Understanding how your investment portfolio translates into liquid cash is essential for modern financial planning. When you decide to apply for a loan against the mutual fund NAV, you are essentially leveraging the current market value of your holdings to secure a line of credit. The Net Asset Value (NAV) is the heartbeat of this process, acting as the primary metric that lenders use to calculate exactly how much capital they can extend to you.

Unlike traditional loans that rely heavily on monthly salary slips, a loan against mutual fund NAV is asset-backed. This means your eligibility is directly proportional to the "mark-to-market" value of your units on the day of application. Since NAV fluctuates daily based on market performance, your borrowing power is a dynamic figure. In the sections below, we will explore the mechanics of NAV in the lending ecosystem and how different fund categories influence your final loan amount.

The Role of NAV in Calculating Loan Limits

The Net Asset Value represents the per-unit market value of a mutual fund scheme. When a financial institution evaluates your application, it does not just look at the number of units you own; it multiplies those units by the latest available NAV to determine the total collateral value. This total value is then subjected to a Loan-to-Value (LTV) ratio, which varies depending on the risk profile of the underlying assets.

Lenders use the NAV to ensure they have a sufficient "margin of safety." If the market rises, your NAV increases, potentially allowing you to apply for a loan against the mutual fund NAV with a higher credit limit. Conversely, a dip in the NAV might lead to a "margin call," where the lender asks for additional units to be pledged or a partial repayment of the principal.

Asset Type | Typical LTV Ratio | Impact of NAV Volatility |

Equity Mutual Funds | 45% to 50% | High; requires a larger margin of safety due to market swings. |

Debt Mutual Funds | 75% to 85% | Low, stable NAV allows for higher borrowing limits. |

Hybrid Funds | 60% to 70% | Moderate; eligibility depends on the equity-debt mix. |

How Equity vs Debt NAV Influences Borrowing Power

When you seek a loan against the mutual fund NAV, the nature of the fund determines the haircut applied by the bank. Equity funds are considered volatile; therefore, even if your NAV is high today, lenders usually only provide up to 50% of that value as a loan. This conservative approach protects the lender if the NAV drops suddenly due to a market correction.

On the other hand, debt funds possess a more stable NAV. Because the underlying securities are fixed-income instruments like bonds or treasury bills, the risk of a sharp decline is lower. Consequently, you can often secure up to 85% of the debt fund’s NAV. If you hold a diverse portfolio, it is often wiser to apply for a loan against the mutual fund NAV of your debt holdings first to maximize your liquidity without pledging a larger portion of your equity growth.

Key Factors Determining Your NAV-Linked Eligibility

Fund Categorization: Lenders maintain an "approved list" of mutual fund schemes. Not every fund is eligible for a lien.

RTA Integration: Most digital platforms link with registrars like CAMS and KFintech to fetch your real-time NAV and automate the pledge process.

Minimum Portfolio Value: Most institutions require a minimum portfolio value (e.g., ₹50,000) before you can apply for a loan against the mutual fund NAV.

Lock-in Periods: Units under ELSS (Tax Saving) schemes cannot be pledged until the 3-year lock-in period is completed, regardless of how high the NAV is.

Understanding the Overdraft Facility Mechanism

A loan against mutual fund NAV is typically offered as an overdraft (OD) facility rather than a lump-sum term loan. This is highly advantageous for the borrower because interest is only charged on the amount actually utilized, not the total sanctioned limit. For instance, if your NAV permits a limit of ₹10 lakhs but you only use ₹2 lakhs for an emergency, you pay interest only on that ₹2 lakhs.

A loan against mutual fund NAV is typically offered as an overdraft (OD) facility rather than a lump-sum term loan. This is highly advantageous for the borrower because interest is only charged on the amount actually utilized, not the total sanctioned limit. For instance, if your NAV permits a limit of ₹10 lakhs but you only use ₹2 lakhs for an emergency, you pay interest only on that ₹2 lakhs.

This flexibility ensures that you can keep your credit line open as a "safety net." As your NAV grows over time, many lenders allow for a "limit enhancement," where your borrowing capacity increases in tandem with your wealth. When you apply for a loan against the mutual fund NAV, you are setting up a revolving credit facility that matures and renews annually, providing long-term financial agility.

Advantages of Choosing NAV-Based Loans Over Personal Loans

Lower Interest Rates: Since the loan is secured by your NAV, interest rates are usually 2% to 5% lower than unsecured personal loans.

No Impact on Compounding: Your units remain in your folio. You continue to earn dividends and benefit from NAV appreciation even while the loan is active.

No Credit Score Obsession: While a good CIBIL score is helpful, the primary eligibility is your NAV. This makes it accessible for those with limited credit history.

