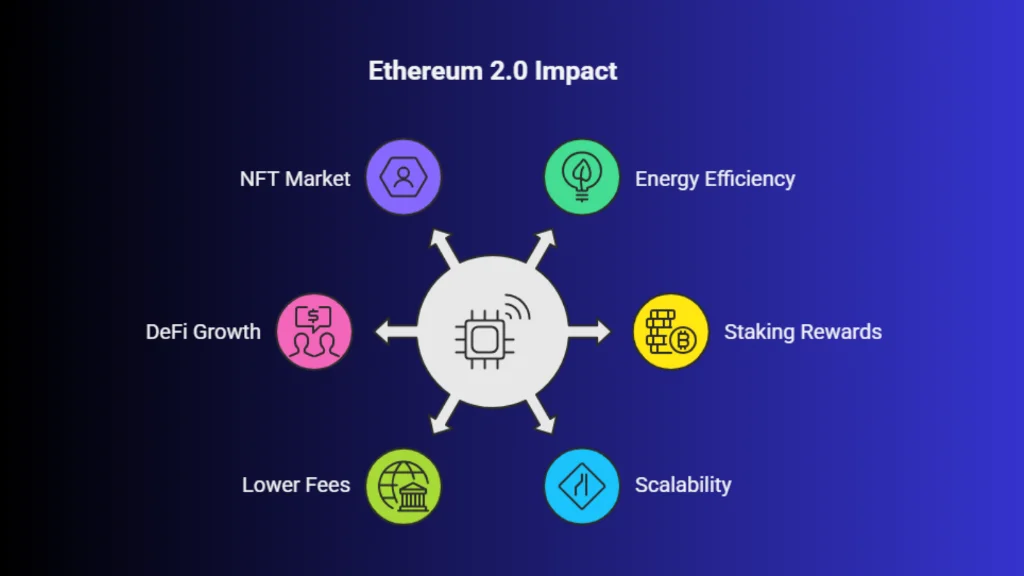

Ethereum’s major upgrade to Ethereum 2.0, transitioning from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus model, is one of the most significant changes in the crypto space. This update has made Ethereum more energy-efficient, with the added benefit of allowing users to stake their ETH for rewards, further boosting its attractiveness. Ethereum’s scalability improvements and the potential for lower transaction fees through Layer 2 solutions make it a promising investment for 2026.

Furthermore, Ethereum's smart contract functionality remains an indispensable tool in the growing DeFi and NFT markets, which continue to gain momentum. Many investors follow Ethereum investment predictions to understand possible price trends and long-term market direction. As these sectors grow, Ethereum’s role as the go-to platform for decentralized finance and digital assets may increase.

Furthermore, Ethereum's smart contract functionality remains an indispensable tool in the growing DeFi and NFT markets, which continue to gain momentum. Many investors follow Ethereum investment predictions to understand possible price trends and long-term market direction. As these sectors grow, Ethereum’s role as the go-to platform for decentralized finance and digital assets may increase.

Expert Predictions for Ethereum in 2026

Ethereum is expected to remain a core driver of the global crypto ecosystem through 2026 as smart contracts, decentralized finance, and real-world blockchain use continue to expand. While price volatility will remain, experts agree that Ethereum’s long-term value will be shaped more by adoption, regulation, and network utility than speculation alone. Investors often compare Ethereum investment predictions with Bitcoin and other altcoins to balance risk and return.

No. | Key prediction | What experts expect | Why it matters for investors |

1 | Strong long-term price growth | Bullish estimates place Ethereum between $7,000–$9,000, while bearish scenarios range from $2,000–$3,000 | Highlights high upside potential but also clear downside risk |

2 | Institutional adoption will expand | More banks, funds, and fintech firms are expected to use Ethereum for settlement and tokenization | Institutional demand improves stability and long-term credibility |

3 | Ethereum will dominate DeFi and Web3 | DeFi, NFTs, gaming, and real-world asset tokenization will continue to grow on Ethereum | Keeps demand for ETH strong due to transaction and staking use |

4 | Regulatory clarity will shape price direction | Global crypto rules will become clearer, reducing uncertainty but increasing compliance costs | Regulation can stabilize prices but may slow short-term growth |

5 | Ethereum staking will become a major income source | More investors will earn passive income through ETH staking | Makes Ethereum attractive beyond just price appreciation |

Key Factors That Will Shape Ethereum's Future

Ethereum’s future will be driven by a mix of technology upgrades, real-world adoption, and global regulations. These factors will determine how Ethereum grows in value, usability, and long-term relevance in the crypto ecosystem.

