Peer-to-peer (P2P) lending has become an increasingly popular way to borrow and lend money, offering benefits to both investors and borrowers. By bypassing traditional financial institutions like banks, P2P lending platforms allow individuals to directly lend money to others, often at better terms than those offered by banks.

Many individuals choose to invest in peer-to-peer lending to earn higher returns compared to traditional savings accounts.

How Peer-to-Peer Lending Works

Peer-to-peer lending platforms act as intermediaries that connect borrowers and lenders online. Borrowers submit loan requests, detailing the amount needed, the purpose of the loan, and the repayment terms. Investors, on the other hand, browse these loan listings and choose which ones to fund based on the borrower’s profile and the loan's risk level.

You can invest in peer-to-peer lending with small amounts, making it an accessible way to diversify your income streams. Once the loan is funded, borrowers make regular payments, and investors receive interest on their investments. The platform typically charges a fee for facilitating the loan process but often has lower fees compared to traditional financial institutions.

Key Benefits of Peer-to-Peer Lending

Peer-to-peer lending has become a popular alternative to traditional bank financing, offering easier access to credit for borrowers and attractive returns for investors. By connecting individuals directly through digital platforms, P2P lending removes intermediaries and reduces overall borrowing costs. Before you invest in peer-to-peer lending, review the platform’s credibility, borrower risk grades, and default rates to protect your capital. As this model continues to grow, it offers unique advantages that make it an appealing option for both lenders and borrowers.

1. Higher Returns for Investors

One of the main advantages of investing in P2P lending is the potential for higher returns compared to traditional investment options like savings accounts, CDs, or bonds. Since P2P lending platforms cut out banks and other intermediaries, they can offer more competitive interest rates for investors.

Attractive Interest Rates: Depending on the risk level of the loan, investors can earn interest rates ranging from 5% to 15% or more. This is significantly higher than the returns offered by most bank savings accounts or bonds.

Diversification: P2P lending allows investors to diversify their portfolios by lending to multiple borrowers across different risk categories. Diversification reduces the risk of losing all investments if one borrower defaults.

2. Accessibility for Borrowers

P2P lending offers an accessible and flexible alternative to traditional bank loans, which may require extensive documentation, high credit scores, and collateral. Many people, especially those with lower credit ratings or nontraditional financial backgrounds, may find it easier to obtain loans through P2P platforms.

Lower Eligibility Requirements: P2P platforms often have more lenient lending criteria compared to banks, allowing more borrowers to access credit.

Lower Eligibility Requirements: P2P platforms often have more lenient lending criteria compared to banks, allowing more borrowers to access credit.Faster Loan Approval: Traditional loan processes can take weeks to approve. In contrast, P2P lending platforms often provide quicker approval, allowing borrowers to access funds faster.

For borrowers who may be overlooked by banks, P2P lending offers an opportunity to secure financing for personal, business, or other purposes with potentially fewer barriers.

3. Lower Fees and Costs

Unlike traditional financial institutions, which often charge high fees for loan origination, processing, and servicing, P2P lending platforms tend to have lower operational costs. This results in lower fees for both borrowers and investors.

Lower Borrowing Costs: Borrowers can often secure loans at lower interest rates compared to what they would pay at a bank, especially if they have good credit. Additionally, P2P platforms often charge minimal fees for loan origination and maintenance.

Reduced Lending Fees: Investors benefit from lower platform fees than those charged by banks or investment funds, allowing them to keep more of their returns.

These lower fees make P2P lending more affordable for borrowers while offering investors the potential for higher net returns.

4. Flexibility for Both Borrowers and Lenders

P2P lending offers flexibility in terms of loan amounts, repayment terms, and interest rates. Borrowers can often choose the loan amount they need, the repayment period, and the interest rate that fits their financial situation.

Customizable Loan Terms: Borrowers can work with lenders to negotiate the loan terms, including the repayment schedule and interest rate, based on their individual needs.

Investment Control: For investors, P2P platforms provide a level of control over their investments. They can choose which loans to fund based on risk preference, loan duration, and the borrower’s credit profile.