Zero Foreclosure Charges: Most digital lenders allow you to repay the amount and remove the lien on your NAV without any penalty.

Step-by-Step Process to Apply for a Loan Against the Mutual Fund NAV

The transition from an investor to a borrower is now entirely digital. Most B2B-facing fintech platforms have streamlined the process to under 15 minutes. Here is how the typical journey looks when you decide to leverage your portfolio:

Step 1: Real-Time Portfolio Fetching via RTA Integration

Step 1: Real-Time Portfolio Fetching via RTA Integration

The first step in the journey is to consolidate your holdings to see exactly what you can leverage. Most modern lending platforms use a secure "Account Aggregator" or a direct RTA fetch mechanism. You simply provide the mobile number or PAN associated with your investments. The system then queries the databases of CAMS and KFintech to pull a comprehensive list of every mutual fund unit you own across various Asset Management Companies (AMCs).

This stage is crucial because it identifies which units are "free" and which are "locked." For example, if you have units in an ELSS scheme that are only two years old, the system will filter those out of your eligibility since they cannot be pledged. Once the fetch is complete, you are presented with a clean dashboard of your investible surplus, allowing you to apply for a loan against the mutual fund NAV with full visibility of your assets.

Step 2: Automated Limit Calculation and LTV Application

Once your portfolio is visible, the lender’s algorithm performs a "Mark-to-Market" (MTM) valuation. The system fetches the previous day’s closing NAV for every scheme in your folio. This ensures that the loan amount offered is based on the most recent market data. The total valuation is then passed through a risk-weighting engine that applies the Loan-to-Value (LTV) ratio.

Fund Category | Calculation Logic | Max Eligibility Example |

Equity Funds | NAV x Units x 50% | ₹10 Lakhs Value = ₹5 Lakhs Loan |

Debt Funds | NAV x Units x 80% | ₹10 Lakhs Value = ₹8 Lakhs Loan |

Liquid Funds | NAV x Units x 85% | ₹10 Lakhs Value = ₹8.5 Lakhs Loan |

This calculation determines your maximum borrowing power. If you decide to apply for a loan against the mutual fund NAV, you can often choose to pledge only a portion of your portfolio rather than the whole amount, giving you granular control over how much debt you take on relative to your net worth.

Step 3: Digital Lien Marking and OTP Authorization

The "Lien" is a legal claim or a "hold" placed on your units, which acts as the collateral for the lender. In a digital loan against mutual fund NAV, this happens instantly through an Electronic Lien Marking (e-Lien) process. Once you select the specific schemes and number of units you wish to pledge, the lender sends a request to the RTA (CAMS/KFintech).

You will receive a secure OTP on your registered mobile number and email. By entering this OTP, you are providing legal consent to mark a lien on those units in favor of the bank or NBFC. It is important to note that you still own these units; they are not transferred to the lender. However, the lien prevents you from selling or redeeming those specific units until the loan is closed. This high level of security is why more investors now apply for a loan against the mutual fund NAV instead of opting for high-interest credit cards.

Step 4: Instant Limit Sanction and Fund Disbursal

After the RTA confirms the lien marking, which usually happens in a matter of minutes, the lender finalizes the credit limit. Unlike a traditional loan, where the money is dropped into your account as a lump sum (and you start paying interest on the whole amount), a loan against mutual fund NAV is typically set up as an Overdraft (OD) account or a "Credit Line."

The sanctioned limit is linked to your bank account. You can withdraw ₹10,000 or ₹10 Lakhs, depending on your immediate need. Interest is calculated only on the amount you draw down and for the number of days you use it. This decision to apply for a loan against the mutual fund NAV is a strategically sound move for business owners or individuals with fluctuating cash flow needs. The entire disbursal process, from portfolio fetch to cash availability, is frequently completed within the same business day.

By choosing to apply for a loan against the mutual fund NAV, you avoid the "opportunity cost" of selling your units during a market downturn. Selling units often leads to capital gains tax and disrupts your long-term compounding journey. Pledging the NAV allows you to have your cake and eat it, too.

