As we enter 2026, mutual funds continue to be a strong choice for Indian investors. Offering access to diversified portfolios, these funds provide long-term growth opportunities while being professionally managed. The Indian economy has been growing steadily, and this trend is expected to continue. As more investors look to diversify their portfolios, mutual funds stand out as a reliable option for those seeking wealth creation, especially in a dynamic market environment. But with so many fund categories to choose from, how do you decide which mutual funds are right for you in 2026?

Mutual funds provide an easy way for investors to benefit from the expertise of professional fund managers, access a wide range of investment options, and enjoy the benefits of diversification. With the ongoing global and domestic shifts, it’s important to choose funds that align with your goals, risk appetite, and time horizon.

Why Mutual Funds Are a Smart Choice in 2026

Before diving into the top funds, let’s quickly explore why mutual funds are gaining attention among Indian investors in 2026. These funds offer several benefits that complement a well-rounded investment strategy. Compare mutual funds online to quickly analyze performance, expense ratios, and asset allocations across thousands of funds from various providers.

Benefits of Mutual Funds

Diversification: Mutual funds pool money from several investors to invest in a variety of stocks, bonds, or other assets. This diversification reduces the risk of relying on a single asset or market sector, helping protect your investment during periods of market volatility.

Long-term Growth: Equity mutual funds, in particular, have been consistent performers for investors looking for long-term wealth generation. The ability to compound returns over several years is one of the key attractions of mutual funds.

Professional Management: Mutual funds are managed by experienced fund managers who monitor the markets and adjust the portfolio as needed. For investors who lack the time or expertise to manage their own portfolios, mutual funds offer a hands-off yet effective investment option.

