Retirement planning is a long-term goal that requires steady investing, disciplined savings, and smart fund choices. Mutual funds remain one of the most accessible and effective ways to build a retirement corpus, thanks to their flexibility, diversification, and professional management. If you want financial security after retirement, choosing the right mutual funds tailored for long-term horizons can make a big difference.

Mutual funds offer a mode of investment that balances risk and return over an extended period. They allow you to invest systematically, benefit from compounding, and stay invested through market ups and downs - features that align well with retirement planning. With several fund types available, it's important to know which ones are usually best suited for retirement.

Why Mutual Funds Work Well for Retirement Planning

Retirement planning involves uncertainty around life changes, inflation, and future financial needs. Mutual funds help tackle these uncertainties in a few key ways:

They offer diversification across assets, sectors, and geographies. This diversification reduces the impact of volatility on your retirement corpus.

Long-term investing through mutual funds helps exploit compounding - where returns generate further returns over time.

Regular investment via SIPs (systematic investment plans) or lump sum ensures consistent contributions, which is especially useful when you have decades until retirement.

Professional management means you don’t need to actively track every stock or bond: fund managers handle asset allocation and rebalancing.

Given the long time horizon typical of retirement planning, mutual funds offer a flexible yet stable avenue for building wealth steadily over the years. You can start investing in retirement funds to build a steady income source for your post-retirement years and reduce future financial stress.

Types of Mutual Funds Suitable for Retirement Planning

Depending on your age, risk tolerance, and retirement timeline, certain mutual fund categories tend to work better than others. Here are the main types often recommended for retirement planning:

Depending on your age, risk tolerance, and retirement timeline, certain mutual fund categories tend to work better than others. Here are the main types often recommended for retirement planning:

1. Equity‑Oriented Funds (for Long-Term Growth)

If you are many years away from retirement - say 15–20 years or more - equity‑oriented funds are a strong candidate. Because you have time to absorb market volatility, these funds give potential for higher growth. Over the decades, the compounding effect can significantly boost your corpus.

Within equity funds, consider diversified large/mid‑cap funds or flexi‑cap funds that offer exposure across company sizes and sectors. These help spread risk while capturing growth across different segments of the economy.

2. Hybrid Funds (Balanced Growth and Stability)

As you approach retirement, your investment horizon shrinks and risk tolerance usually declines. Hybrid funds - which combine equity and debt - offer a balance between growth and stability. They help reduce volatility compared to pure equity funds while still providing reasonable growth potential.

Hybrid funds are suitable for mid-term investors or as a bridge between aggressive equity exposure and conservative debt exposure as you near retirement.

3. Debt & Debt‑Oriented Funds (For Stability and Income)

When you are closer to retirement, preserving capital and generating stable income becomes more important than aggressive growth. Debt mutual funds, or debt‑oriented hybrid funds, can play a useful role. They help reduce risk, provide regular income, and protect capital against sudden market swings.

Short‑term and medium‑term debt funds, or conservative hybrid funds, can help lock in retirement savings while limiting volatility.

4. Target‑Date Funds or Retirement Funds (If Available)

Some mutual fund schemes are designed with retirement goals in mind - these funds adjust their asset allocation automatically as you near your target retirement date. If such options are available, they can be a convenient “set‑and‑forget” solution, mixing growth and stability in a single package.

If target‑date funds are not available, combining equity in early years, hybrids in mid years, and debt later can mimic the same lifecycle approach manually.

How to Select the Right Funds for Your Retirement Goals

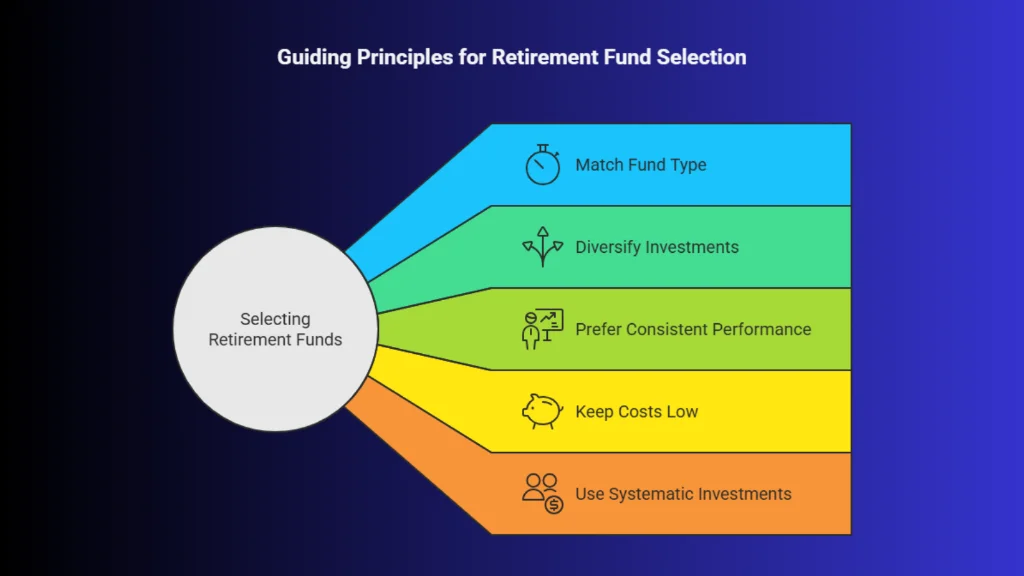

Selecting mutual funds for retirement requires a thoughtful approach. Most investment platforms now let you start investing in retirement funds online with simple KYC and low minimum amounts. Here are some guiding principles:

Selecting mutual funds for retirement requires a thoughtful approach. Most investment platforms now let you start investing in retirement funds online with simple KYC and low minimum amounts. Here are some guiding principles:

Match fund type to time horizon and risk appetite - longer horizons allow for equity growth; shorter horizons favor stability via debt or hybrids.

Diversify across funds and asset classes - don’t put all money in one fund; mix equity, hybrid, and debt for balanced risk-return.

Prefer consistent past performance over flashy returns - consistent returns over 5-10 years matter more than occasional high peaks.

Keep costs low - lower expense ratios improve compounding benefits.

Use systematic investments (SIP) - regular, small investments reduce timing risk and make investing easier.

Conclusion

For retirement planning, mutual funds offer a flexible, diversified, and professionally managed path to build a substantial corpus over time. Equity‑oriented funds suit early‑career investors aiming for long‑term growth. Hybrid funds are ideal for mid‑career stages with moderate risk tolerance, while debt‑oriented funds help protect savings nearer retirement.

By selecting the right combination based on your timeline, risk comfort, and financial goals, you can create a retirement investment plan tailored to your needs. If you want long-term financial security and peace of mind, now is the right time to start investing in retirement funds. Log in to your investment platform today to explore suitable funds and start building your retirement portfolio now.