1. Institutional Adoption

Ethereum has already seen significant interest from institutional investors, with companies like Tesla and MicroStrategy adding cryptocurrency to their balance sheets. In 2026, more institutional players are expected to enter the Ethereum ecosystem, either by holding ETH as part of their treasury reserves or by investing in Ethereum-based products and services.

Institutional adoption can provide a massive price catalyst for Ethereum, as larger volumes of capital flow into the asset. The growing acceptance of Ethereum by financial institutions is also likely to bring greater legitimacy to the cryptocurrency, helping mitigate some of the volatility risks.

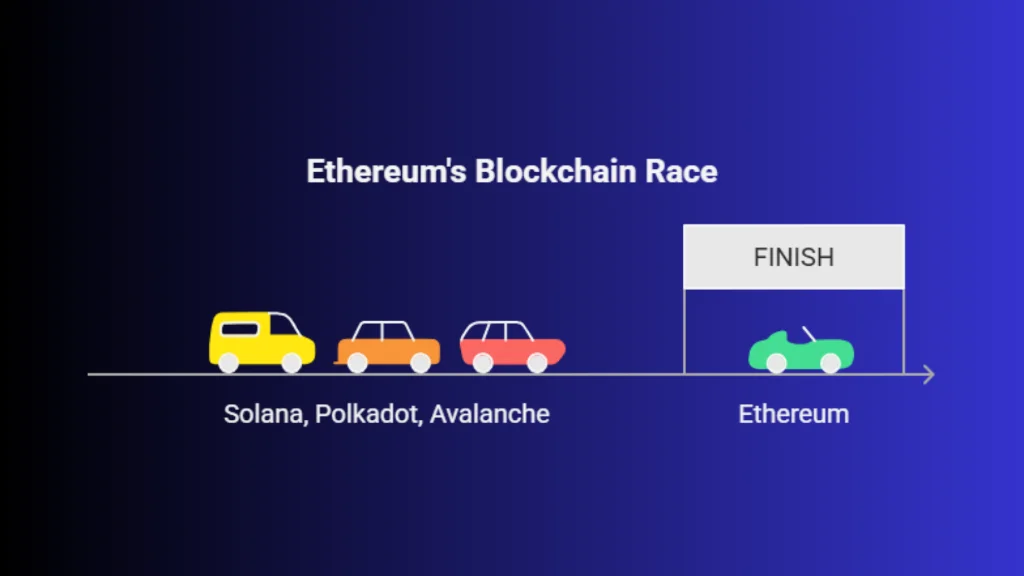

2. Competition from Other Blockchains

Ethereum’s dominance in the smart contract and DeFi space has been challenged by newer blockchains like Solana, Polkadot, and Avalanche, which offer faster transaction speeds and lower fees. These competitors have been attracting developers and users, which may reduce Ethereum’s market share.

However, Ethereum 2.0’s scalability improvements, along with Layer 2 solutions like Optimism and Arbitrum, are expected to address many of Ethereum’s current limitations, including high transaction fees and slow confirmation times. Ethereum’s ability to scale and reduce costs will be crucial to maintaining its leadership position in the blockchain space.

However, Ethereum 2.0’s scalability improvements, along with Layer 2 solutions like Optimism and Arbitrum, are expected to address many of Ethereum’s current limitations, including high transaction fees and slow confirmation times. Ethereum’s ability to scale and reduce costs will be crucial to maintaining its leadership position in the blockchain space.

3. Regulatory Landscape

Regulation remains one of the biggest risks to Ethereum’s future. As governments around the world focus on creating frameworks to regulate cryptocurrencies, the future of Ethereum will depend on how these regulations unfold. In particular, how governments treat decentralized finance (DeFi) and smart contracts will have a significant impact on Ethereum’s growth.

Clear regulatory frameworks could help Ethereum gain further adoption by institutional investors and developers. However, stringent regulations or outright bans on cryptocurrency in certain regions could hamper Ethereum’s growth potential.

Is Ethereum Still a Good Investment in 2026?

Ethereum’s potential for innovation, widespread adoption, and role in decentralized finance make it an appealing investment for many. With its transition to Ethereum 2.0, it is better positioned to scale, reduce transaction costs, and offer additional features like staking, which could attract more investors in 2026.

If you are planning for long-term growth, Ethereum investment predictions can help you build confidence in your strategy. For those willing to accept higher volatility in exchange for long-term growth potential, Ethereum could still be a very good investment. However, as with any investment in the cryptocurrency space, it’s essential to conduct thorough research, understand the risks involved, and invest within your risk tolerance.

Log in today to explore Ethereum investment opportunities and stay ahead of market trends as we approach 2026.