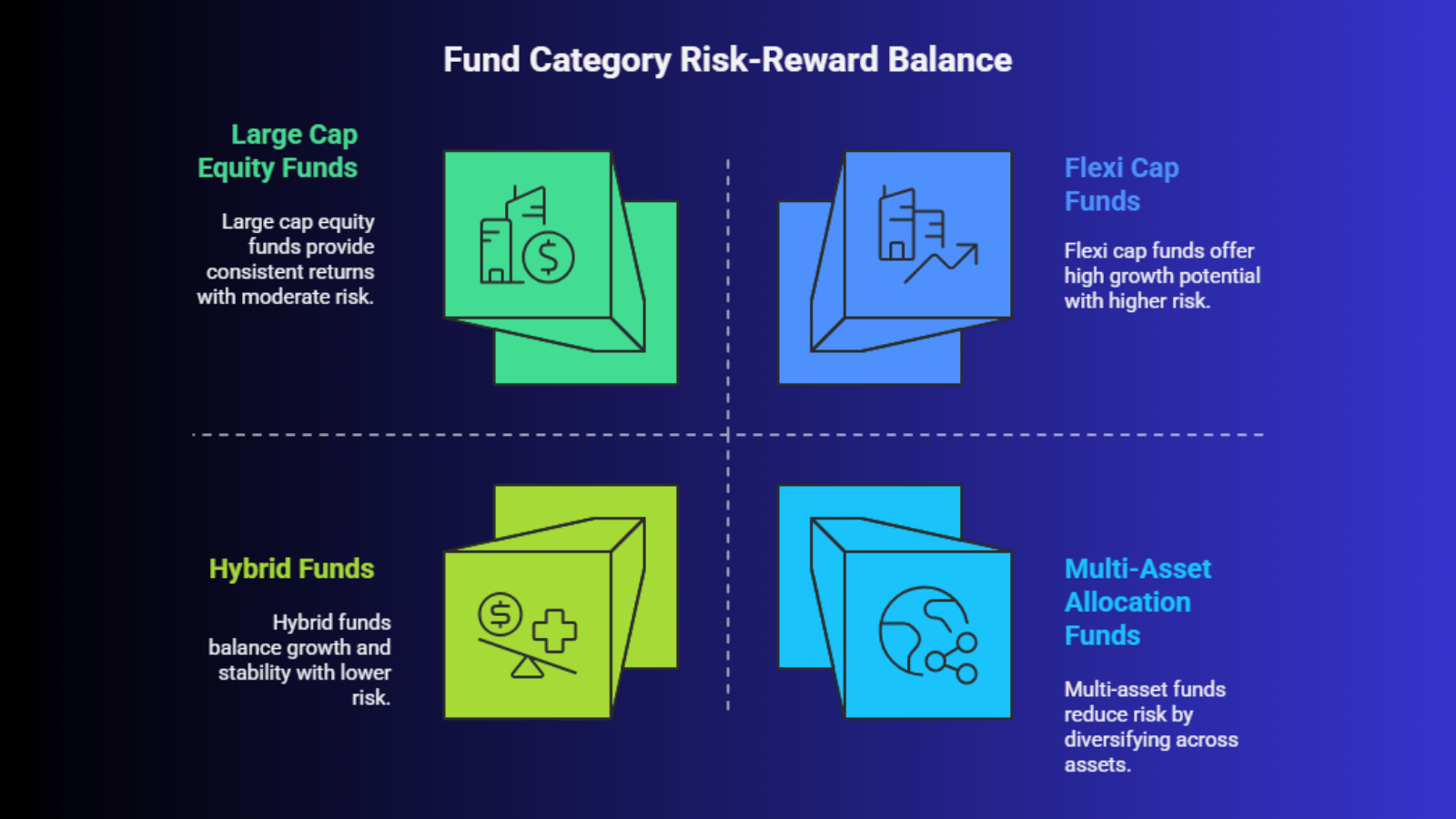

Categories of Mutual Funds to Consider for 2026

With so many fund types available, here are the most recommended categories for 2026 that strike a balance between risk and reward.

With so many fund types available, here are the most recommended categories for 2026 that strike a balance between risk and reward.

1. Large Cap Equity Funds

Large-cap equity funds focus on established, financially stable companies with strong growth potential. These funds are best suited for investors who seek consistent performance with moderate risk.

2. Flexi Cap Funds

Flexi-cap funds are more flexible, allowing managers to invest in large, mid, and small-cap stocks. These funds offer greater growth opportunities by investing in a diversified portfolio across different market sectors. They are ideal for investors looking for both stability and growth.

3. Hybrid Funds

Hybrid funds combine equity and debt, balancing growth and stability. These funds are a great option for investors who prefer lower volatility while still participating in the growth potential of equities.

4. Multi-Asset Allocation Funds

Multi-asset funds invest across different asset classes like equity, debt, and commodities such as gold. These funds are designed to reduce risk by spreading investments across various assets, offering protection during uncertain market periods.

Top 10 Mutual Funds to Consider in 2026

With India’s equity markets showing recovery potential and structural growth across financials, consumption, manufacturing, and mid-/small-cap companies, 2026 may offer good opportunities for disciplined investors. A mix of large-cap, flexi-cap, mid-cap and small-cap funds helps balance stability, growth and long-term wealth creation.

Fund Name | Who Should Invest | Suggested Investment Approach / Amount* | Risk Level | Pros | Cons |

Nippon India Large Cap Fund | Conservative-to-moderate investors seeking stability + equity exposure | Monthly SIP of ₹1,000–5,000 for 5+ years | Moderate | Exposure to blue-chip large-cap firms; relatively stable returns across cycles | Limited upside compared to mid/small-cap funds; slower growth during bull run |

ICICI Prudential Large Cap Fund | Investors wanting reliable large-cap exposure, suitable for long-term wealth creation | SIP / lump sum (₹20,000+) | Moderate | Diversified large-cap portfolio; relatively lower volatility among equity funds | Equity market risk remains; gains likely moderate vs aggressive funds |

