Debt mutual funds are a popular investment option for those seeking a stable, relatively lower-risk avenue for wealth creation. These funds primarily invest in fixed-income securities like government bonds, corporate bonds, treasury bills, and money market instruments. They offer a steady stream of income and are often considered safer than equity funds. However, like all investments, debt mutual funds come with their own set of risks, and understanding both the risks and returns is crucial for making informed investment decisions.

Understanding Debt Mutual Funds

Before we delve into the risks and returns, it's important to understand how debt mutual funds work. These funds pool investors' money and invest it in a variety of fixed-income instruments. The goal of debt mutual funds is to provide regular income to investors with relatively lower volatility compared to equity funds. The returns from these funds are typically in the form of interest earned on the bonds and securities in the portfolio.

While debt mutual funds are generally considered safer than equity funds, they do carry certain risks that investors must consider. You must start investing in debt funds now to diversify your overall portfolio, balancing the volatility of your equity holdings and ensuring a stable accrual income stream during market downturns. The returns from debt mutual funds depend on factors like interest rates, credit ratings, and the economic environment.

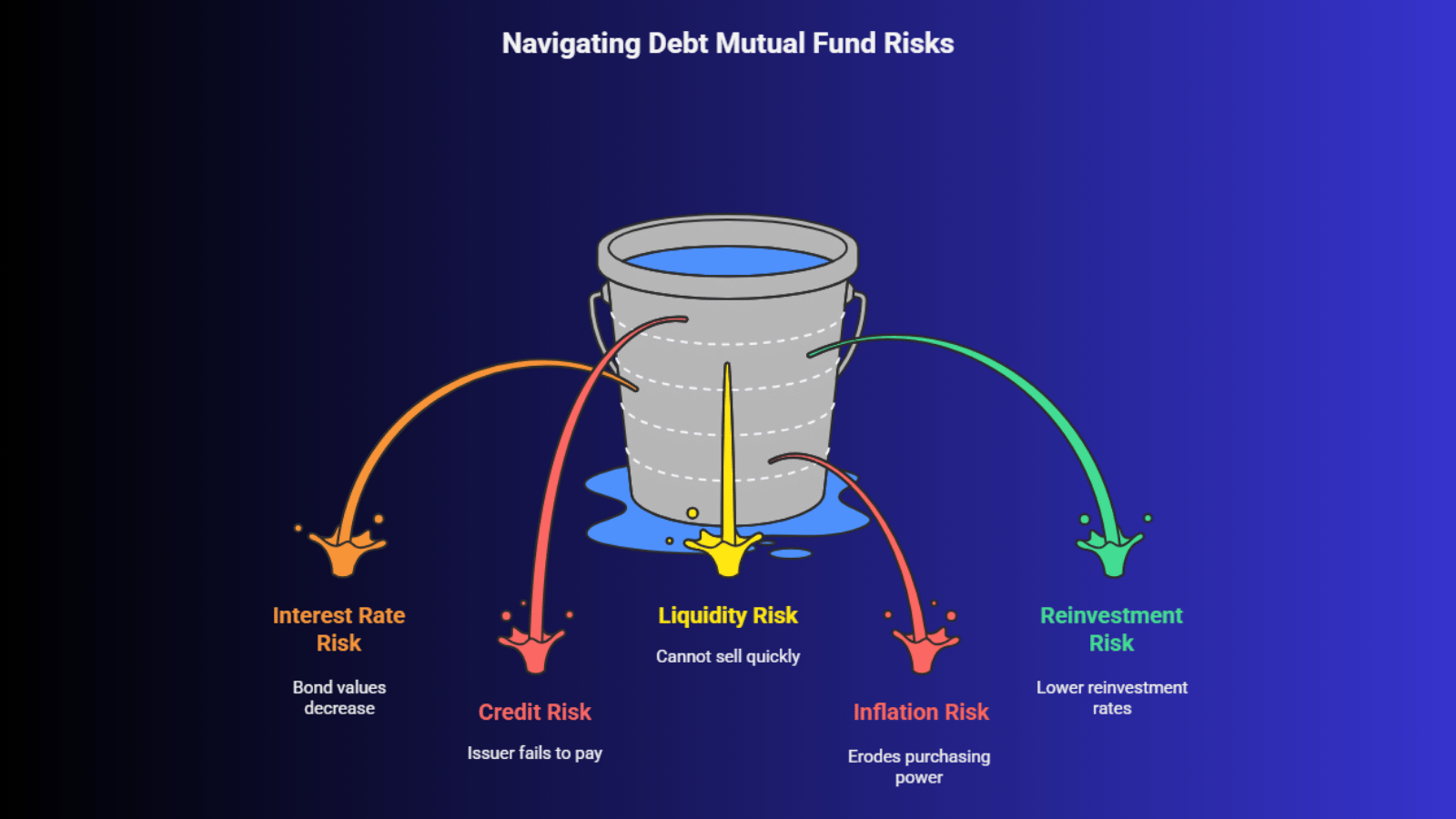

Key Risks of Debt Mutual Funds

Debt mutual funds, though lower-risk than equity funds, still involve several risks that can affect returns. Here are the main risks to consider:

