In the world of cryptocurrency and blockchain technology, Decentralized Finance (DeFi) stands out as one of the most revolutionary concepts. By eliminating traditional intermediaries such as banks, DeFi platforms offer a more open, transparent, and inclusive financial system. With its rapid growth and increasing adoption, many are asking: What does the future of DeFi hold in 2026?

As the DeFi space continues to expand, we’re seeing innovations, opportunities, and challenges that will reshape the financial ecosystem. This blog explores the key trends and developments in DeFi that are likely to define the industry in 2026.

What is DeFi, and why is it Gaining Popularity?

DeFi refers to a set of financial services that operate on blockchain networks, primarily Ethereum, allowing users to borrow, lend, trade, and invest in a decentralized manner. Unlike traditional financial systems, DeFi platforms don’t rely on banks or other intermediaries, meaning users retain full control over their assets.

DeFi’s popularity is driven by the promise of financial inclusion, greater transparency, and lower costs. In countries where access to traditional banking is limited, DeFi offers an accessible alternative for a wide range of users. Additionally, it allows for peer-to-peer transactions, which can reduce reliance on centralized institutions and eliminate intermediaries.

To take advantage of faster, cheaper transactions, explore DeFi in 2026 across Layer-2 scaling solutions and cross-chain protocols that unify liquidity, moving beyond the fragmented environment of earlier years.

Key Trends Shaping the Future of DeFi in 2026

The DeFi space is evolving rapidly, and several key trends will likely shape its future in 2026. Here are some of the most prominent developments to watch for:

1. Increased Regulatory Clarity

One of the biggest challenges DeFi faces is the lack of clear regulatory frameworks. In 2026, we expect regulators to provide more guidance on how DeFi platforms should operate within existing legal frameworks. This could help protect investors, improve security, and promote mainstream adoption.

As regulations become clearer, more traditional financial institutions may feel comfortable entering the DeFi space, further driving growth. Additionally, regulatory clarity could reduce the risks associated with operating in a largely unregulated environment, providing investors with greater confidence in the security and legitimacy of DeFi platforms.