Parag Parikh Flexi Cap Fund | Investors wanting a diversified equity fund with flexibility across cap-sizes | SIP of ₹2,000+ or lumpsum | Moderate-High | Flexibility across large, mid & small caps; diversified portfolio; historically solid returns | Exposure across mid & small caps means higher volatility in short term |

HDFC Flexi Cap Fund | Long-term investors who want a diversified, actively managed equity fund | SIP / lumpsum over 5–10 years | Moderate-High | Active management, diversified across caps, good long-term CAGR potential | Higher risk compared to pure large-cap; market volatility affects performance |

HDFC Mid Cap Fund | Investors with 5–10+ year horizon, willing to take moderate risk for higher growth | ₹1,000+ SIP or lumpsum for long term | High | Mid-cap growth potential; higher returns historically vs large caps over long horizon | More volatile in downturns; requires patience and long horizon |

Motilal Oswal Midcap Fund | Investors wanting aggressive growth and comfortable with risk | Lump sum or SIP; larger lumpsum may be better | High | Strong past performance; potential high rewards over 5–7 years | High volatility, especially in bear market; risk of value swings |

Nippon India Small Cap Fund | Young investors / long-term wealth builders willing to accept high risk | SIP (₹1,000) or lumpsum (₹10,000+) over 7–10 years | Very High | Highest growth potential among equity funds; good for long-term compounding | Very volatile; small-cap companies more vulnerable to economic dips |

Bandhan Small Cap Fund | Investors with high risk tolerance and long-term horizon | SIP or lumpsum; for investors comfortable with swings | Very High | Opportunity for high returns over long horizon; diversification benefits | High risk, requires strong risk appetite and discipline |

Quant Small Cap Fund | Aggressive investors aiming for long-term wealth creation and diversification across small caps | SIP + disciplined long-term approach (5–10 years) | Very High | Historically high CAGR, often outperforms many peers in small-cap segment | Risk of volatility; small-cap sudden downturns; best suited for long horizon |

ICICI Prudential Equity & Debt Fund (Aggressive Hybrid) | Investors seeking a balance between growth and relative stability; first-time equity investors needing some cushion | Monthly SIP ₹1,000–3,000; hold 3–5 years | Moderate | Combines equity and debt reducing risk vs pure equity; more stable during volatile markets | Returns lower than pure equity funds over long term; debt portion limits upside |

How to Choose the Right Mutual Fund for Your Investment Strategy

Selecting the right mutual fund depends on several factors, including your risk tolerance, investment goals, and time horizon. Here are some tips to help you make an informed choice:

Selecting the right mutual fund depends on several factors, including your risk tolerance, investment goals, and time horizon. Here are some tips to help you make an informed choice:

Choosing the right mutual fund starts with clearly defining your financial goal, whether you want long-term growth through equity funds or prefer balanced, stable returns from hybrid or multi-asset funds.

Once your goal is set, evaluate the fund’s past performance over the last five to seven years to understand how it has navigated different market cycles, keeping in mind that past returns do not guarantee future results. It is equally important to assess your own risk profile because risk-averse investors may be better suited to debt or hybrid funds, while those comfortable with volatility can consider equity or flexi-cap options.

Stop manually compiling data; you can compare mutual funds online with customizable filters to find the best-performing funds that perfectly match your specific risk tolerance and financial goals.

Finally, use online comparison tools to review expense ratios, historical performance, and ratings across multiple funds so you can make a more informed, data-backed investment decision.

Final Decision and Next Steps

Choosing the best mutual funds in 2026 boils down to understanding your investment goals, risk appetite, and timeline. With options like large-cap, flexi cap, and hybrid funds available, you can build a diversified portfolio that suits your financial objectives. While equity funds are ideal for long-term growth, hybrid funds offer a balanced approach with less volatility.

Ready to invest? Use the platform to compare mutual funds online, select your top three contenders, and complete the purchase directly from the same screen.

Log in to your investment account today and explore the mutual funds that fit your needs. Consult with a financial advisor to ensure your portfolio aligns with your long-term strategy and financial goals.