The renewable energy sector has witnessed a significant transformation over the past decade, and in 2026, it continues to be one of the most promising and sustainable investment opportunities. With growing global concerns about climate change and the shift towards green energy, renewable energy stocks have gained momentum as investors increasingly look for opportunities in sustainable industries.

Smart investors are choosing to invest in renewable energy stocks to capture long-term growth driven by clean power adoption and global sustainability targets. Let’s explore why investing in renewable energy stocks is a smart move for 2026, how to evaluate these stocks, and the top sectors driving growth in the green energy revolution.

Why Invest in Renewable Energy Stocks in 2026?

The renewable energy sector is expected to see exponential growth in the coming years, driven by several key factors:

1. Global Push for Sustainability

Governments and businesses worldwide are setting ambitious targets to reduce carbon emissions and transition to clean energy. International agreements like the Paris Agreement and national policies focused on reducing fossil fuel dependence have created a favorable environment for the renewable energy sector. In 2026, countries around the world will likely continue to increase their investments in renewable energy infrastructure.

2. Technological Advancements

Renewable energy technologies have made significant strides in recent years. Solar, wind, and battery storage technologies are more efficient and cost-effective than ever before. As technology continues to improve, renewable energy stocks will benefit from the growing adoption of these clean energy solutions.

3. Growing Consumer Demand for Green Energy

There is a rising consumer demand for environmentally-friendly products and services. This trend has extended to energy consumption, with more individuals and businesses opting for renewable energy sources. The growing popularity of electric vehicles (EVs), for example, will also boost demand for clean energy to power these vehicles.

4. Attractive Government Incentives

Many governments offer tax credits, subsidies, and other financial incentives to companies involved in renewable energy production and infrastructure development. These incentives not only make renewable energy more affordable but also make investing in the sector more attractive.

5. Strong Long-Term Growth Potential

Unlike traditional fossil fuel-based industries, renewable energy is inherently more sustainable. As the world moves toward decarbonization, companies in the renewable energy sector are well-positioned for long-term growth. This makes renewable energy stocks an excellent option for investors looking to build a future-proof portfolio.

