Thematic mutual funds have become increasingly popular among investors seeking to capitalize on specific trends or sectors. These funds focus on particular themes, such as technology, healthcare, or green energy, and invest in companies that align with those themes. With their ability to offer higher returns by focusing on emerging opportunities, thematic funds have gained attention, especially in 2026. But before you invest, it’s essential to understand how they work, the benefits they offer, and the risks involved.

Thematic funds allow investors to directly invest in industries or sectors they believe will outperform in the future. If you're interested in aligning your investments with trends like artificial intelligence, renewable energy, or electric vehicles, thematic mutual funds are a great way to gain exposure.

Why Invest in Thematic Mutual Funds?

Before diving into the process of investing, let’s first look at why thematic mutual funds have gained popularity in recent years.

Before diving into the process of investing, let’s first look at why thematic mutual funds have gained popularity in recent years.

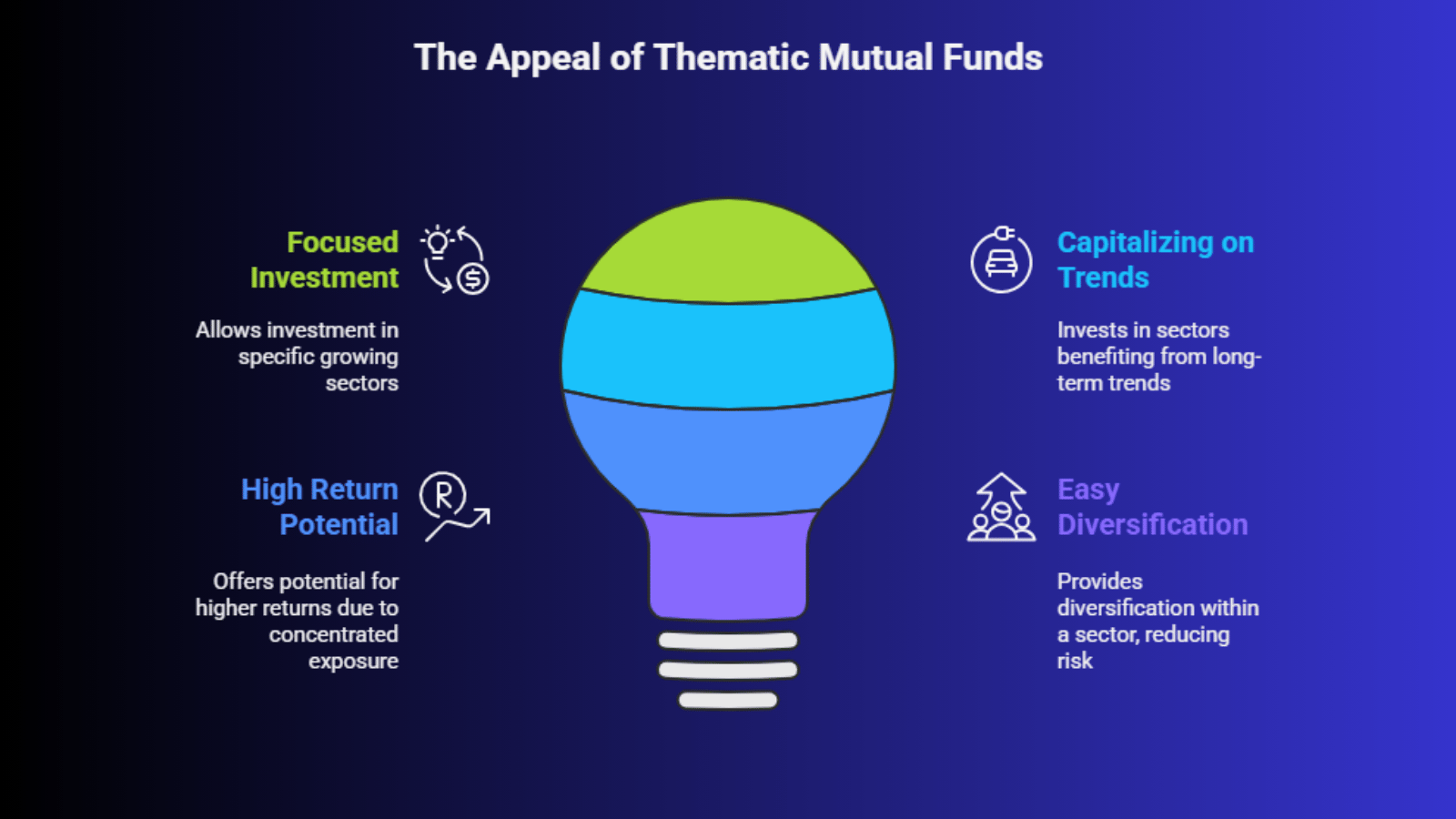

Focused Investment in Growing Sectors: Thematic funds allow you to invest in specific sectors that you believe will grow significantly. For example, investing in a fund focused on renewable energy enables you to benefit from the global shift toward cleaner energy sources.

Capitalizing on Market Trends: These funds invest in sectors that are benefiting from long-term trends. For instance, funds focused on technology or electric vehicles may offer excellent growth potential as demand in these sectors rises globally.

High Return Potential: Thematic funds often outperform broader market indices due to their concentrated exposure to high-growth sectors. However, this comes with higher volatility and potential for higher returns over time.

Easy Diversification within a Theme: Rather than picking individual stocks, thematic funds provide diversification within a sector, reducing the risk of relying on a single stock or company. This gives you broad exposure to multiple companies in the same industry.

How to Choose and Invest in Thematic Mutual Funds

Once you’ve decided to explore thematic mutual funds, the next step is selecting the right fund. Below are some guidelines to help you make an informed decision:

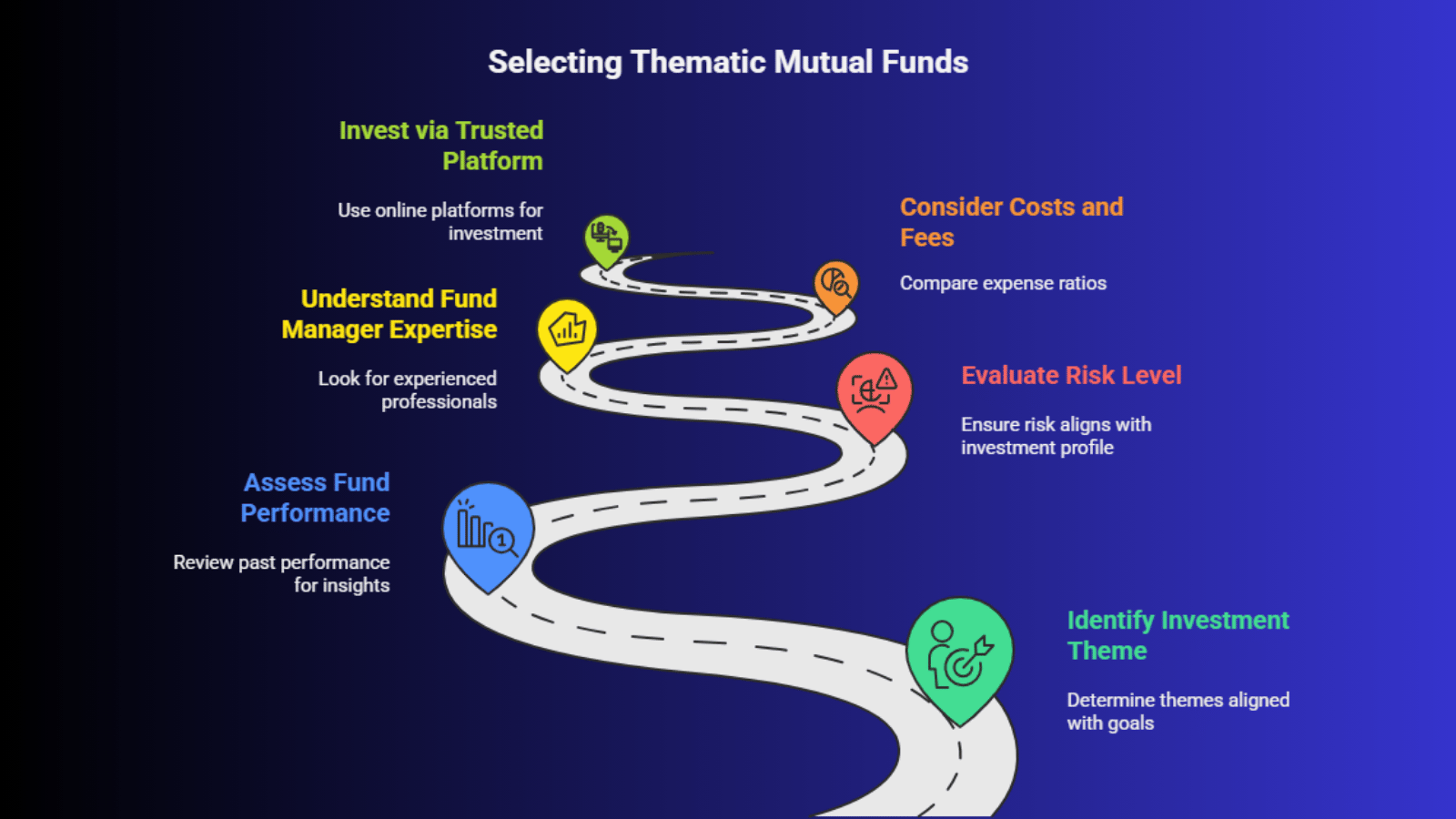

1. Identify Your Investment Theme

Start by identifying the themes that align with your investment goals. For example, if you are passionate about sustainable investing, you might choose funds focused on environmental, social, and governance (ESG) factors or renewable energy.

2. Assess the Fund’s Performance

Look at the performance history of the thematic fund over different time periods. While past performance does not guarantee future results, it provides insight into how the fund has performed in various market conditions.

3. Evaluate the Risk Level

Thematic funds often come with higher risk due to their concentrated nature. Some sectors, like technology or biotechnology, can be volatile, and the success of the fund is tied to the performance of the theme itself. Make sure the risk level aligns with your investment profile.

4. Understand the Fund Manager’s Expertise

Thematic funds depend heavily on the expertise of the fund manager. Look for funds managed by experienced professionals who have a deep understanding of the specific sector or theme the fund focuses on.

5. Consider Costs and Fees

Just like other mutual funds, thematic funds come with management fees and expenses. Make sure to compare the expense ratios of different funds and ensure the costs are justified by the potential for growth and returns.

6. Invest via a Trusted Platform

Once you have chosen the right thematic fund, you can invest in it through an online platform or mutual fund distributor. Many online platforms provide easy access to a variety of thematic funds, allowing you to start with small investments.

