When we talk about everything you should know about pledging mutual funds for credit, the first step is understanding the underlying mechanism. Pledging involves marking a "lien" on your existing mutual fund units in favor of a lender, such as a bank or an NBFC. By pledging mutual funds, you are essentially using your investments as collateral to secure a loan. The ownership of the units remains with you, and you continue to receive any dividends or capital appreciation associated with those units.

Key Features of a Pledged Asset

Ownership Retention: You remain the owner of the units on record.

Income Continuity: Dividends and interest continue to accrue to your account.

Digital Lien: The process is entirely paperless through RTAs like CAMS or KFintech.

Asset Safety: Your funds are not sold; they are simply restricted from being redeemed until the loan is closed.

The primary appeal here is that the units are not sold. Instead, they are temporarily frozen for redemption until the loan is repaid. This ensures that your wealth-building journey is not interrupted by short-term cash flow requirements. If you are looking to unlock value from your portfolio, you can apply for a loan against MF through digital platforms that connect your holdings with institutional lenders.

How the Process of Pledging Mutual Funds Works

To grasp everything you should know about pledging mutual funds for credit, one must look at the digital infrastructure supporting it. In India, the process is streamlined through Registrar and Transfer Agents (RTAs). When you initiate a request, the lender sends a lien-marking instruction to the RTA. Once you authorize this via an OTP, the units are "pledged," and the credit limit is sanctioned.

Step-by-Step Execution

Portfolio Fetching: The lender pulls your consolidated account statement using your PAN.

Selection of Units: You choose which specific schemes and number of units to pledge.

OTP Verification: You provide consent via a secure RTA link.

Limit Activation: The lender sets up an overdraft or a term loan account.

Modern technology has made this nearly instantaneous. You can often see your credit limit within minutes of pledging mutual funds. The loan is usually structured as an overdraft facility, meaning you only pay interest on the amount you actually withdraw and use, rather than the total sanctioned limit. This flexibility is a cornerstone of everything you should know about pledging mutual funds for credit.

Analysis of Loan Against Mutual Funds Interest Rates

One of the most critical factors for any borrower is the cost of capital. Loan against Mutual Funds interest rates are typically much more competitive than those of unsecured personal loans. Because the loan is backed by a liquid asset, lenders perceive lower risk, which translates to savings for you.

Comparative Cost Structure

Comparative Cost Structure

Interest rates vary based on the underlying asset class (Equity vs. Debt) and the borrower's credit profile. Understanding everything you should know about pledging mutual funds for credit means recognizing that the interest you pay is often lower than the potential returns your mutual funds might generate during the same period.

Lender Category | Typical Loan against Mutual Funds interest rates (p.a.) | Processing Fee Range |

Public Sector Banks | 9.25% - 10.50% | 0.5% - 0.75% |

Private Sector Banks | 10.00% - 11.75% | ₹999 - ₹2,500 |

Top-tier NBFCs | 10.50% - 12.50% | 0% - 1% |

Digital Platforms | 9.50% - 11.00% | Flat processing fee |

When you apply for a loan against MF, always look for lenders that offer "interest-only" repayment models, which further reduce your monthly cash outflow.

Eligibility and Loan to Value (LTV) Ratios

Not every mutual fund qualifies for the same amount of credit. In the context of everything you should know about pledging mutual funds for credit, the Loan to Value (LTV) ratio is a decisive metric. The LTV determines what percentage of your portfolio's current market value can be availed as a loan.

When you apply for a loan against MF, the most significant constraint on your borrowing capacity is the Loan-to-Value (LTV) ratio. The LTV is the percentage of your portfolio's market value that a lender is willing to provide as credit. This ratio is not arbitrary; it is strictly regulated by the Reserve Bank of India (RBI) to protect both the borrower and the lender from the inherent risks of market volatility.

When you apply for a loan against MF, the most significant constraint on your borrowing capacity is the Loan-to-Value (LTV) ratio. The LTV is the percentage of your portfolio's market value that a lender is willing to provide as credit. This ratio is not arbitrary; it is strictly regulated by the Reserve Bank of India (RBI) to protect both the borrower and the lender from the inherent risks of market volatility.

1. Equity Mutual Funds: The 50% Standard

For most equity-oriented schemes, the LTV is capped at 50%. This means if you have an equity portfolio worth ₹10 Lakhs, you can typically access up to ₹5 Lakhs. The reason for this relatively lower limit is the high standard deviation in equity markets.