2. Cross-Chain Interoperability

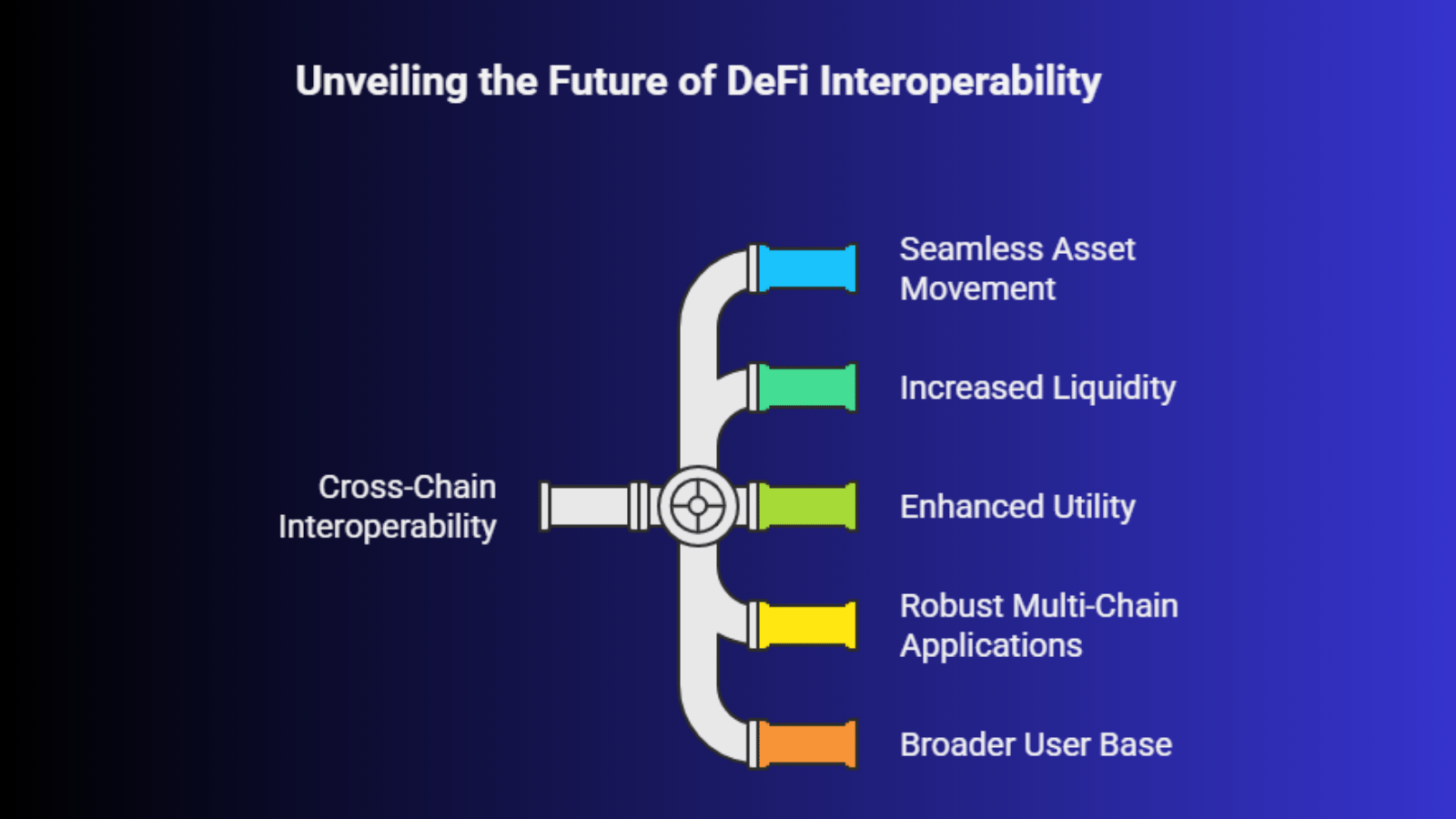

Cross-chain interoperability is crucial for the DeFi ecosystem to reach its full potential. In 2026, we expect significant advancements in the ability for different blockchain networks to communicate and interact with one another. Currently, DeFi platforms are often confined to specific blockchains, such as Ethereum, Binance Smart Chain, or Solana.

Cross-chain interoperability will allow users to move assets seamlessly between different blockchains, increasing the liquidity and utility of DeFi platforms. This development could result in the creation of more robust, multi-chain DeFi applications that are accessible to a broader user base.

Cross-chain interoperability will allow users to move assets seamlessly between different blockchains, increasing the liquidity and utility of DeFi platforms. This development could result in the creation of more robust, multi-chain DeFi applications that are accessible to a broader user base.

3. Layer 2 Solutions and Scalability

Scalability is one of the most pressing issues for DeFi platforms, especially those built on Ethereum, where high gas fees and slow transaction times can hinder adoption. Layer 2 solutions, such as Optimism, Arbitrum, and Polygon, are already addressing this issue by enabling faster and cheaper transactions while leveraging the security of the Ethereum mainnet.

In 2026, we expect Layer 2 solutions to become more widespread and efficient, allowing DeFi platforms to scale effectively without compromising security or decentralization. These solutions will play a pivotal role in making DeFi more accessible and user-friendly for individuals and institutions alike.

4. Decentralized Identity and Privacy

As DeFi platforms continue to grow, the need for enhanced privacy and identity verification will become more important. Privacy-focused technologies such as zero-knowledge proofs and decentralized identity management systems are expected to gain traction in 2026.

These technologies will enable users to maintain control over their personal data and financial information while still being able to participate in DeFi services. Decentralized identity systems can provide more secure and private transactions, addressing one of the biggest concerns of users and regulators alike.

5. DeFi Lending and Borrowing Expansion

DeFi lending and borrowing platforms have already gained significant traction, allowing users to lend their assets and earn interest, or borrow assets without relying on traditional financial institutions. By 2026, we expect these platforms to grow even further, with more innovative features, such as collateralized NFTs or the ability to access a wider range of assets for borrowing.

These platforms may also become more user-friendly and integrate with other DeFi services, creating seamless, all-in-one financial solutions for users. The continued growth of decentralized lending and borrowing could disrupt traditional credit markets, offering a more transparent and accessible way for individuals to manage credit.

You must explore DeFi in 2026 with a focus on Real-World Asset (RWA) tokenization and permissioned pools, as these are the primary institutional on-ramps that will drive the next wave of capital into the ecosystem.

The Challenges DeFi Needs to Overcome

Decentralized Finance, or DeFi, has transformed how people access financial services by removing traditional intermediaries. However, despite its rapid growth and innovation, DeFi still faces several major challenges that must be addressed before it can reach true global adoption and long-term stability.