1. Interest Rate Risk

Interest rate risk is the most significant risk affecting debt mutual funds. When interest rates rise, the value of existing bonds in the fund decreases. This happens because newer bonds issued at higher interest rates become more attractive to investors, causing the prices of older bonds with lower rates to fall. This can lead to a decrease in the value of the debt mutual fund.

For example, if the Reserve Bank of India increases interest rates, bond prices generally fall, and this can impact the performance of debt mutual funds that hold long-term bonds. Investors holding funds with long-duration bonds are particularly exposed to this risk.

2. Credit Risk

Credit risk arises when the issuer of a bond fails to make the required interest or principal payments. Debt mutual funds invest in bonds issued by both governments and corporations. While government bonds tend to be low-risk, corporate bonds may carry higher risks, especially if the issuing company’s financial health deteriorates.

If a company defaults on its bond payments, the value of the bond falls, and the fund's NAV (Net Asset Value) may decline. To mitigate credit risk, it is important to assess the credit ratings of the bonds in the fund’s portfolio. Funds investing in high-quality bonds tend to have lower credit risk, but they may offer lower returns as well.

3. Liquidity Risk

Liquidity risk refers to the risk of being unable to sell a security or asset quickly without affecting its price. While most debt mutual funds invest in highly liquid securities, some funds may hold less liquid bonds, particularly in the case of lower-rated or smaller corporate issuers. In situations where a large number of investors decide to redeem their units, the fund may struggle to sell these illiquid securities at a fair price.

4. Inflation Risk

Inflation risk is the risk that inflation will erode the purchasing power of your returns. Debt mutual funds provide fixed interest payments, but if inflation rises, the real value of these payments decreases. In periods of high inflation, the returns from debt mutual funds may not be enough to outpace inflation, reducing the overall purchasing power of the investor.

5. Reinvestment Risk

Reinvestment risk occurs when the interest or principal payments from bonds are reinvested at a lower rate than the original investment. This is more likely to happen in a falling interest rate environment, where the returns from reinvesting the proceeds are lower than the original coupon rates. This can affect the total returns generated by the debt fund.

To safely park your emergency corpus or capital for short-term goals (under 3 years), you should start investing in debt funds, specifically low-risk categories like Liquid or Ultra Short Duration funds.

To safely park your emergency corpus or capital for short-term goals (under 3 years), you should start investing in debt funds, specifically low-risk categories like Liquid or Ultra Short Duration funds.