Market Volatility: Equities can witness double-digit swings in short periods. A 50% LTV provides a "margin of safety" so the lender doesn't have to liquidate your units immediately during a minor market correction.

Concentration Risk: Lenders often check if your equity holdings are diversified across sectors or concentrated in a single thematic fund, which can further influence the specific limit granted.

2. Debt Mutual Funds: Stability and Higher Limits

Debt funds are backed by fixed-income securities like corporate bonds, treasury bills, and government securities. Because these assets are less volatile than stocks, lenders offer a significantly higher LTV, usually between 75% and 80%.

Predictable NAV: The Net Asset Value of debt funds moves in a much narrower band, allowing lenders to lend more aggressively.

RBI's Proactive Stance: Recent draft proposals in 2025 have even suggested pushing the ceiling for debt mutual fund LTVs higher to improve credit flow for retail investors.

3. Liquid and Overnight Funds: The Gold Standard of Collateral

Liquid funds are considered the "safest" within the mutual fund universe because they invest in highly liquid, short-maturity instruments (up to 91 days). Due to their extreme price stability, they command the highest LTV in the industry, often reaching 90%.

Near-Cash Status: Since these funds can be converted to cash almost instantly and have negligible interest rate risk, they are the preferred collateral for many NBFCs.

Strategic Use: Investors often move their idle cash into liquid funds and then pledge mutual funds from this category to maintain a high-liquidity credit line at low Loan against Mutual Funds interest rates.

4. Hybrid Funds: The Middle Ground

Hybrid or Balanced Advantage funds invest in a mix of equity and debt. Consequently, their LTV is a weighted average of the two, generally hovering between 50% and 60%.

Dynamic LTV: Some advanced lending platforms adjust the LTV of hybrid funds dynamically based on the current asset allocation (equity-to-debt ratio) of the fund.

Conservative Buffering: Even if a hybrid fund is 70% debt, lenders might still stick to a conservative 60% cap to account for the volatile equity component.

By pledging mutual funds, you can access a significant portion of your wealth without waiting for a market cycle to end. It is a vital part of everything you should know about pledging mutual funds for credit to remember that ELSS funds can only be pledged after their mandatory three-year lock-in period is over. If you're ready to explore these limits, you can apply for a loan against MF today to see your personalized eligibility.