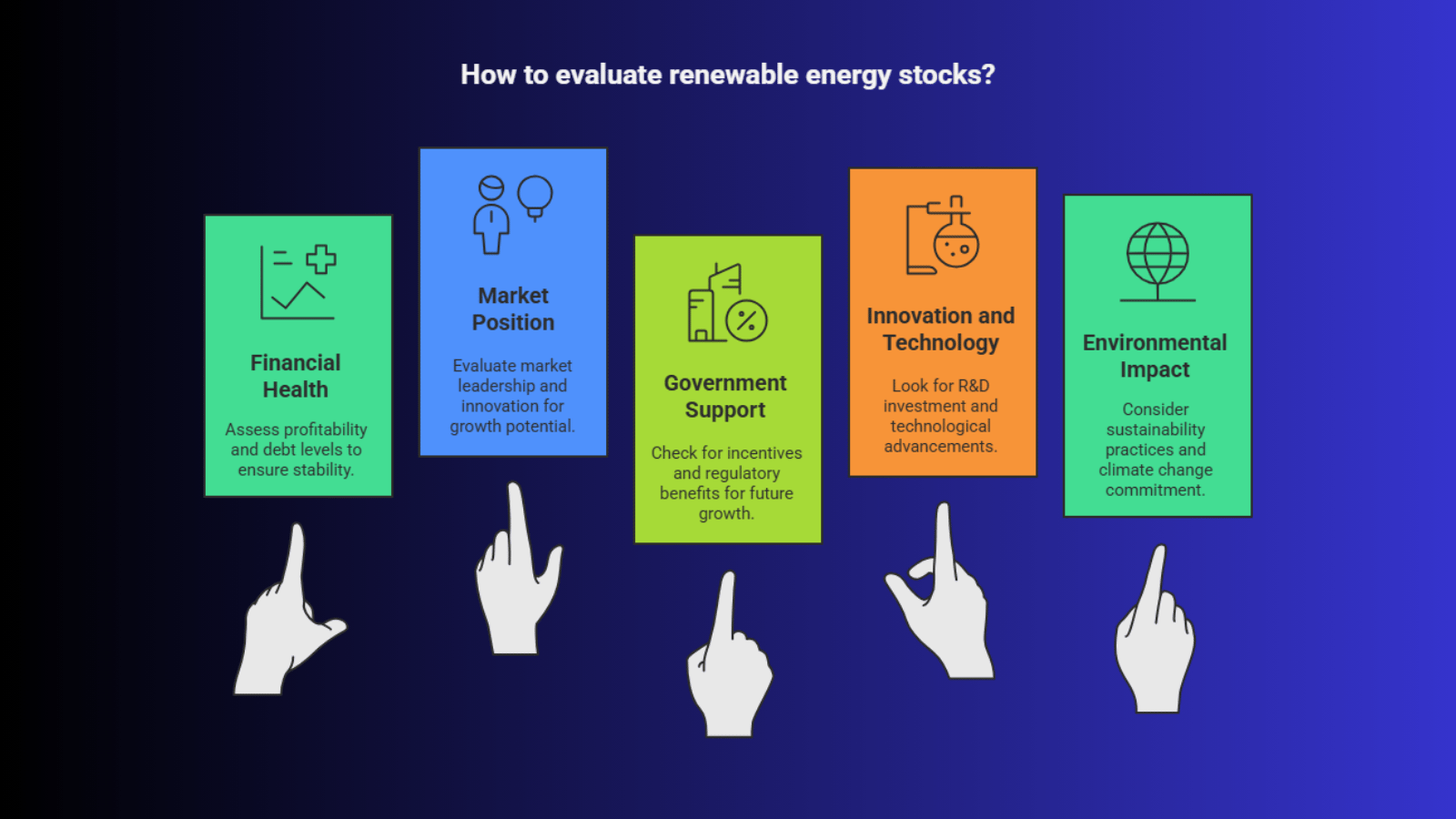

How to Evaluate Renewable Energy Stocks

Before diving into renewable energy investments, it’s essential to evaluate the companies in this space to ensure you are making sound investment decisions. Here are some key factors to consider when evaluating renewable energy stocks:

Before diving into renewable energy investments, it’s essential to evaluate the companies in this space to ensure you are making sound investment decisions. Here are some key factors to consider when evaluating renewable energy stocks:

1. Financial Health: Look at the financial stability of the company. Are they profitable? Do they have a solid balance sheet with manageable debt levels? Financially healthy companies are more likely to thrive in a growing market like renewable energy.

2. Market Position: Consider the company’s position in the market. Are they a leader in the renewable energy space? Are they innovating and developing new technologies? Companies with a strong market position, solid infrastructure, and a track record of growth are more likely to succeed.

3. Government Support: Renewable energy companies that benefit from government incentives, subsidies, and regulatory support are well-positioned for future growth. Ensure that the company is taking full advantage of the incentives available in its country or region.

4. Innovation and Technology: The renewable energy sector is evolving rapidly, with new technologies emerging all the time. Companies that invest in research and development (R&D) and are innovative in their approach are more likely to gain a competitive edge and achieve long-term success.

5. Environmental and Social Impact: Consider the environmental and social impact of the company. Investors increasingly focus on companies that not only deliver financial returns but also contribute to positive social and environmental outcomes. Look for companies with strong sustainability practices and a clear commitment to tackling climate change.

Top Renewable Energy Sectors to Watch in 2026

As the renewable energy landscape grows, several sectors within this industry are expected to perform exceptionally well in 2026. Here are some key sectors to watch:

1. Solar Energy

Solar energy is one of the most mature renewable energy sectors and continues to expand rapidly. Advances in solar panel efficiency, coupled with falling installation costs, make solar energy one of the most promising sectors for investment in 2026. Leading companies in solar energy production, installation, and storage solutions will likely experience significant growth.

Company Examples:

First Solar (USA) – Large-scale solar manufacturing and utility projects

Adani Green Energy (India) – One of the biggest renewable power producers

LONGi Green Energy (China) – World leader in solar panel manufacturing

Use Case Growth: Rooftop solar, solar farms, hybrid solar + storage projects

2. Wind Energy

Both onshore and offshore wind energy production have become increasingly cost-competitive with fossil fuels. In 2026, wind energy is expected to play a critical role in global energy production. Companies involved in wind turbine manufacturing, installation, and maintenance are well-positioned to benefit from the growing demand for clean power.

Company Examples:

Vestas Wind Systems (Denmark) – World’s largest wind turbine maker

Siemens Gamesa (Germany/Spain) – Offshore and onshore turbine leader

Suzlon Energy (India) – Major domestic wind energy player

Use Case Growth: Offshore wind parks, repowering old wind farms

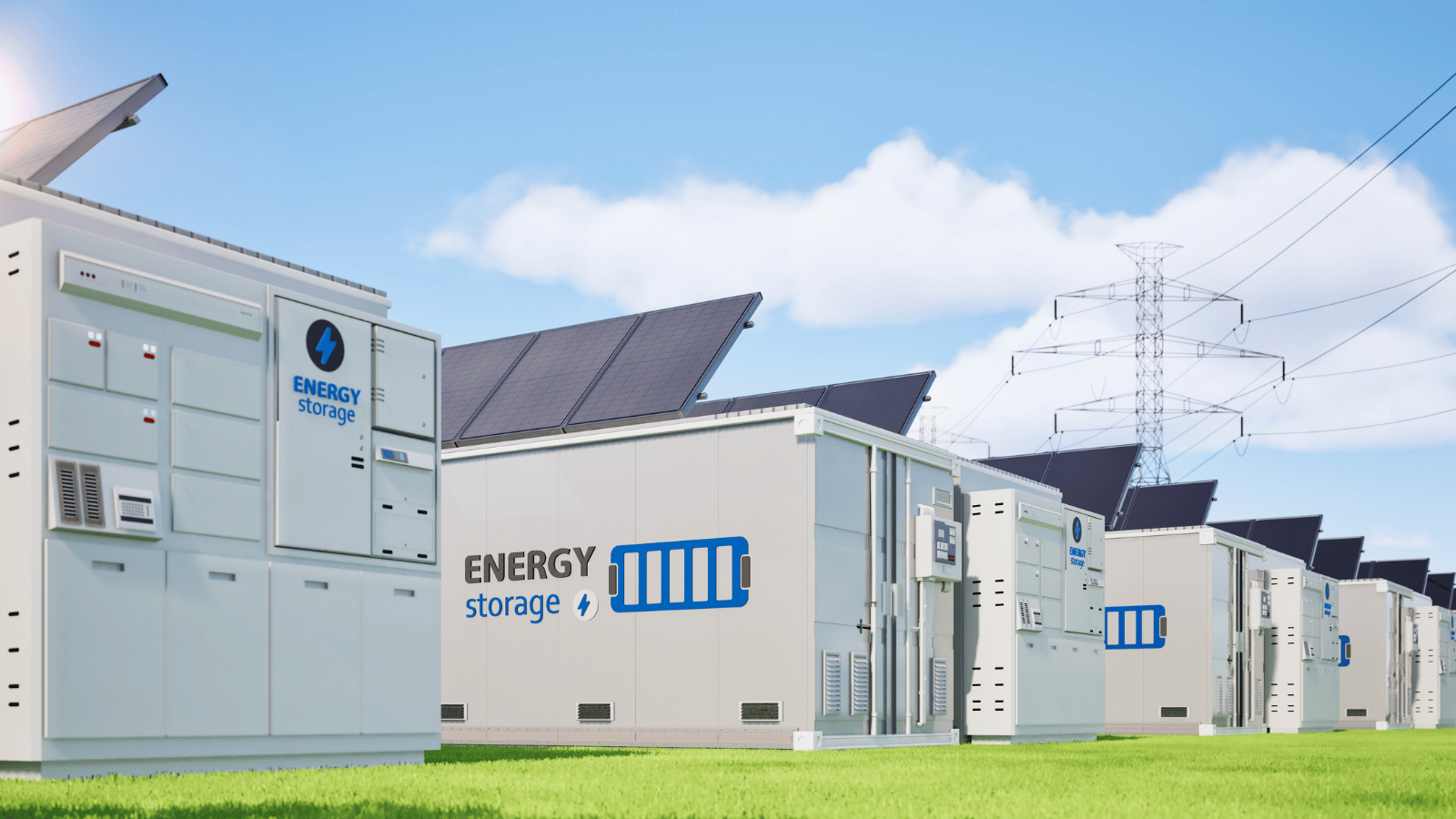

3. Battery Storage

As renewable energy sources like solar and wind are intermittent, the need for energy storage solutions is becoming more pressing. Companies involved in developing and manufacturing advanced battery storage systems, particularly those used for grid storage and electric vehicles, are expected to see significant growth. Company Examples:

Company Examples:

Tesla Energy (USA) – Powerwall and Megapack grid storage systems

CATL (China) – Largest lithium-ion battery manufacturer

Exide Industries (India) – Growing EV and grid battery storage segment

Use Case Growth: Grid-scale batteries, home storage, fast-charging stations

4. Electric Vehicles (EVs)

The rise of electric vehicles is closely tied to the renewable energy transition. As more consumers shift to EVs, the demand for clean energy to power these vehicles will rise. Companies that produce electric vehicles, batteries, and EV charging infrastructure will play a crucial role in the clean energy transition.