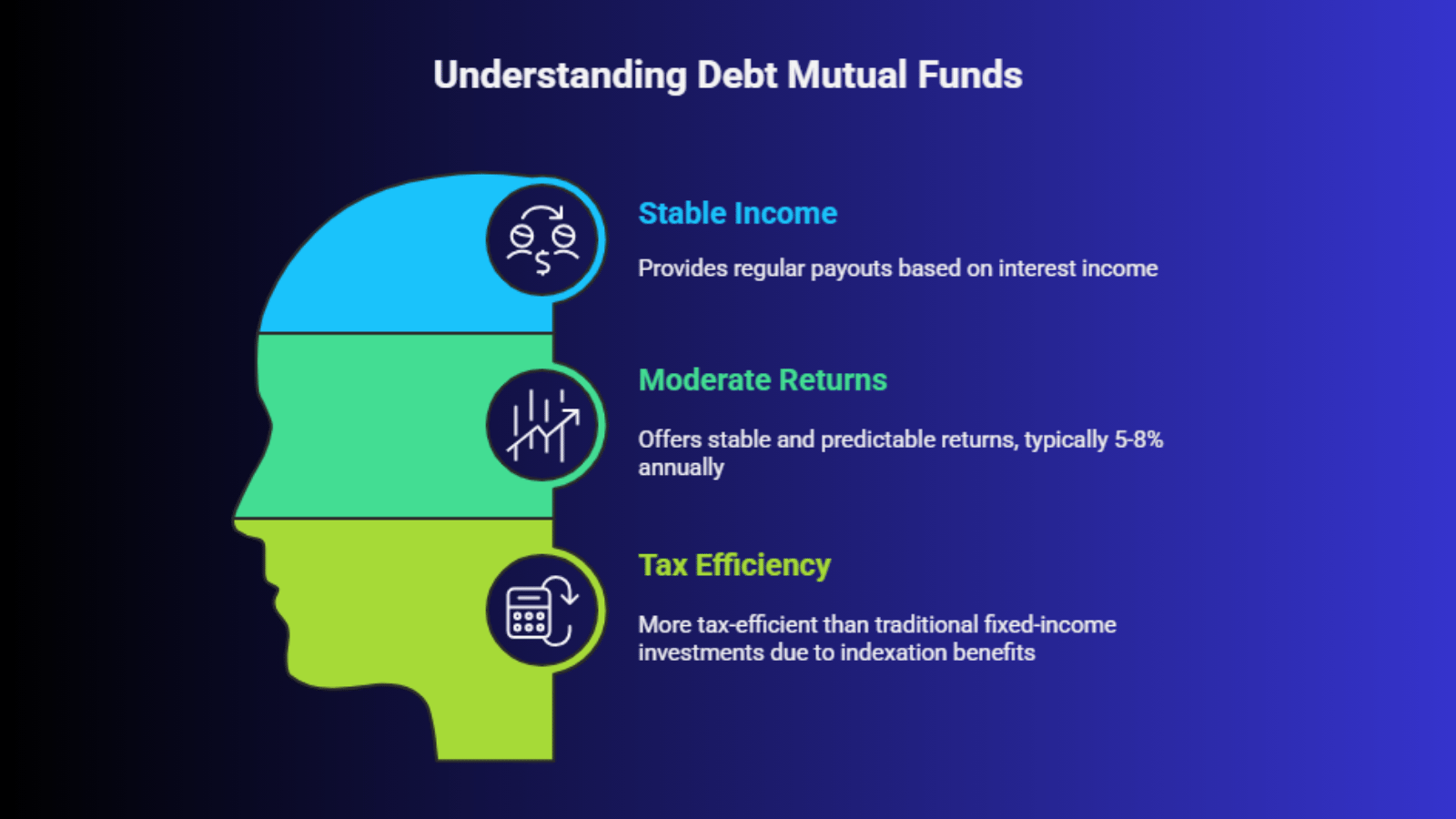

Potential Returns from Debt Mutual Funds

Debt mutual funds are often seen as a safer investment choice, offering stable returns. The returns from these funds depend on several factors, including interest rates, the duration of the bonds, and the quality of the bonds in the portfolio.

1. Stable Income: One of the main reasons investors opt for debt mutual funds is the potential for regular income. These funds generally provide monthly or quarterly payouts based on the interest income generated by the bonds in the portfolio. These payments are predictable and can be a reliable source of income, especially for conservative investors or those seeking to diversify their income sources.

2. Moderate Returns: While debt mutual funds offer lower returns than equity mutual funds, they tend to provide more stable and predictable returns. On average, debt mutual funds can yield returns ranging from 5% to 8% annually, depending on the fund type, the interest rate environment, and the credit quality of the securities. For example, government bond funds and short-term debt funds are less sensitive to interest rate changes and generally provide lower, but stable returns. On the other hand, long-duration funds and corporate bond funds may offer higher returns but come with increased risks.

3. Tax Efficiency: Debt mutual funds are more tax-efficient than traditional fixed-income investments, such as fixed deposits. The returns from debt mutual funds are taxed at 20% with indexation benefits if held for more than three years, which can significantly reduce the tax burden. Short-term capital gains (less than three years) are taxed at 30%, similar to fixed deposits.

The Final Verdict

The Final Verdict

Debt mutual funds can be an excellent choice for conservative investors looking for stable returns with lower risk. However, like all investments, they come with risks such as interest rate risk, credit risk, and liquidity risk. It’s essential to evaluate these risks and the potential returns before investing in debt mutual funds.

Before you start investing in debt funds, first determine your exact investment horizon (e.g., 6 months, 2 years, or 5 years) and match it to a fund with a corresponding Macaulay duration to manage interest rate risk effectively.

If you're looking for stability, regular income, and lower volatility in your portfolio, debt mutual funds may be a suitable option. Log in to your investment platform today to explore various debt mutual funds and make informed decisions based on your investment goals.