Silver has long been seen as a reliable store of value and a hedge against inflation, similar to gold. In recent years, the rise of digital silver has made it easier for investors to gain exposure to silver without the need for physical storage. Digital silver allows investors to buy silver in a digital format, which is backed by physical silver stored in secure vaults.

In this blog, we’ll explore how to buy digital silver safely in 2026, including the key benefits, what to look for when selecting a platform, and how to secure your digital silver investment.

What is Digital Silver?

Digital silver is essentially a way of investing in silver without the need to hold or store the physical metal. Through digital silver platforms, investors can buy silver units that are backed by real silver stored in secure vaults. These platforms provide investors with the flexibility to buy and sell silver quickly, while offering the same benefits of owning the physical metal.

The main advantage of digital silver over traditional silver investments is the convenience. You don’t need to worry about storing, securing, or insuring physical silver, which can come with additional costs and risks. Instead, digital silver provides a streamlined and accessible way to invest in silver.

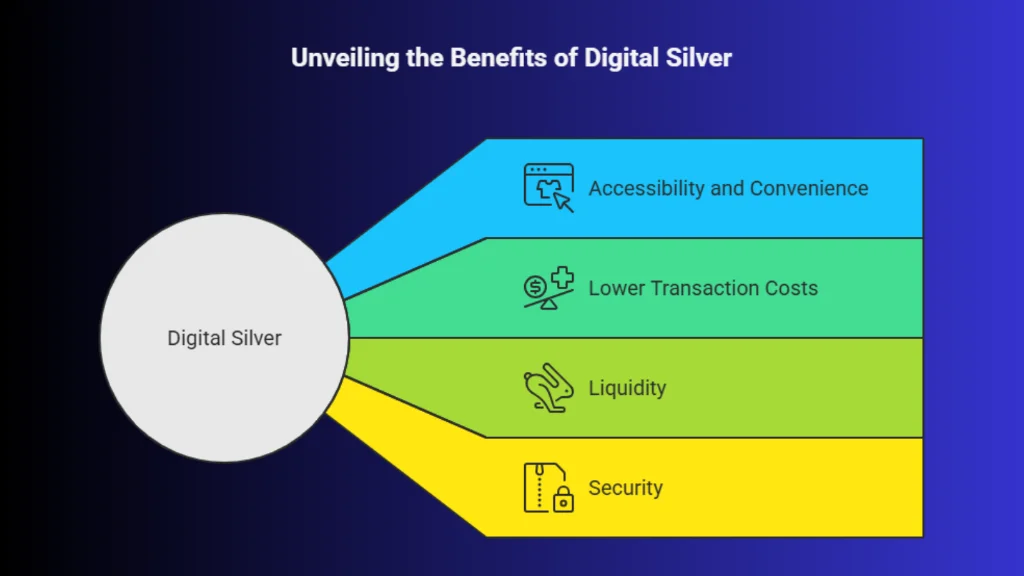

Key Benefits of Digital Silver

Digital silver is rapidly gaining popularity as investors look for affordable and accessible ways to diversify their portfolios. It offers the convenience of online buying and selling, eliminating the challenges of storing physical silver. With rising industrial demand and long-term value potential, digital silver provides an easy entry point for both new and experienced investors. Adding it to your investment strategy can strengthen your portfolio’s stability and growth potential.

Digital silver is rapidly gaining popularity as investors look for affordable and accessible ways to diversify their portfolios. It offers the convenience of online buying and selling, eliminating the challenges of storing physical silver. With rising industrial demand and long-term value potential, digital silver provides an easy entry point for both new and experienced investors. Adding it to your investment strategy can strengthen your portfolio’s stability and growth potential.

1. Accessibility and Convenience

One of the main advantages of digital silver is its accessibility. Unlike physical silver, which requires you to find secure storage options, digital silver can be easily purchased and sold online through various platforms. You can buy digital silver from the comfort of your home, and the transaction is usually processed quickly.

2. Lower Transaction Costs

Buying physical silver often comes with higher transaction fees, including shipping, storage, and insurance. Digital silver platforms generally offer lower fees because the logistics of handling physical silver are eliminated. This makes it an affordable option for investors who want to diversify their portfolios with silver.

3. Liquidity

Digital silver is highly liquid, meaning you can easily buy or sell it on the platform at any time. The value of digital silver is directly tied to the current market price of silver, so you can monitor your investment and make quick decisions when needed.

4. Security

Digital silver is typically backed by physical silver stored in secure vaults. This provides peace of mind to investors, knowing that their investment is backed by real assets. Additionally, many digital silver platforms have security measures in place, such as encryption and insurance, to protect your investment from theft or loss.

How to Buy Digital Silver Safely in 2026

While buying digital silver is convenient, it’s important to take steps to ensure that you’re investing in a safe and reliable platform. Here’s how you can buy digital silver safely in 2026:

While buying digital silver is convenient, it’s important to take steps to ensure that you’re investing in a safe and reliable platform. Here’s how you can buy digital silver safely in 2026:

1. Choose a Reputable Platform

The first step in buying digital silver safely is selecting a trustworthy platform. Look for platforms that are well-established, transparent, and have a solid reputation in the market. Ensure that the platform is regulated by relevant authorities and offers a secure, user-friendly interface for buying and selling silver.

2. Verify the Platform’s Security Measures

Security is a top priority when buying digital silver. Make sure that the platform employs robust security measures, such as encryption, two-factor authentication (2FA), and insurance to protect your investment. These measures help ensure that your personal information and funds are secure during transactions.

3. Check the Storage and Backing of the Silver

When purchasing digital silver, it’s important to verify that the silver is actually backed by physical silver stored in a secure, audited vault. Reputable platforms usually provide information about where the silver is stored and how it is protected. Some platforms also offer transparency by allowing investors to view or track the stored silver.

4. Understand the Fees and Terms

Before buying digital silver, review the platform’s fee structure and terms. Make sure you understand any transaction fees, storage fees, or other costs associated with buying and holding digital silver. Some platforms may charge a small fee for holding your digital silver in storage, while others may offer fee-free storage.

5. Start Small and Diversify

If you’re new to digital silver, it’s advisable to start with a small investment. This will allow you to become familiar with the platform and the process of buying and selling digital silver. Once you’re comfortable, you can gradually increase your investment.

Additionally, consider diversifying your investments. While digital silver is a great way to add precious metals to your portfolio, it’s important to have a mix of assets in your investment strategy, including stocks, bonds, and other commodities.

Additionally, consider diversifying your investments. While digital silver is a great way to add precious metals to your portfolio, it’s important to have a mix of assets in your investment strategy, including stocks, bonds, and other commodities.

6. Monitor Your Investment

Once you’ve purchased digital silver, it’s important to regularly monitor your investment. The price of silver can fluctuate, so keeping track of market trends and updates can help you make informed decisions about buying, selling, or holding your digital silver.

Final Thoughts

Digital silver offers a convenient, cost-effective way to invest in silver without the need to own physical metal. With its accessibility, liquidity, and security, it’s an attractive option for investors looking to diversify their portfolios and hedge against inflation.

To buy digital silver safely in 2026, choose a reputable platform, verify the security measures and silver backing, and understand the fees associated with your investment. Start small, diversify, and monitor your investment to make the most of this digital asset.

Log in today to explore digital silver platforms and begin building your portfolio with this reliable precious metal investment.