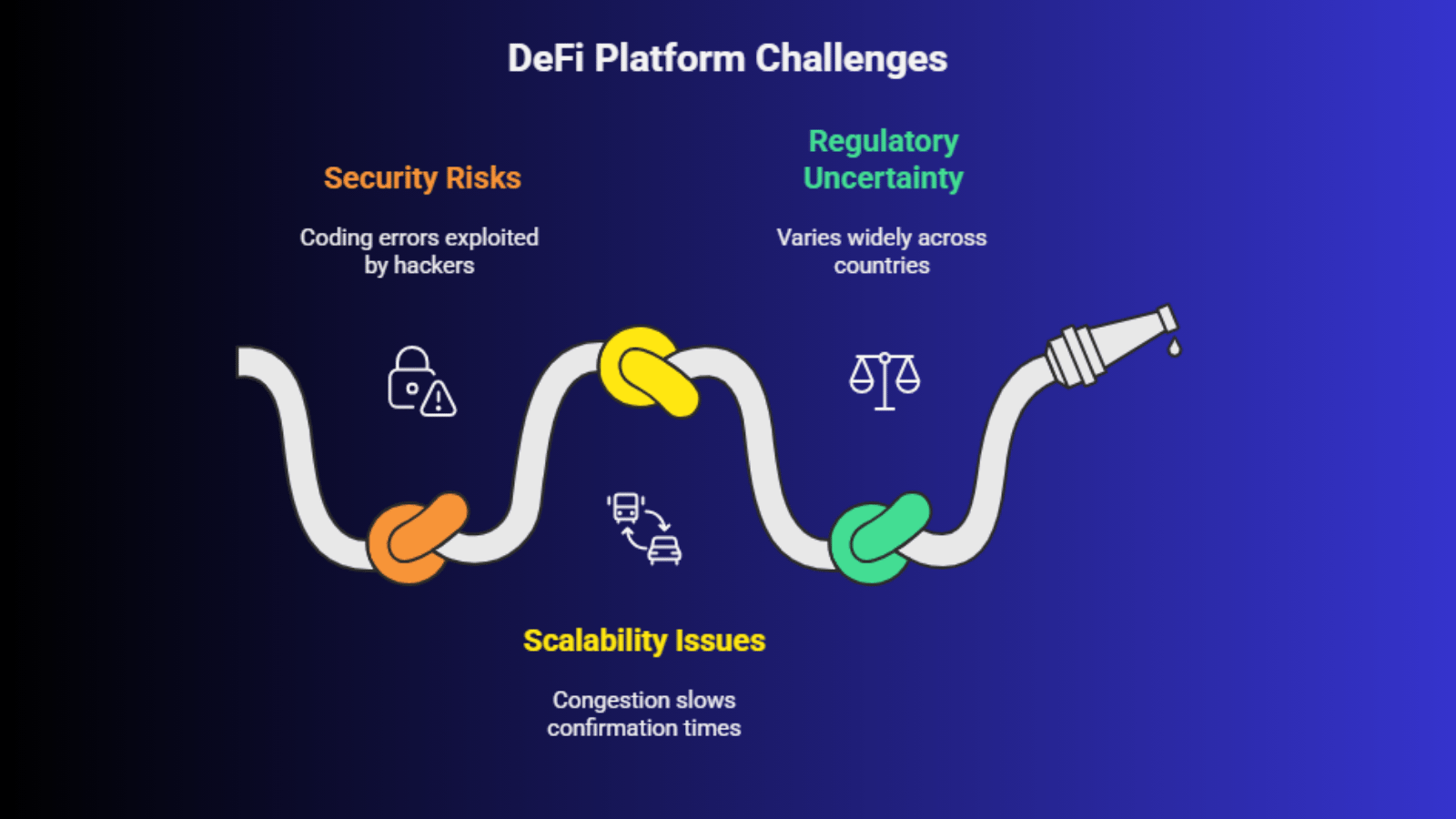

Security Risks are the biggest threat to DeFi platforms. Since DeFi protocols rely on smart contracts, even a small coding error can be exploited by hackers. Over the years, several platforms have suffered massive losses due to reentrancy attacks, flash loan exploits, rug pulls, and wallet breaches. Unlike traditional banks, there is often no central authority to reverse transactions or refund users. This means that investors can permanently lose their funds in a single attack. To improve security, DeFi projects must invest heavily in third-party audits, continuous security testing, and user education on safe wallet practices.

Security Risks are the biggest threat to DeFi platforms. Since DeFi protocols rely on smart contracts, even a small coding error can be exploited by hackers. Over the years, several platforms have suffered massive losses due to reentrancy attacks, flash loan exploits, rug pulls, and wallet breaches. Unlike traditional banks, there is often no central authority to reverse transactions or refund users. This means that investors can permanently lose their funds in a single attack. To improve security, DeFi projects must invest heavily in third-party audits, continuous security testing, and user education on safe wallet practices.Scalability Issues also limit the efficiency of DeFi platforms. As more users join and transaction volumes increase, many blockchains struggle with congestion, slower confirmation times, and sharply rising gas fees. During periods of high demand, simple activities like token swaps or staking can become expensive and time-consuming. Scaling solutions such as Layer-2 networks, sidechains, and more efficient consensus mechanisms are essential to ensure DeFi remains fast, affordable, and accessible to everyday users.

Regulatory Uncertainty adds another layer of complexity. DeFi operates globally, but financial regulations vary widely across countries. Many governments are still deciding how to classify DeFi platforms, how they should be taxed, and how user protection should be enforced. The absence of clear and consistent rules creates legal risks for developers and uncertainty for investors. Moving forward, constructive dialogue between regulators, developers, and the DeFi community will be necessary to create balanced policies that support innovation while protecting users.

Overcoming these challenges is critical for DeFi to evolve into a secure, scalable, and trusted alternative to traditional financial systems. As global jurisdictions implement frameworks like MiCA, you should explore DeFi in 2026 by prioritizing protocols with strong security audits and clear compliance roadmaps, moving towards a future of "Hybrid Finance."

Final Thoughts

The future of DeFi in 2026 is filled with immense potential. As DeFi continues to mature, we’ll see greater interoperability, scalability, and security, making decentralized finance more accessible to a wider audience. For investors and users, the opportunity to participate in a financial system that is more inclusive, transparent, and decentralized is a major draw.

To explore the latest developments and opportunities in DeFi, log in to your platform today and start understanding how decentralized finance can impact your investment strategy.