The Risk of NAV Fluctuations and Margin Calls

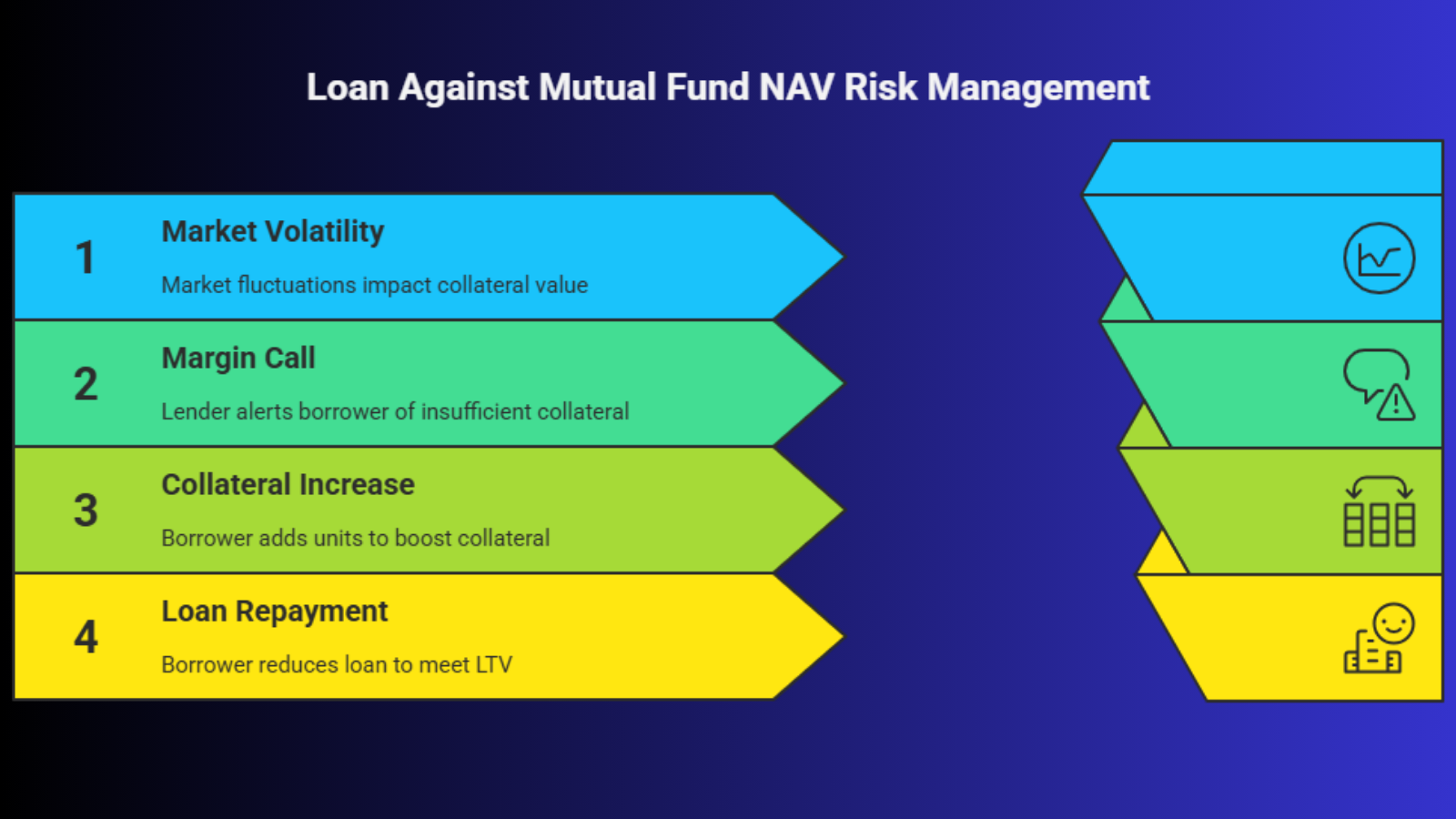

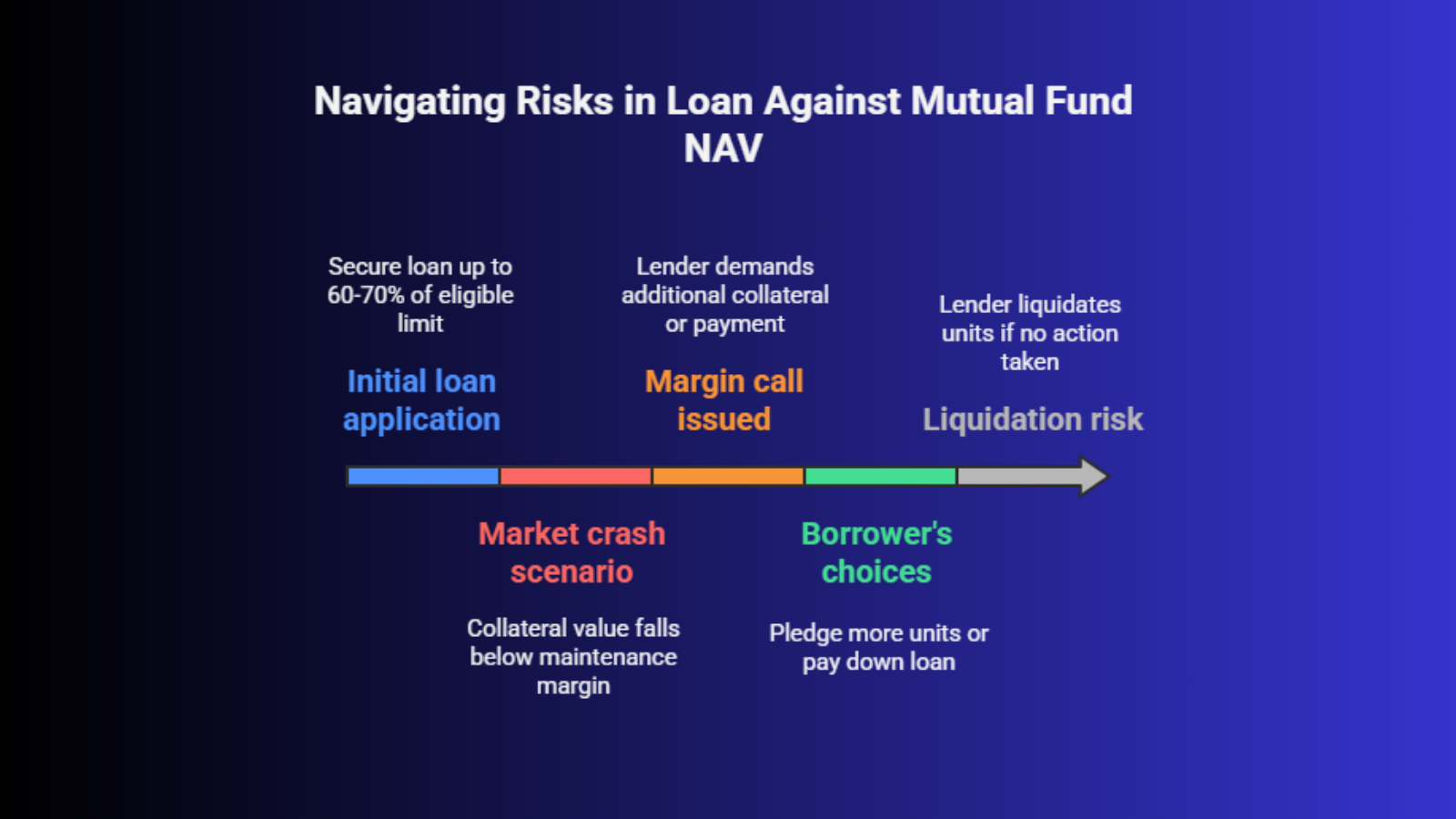

While a loan against mutual fund NAV is a powerful tool, it is not without risks. Because the collateral value is tied to the market, a significant crash can reduce your eligibility mid-tenure. If the value of your pledged units falls below the required maintenance margin (usually 10-15% below the initial LTV), the lender will issue a margin call.

In such a scenario, you have two choices:

In such a scenario, you have two choices:

Pledge additional mutual fund units to increase the collateral value.

Pay a portion of the outstanding loan to bring the LTV back within the acceptable range.

If neither action is taken, the lender has the legal right to liquidate your units at the current NAV to recover the dues. This is why it is recommended to apply for a loan against the mutual fund NAV for only 60-70% of your maximum eligible limit, leaving a buffer for market volatility.

Comparing Top Lenders for NAV-Based Loans

Lender Name | Interest Rate (Approx) | Max Loan Against NAV | Digital Process |

SBI | 8.5% - 10% | Up to ₹5 Crores | Partial Online |

HDFC Bank | 9.5% - 11% | Up to ₹1 Crore | Fully Digital |

Bajaj Finserv | 10% - 12.5% | Up to ₹1000 Crores (Corp) | Fully Digital |

Competitive | Portfolio Dependent | Instant Approval |

When you are ready to apply for a loan against the mutual fund NAV, comparing these parameters helps in choosing a partner that offers the best balance of speed and cost.

Why discvr.ai is the Right Partner for Your Liquidity Needs?

Navigating the complexities of NAV valuations and lien marking can be daunting. At discvr.ai, we simplify the entire lifecycle of a loan against mutual fund NAV. Our platform is designed to provide instant transparency into your borrowing power, ensuring you get the maximum value for your investments without the bureaucratic hurdles of traditional banking.

Whether you are looking to fund a business expansion or manage a personal exigency, our LAMF product ensures your wealth continues to grow while you access the funds you need. Don't let your capital sit idle or sell your future gains for today's needs.

Ready to unlock the power of your portfolio? Visit discvr.ai to check your eligibility and apply for a loan against your mutual funds today.