This flexibility is one of the main reasons P2P lending is attractive to both parties involved.

5. Transparency and Information Access

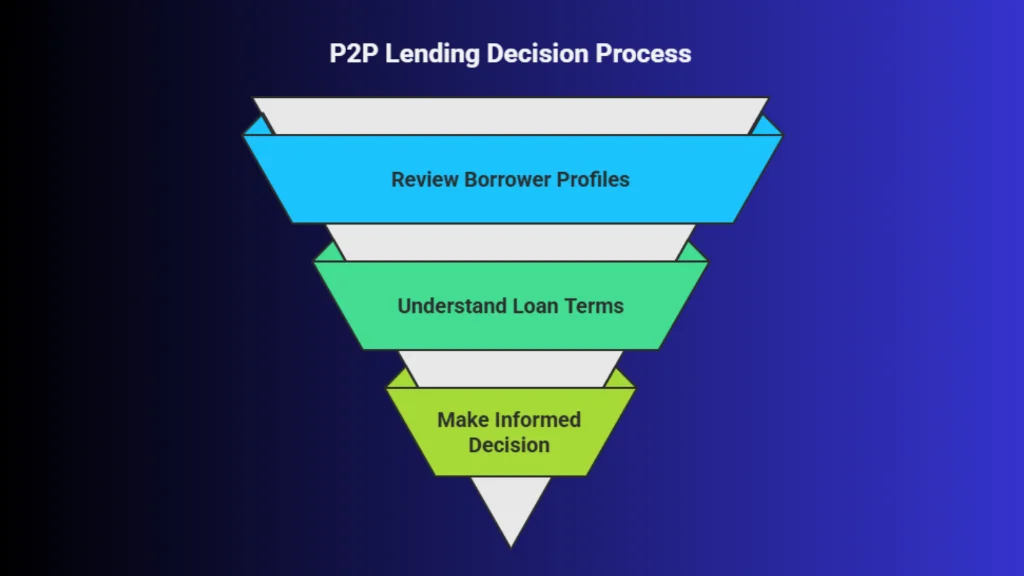

P2P lending platforms typically provide detailed information about borrowers, including their credit history, employment status, loan purpose, and other relevant data. This allows investors to make more informed decisions when choosing which loans to fund.

Detailed Borrower Profiles: Investors can review detailed borrower profiles to assess risk before committing funds. This transparency helps ensure that lending decisions are based on solid information.

Detailed Borrower Profiles: Investors can review detailed borrower profiles to assess risk before committing funds. This transparency helps ensure that lending decisions are based on solid information.Clear Terms: The terms of the loan, including interest rates, fees, and repayment schedules, are clearly outlined, so both borrowers and investors understand their responsibilities and expectations.

This level of transparency reduces the risk of hidden fees or unclear terms and promotes trust in the P2P lending process.

6. Social Impact

P2P lending can also have a positive social impact by providing funding to individuals and businesses who might otherwise be excluded from traditional banking systems. This is particularly beneficial in emerging markets or for underserved populations.

Access to Capital: Entrepreneurs or individuals in developing areas can access capital that may not be available through traditional financial institutions, helping to drive economic growth and innovation.

Support for Small Businesses: Many P2P platforms focus on small business loans, providing small business owners with the funding they need to grow their enterprises.

For investors who want to make a positive difference, investing in P2P lending platforms can be a way to support entrepreneurship and economic development.

Bottom Line

Peer-to-peer lending platforms offer a unique and effective way to invest and borrow money, providing benefits such as higher returns for investors, easier access to loans for borrowers, and lower fees for both parties. With the flexibility, transparency, and potential for positive social impact, P2P lending has become a popular alternative to traditional financial institutions.

Several online platforms allow users to invest in peer-to-peer lending quickly by automating loan selection and repayment tracking. If you’re looking to diversify your investment portfolio, gain access to more affordable loans, or support small businesses, P2P lending is a great option to explore. Log in today to explore P2P lending opportunities and start building your investment portfolio with higher returns.