Company Examples:

Tesla (USA) – EVs, charging infrastructure, battery tech

BYD (China) – EVs, buses, and large-scale batteries

Tata Motors EV (India) – Mass-market electric mobility leader

Use Case Growth: Passenger EVs, electric buses, fast-charging networks

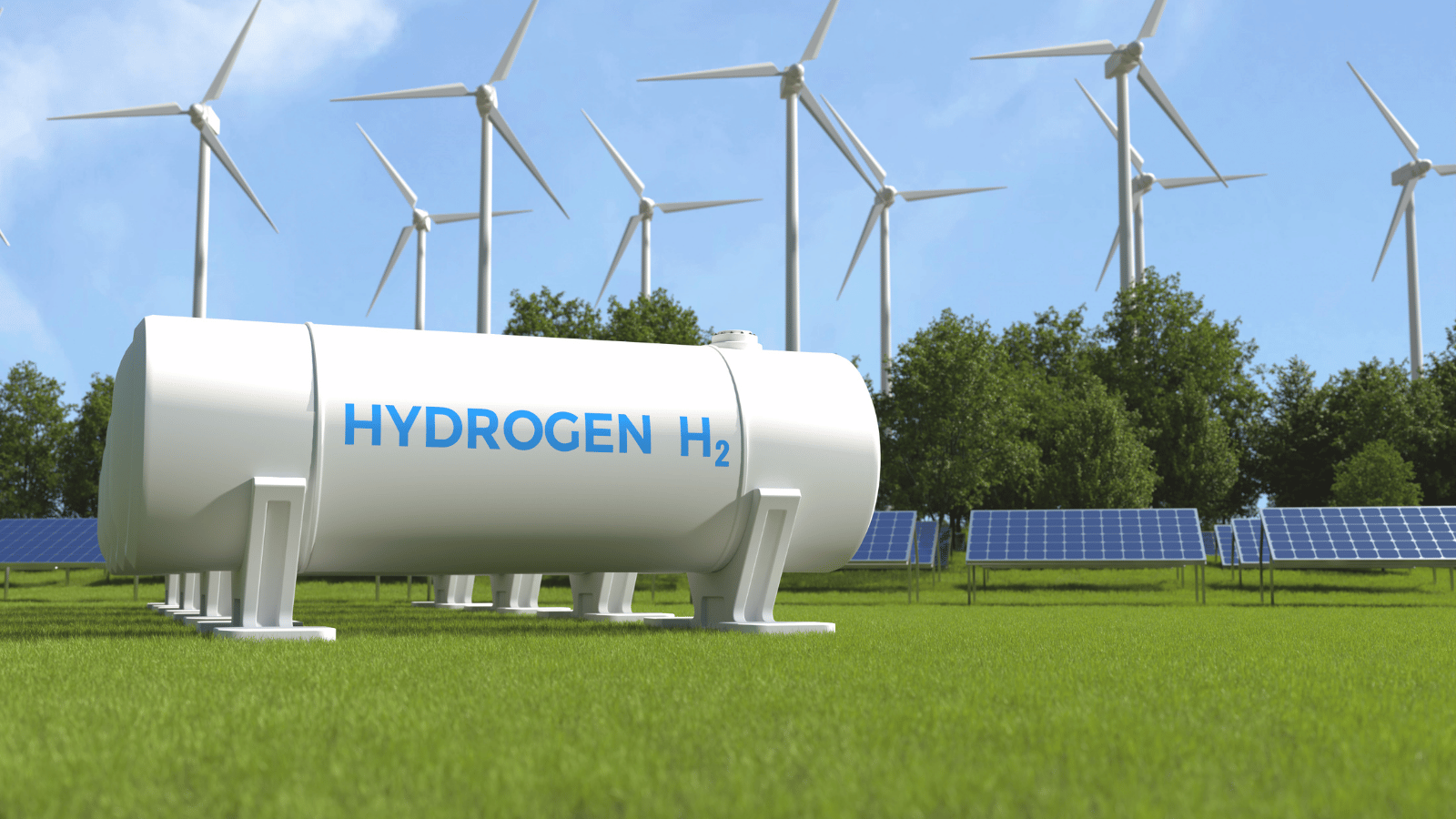

5. Green Hydrogen

Green hydrogen, produced through renewable energy sources, is an emerging sector with vast potential. It can be used in industries like transportation, power generation, and industrial processes, offering a clean alternative to fossil fuels. Investing in companies focused on green hydrogen production and infrastructure could yield significant returns in the coming years.

Company Examples:

Company Examples:

Plug Power (USA) – Green hydrogen and fuel cells

Linde (Global) – Hydrogen infrastructure and storage

Reliance Industries (India) – Gigafactory for green hydrogen ecosystem

Use Case Growth: Steel production, heavy trucks, power backup, shipping fuel

Conclusion

Investing in renewable energy stocks offers exciting opportunities for growth in 2026 and beyond. As the world transitions to clean energy, companies involved in solar, wind, battery storage, and electric vehicles are well-positioned to benefit from the growing demand for sustainable solutions. By focusing on financially strong, innovative companies with government support, you can build a future-proof portfolio that aligns with the global shift towards sustainability.

Log in to your investment platform today and start exploring renewable energy stocks to make the most of this dynamic sector in 2026.