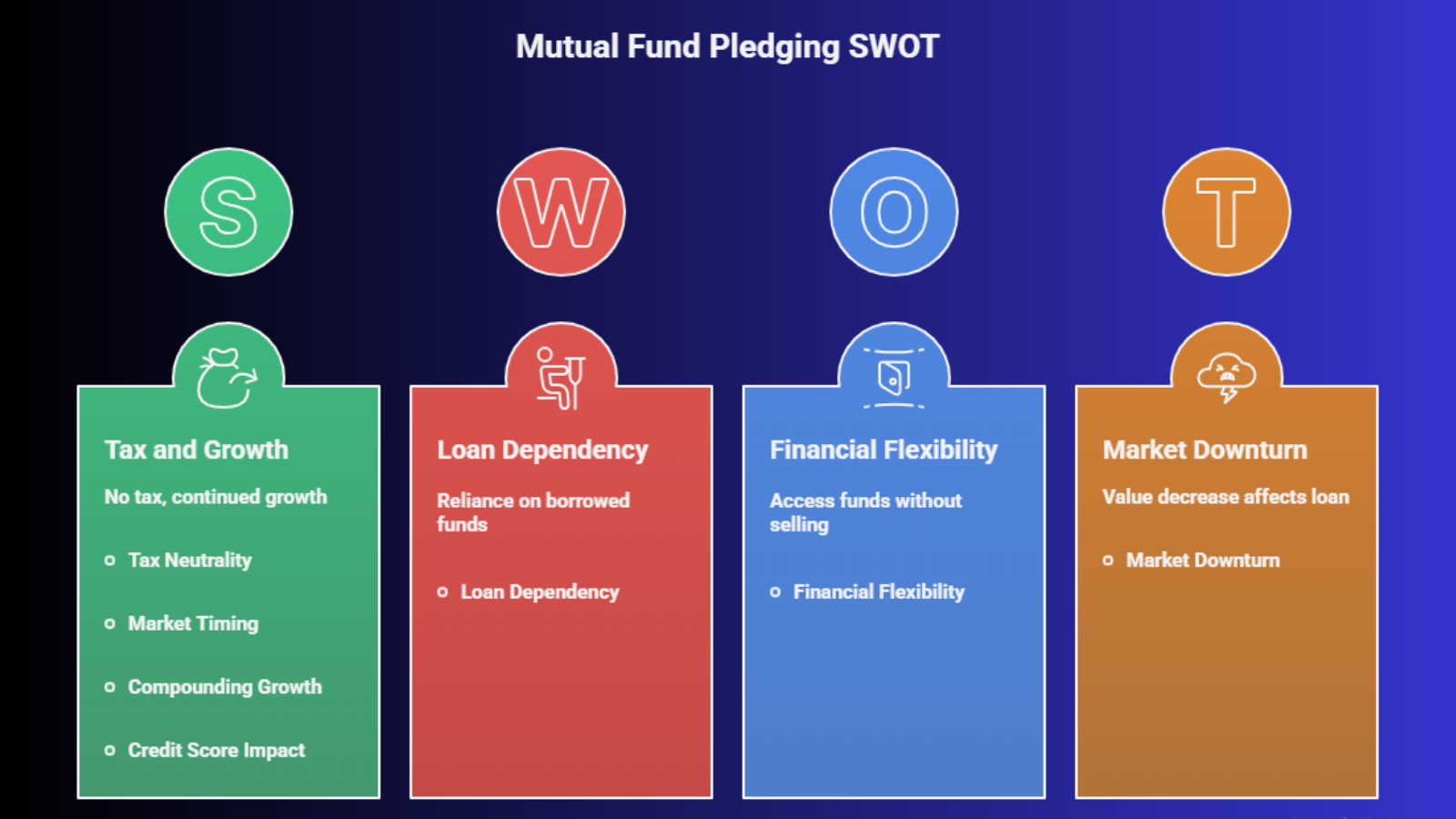

Why Pledging is Better Than Redeeming

If you are evaluating everything you should know about pledging mutual funds for credit, you must weigh it against the alternative of selling your units. Redemption often triggers Capital Gains Tax (LTCG or STCG) and might involve exit loads if the units are sold within a specific timeframe. By choosing to apply for a loan against MF, you bypass these immediate costs.

Critical Advantages of Pledging

Critical Advantages of Pledging

Tax Neutrality: Since there is no sale of units, no tax liability is generated.

Market Timing: You don't have to sell in a "down" market to meet a cash requirement.

Compounding Growth: Your ₹10 Lakhs continues to grow as ₹10 Lakhs, even if you have borrowed ₹5 Lakhs against it.

Credit Score Impact: Timely repayment of this secured loan can help build your credit history.

Furthermore, pledging mutual funds preserves your "time in the market." If the market rallies while you have a loan, your pledged units grow in value, effectively reducing the net cost of your loan. This dual benefit of liquidity and continued compounding is why many savvy investors prioritize knowing everything you should know about pledging mutual funds for credit.

Risk Management: Dealing with Margin Calls

A comprehensive look at everything you should know about pledging mutual funds for credit would be incomplete without discussing risks. Since the collateral is a market-linked asset, a sharp decline in the NAV can affect your LTV ratio. If the value of your pledging mutual funds drops below a certain threshold, the lender may issue a "margin call."

How to Handle Market Volatility

Buffer Maintenance: Never utilize 100% of your sanctioned limit.

Diversification: Pledge a mix of debt and equity to stabilize the collateral value.

Top-up Option: Be prepared to pledge additional units if the market falls significantly.

Partial Repayment: You can pay back a portion of the principal to restore the required LTV ratio.

In such a scenario, you might be required to pledge more units or repay a portion of the loan to bring the LTV back within the allowed limits. When you apply for a loan against MF, it is wise to only borrow about 70% to 80% of your total eligible limit to create a safety buffer against market swings. This proactive approach is a key lesson in everything you should know about pledging mutual funds for credit.

Why discvr.ai is the Right Partner for Your Liquidity Needs

When you are looking for everything you should know about pledging mutual funds for credit, choosing the right platform is as important as the loan itself. discvr.ai offers a seamless, enterprise-grade experience for investors seeking to leverage their portfolios. By providing transparent Loan against Mutual Funds interest rates and a user-friendly interface to apply for a loan against MF, it ensures that your wealth stays productive while you meet your financial obligations.

With a focus on speed and security, discvr.ai simplifies pledging mutual funds by integrating directly with leading RTAs and lenders. This eliminates the guesswork and helps you manage your liquidity with the precision that modern finance demands. Whether it is for a short-term bridge or a strategic business move, knowing everything you should know about pledging mutual funds for credit with DiscvrAI-LAMF gives you the competitive edge you need.