You should invest in thematic mutual funds only if you have a high-risk appetite and a long investment horizon (5-7+ years), as their concentrated focus leads to higher short-term volatility.

You should invest in thematic mutual funds only if you have a high-risk appetite and a long investment horizon (5-7+ years), as their concentrated focus leads to higher short-term volatility.

Key Risks of Thematic Mutual Funds

While thematic funds offer the potential for higher returns, they also carry some risks that investors should be aware of:

Risk Factor | What It Means | Impact on Investors | Who Should Be Cautious |

1. Higher Volatility | Thematic funds focus on a narrow investment theme, so price swings are sharper than diversified equity funds. | Portfolio value can fluctuate heavily in short periods, leading to emotional and financial stress. | Conservative and short-term investors |

2. Sector-Specific Risk | Performance completely depends on one sector or theme, such as IT, pharma, infrastructure, EV, or defence. | Any slowdown, policy shock, or demand contraction can hurt returns across the entire portfolio. | Investors without sector knowledge |

3. Overconcentration Risk | The majority of assets are invested in closely related stocks instead of spreading across industries. | Losses get amplified if the theme underperforms since there are limited fallback sectors. | Investors lacking diversification elsewhere |

4. Timing Risk | Returns depend heavily on when you enter the theme’s growth cycle. | Entering a theme at peak valuation can result in long years of poor returns. | Momentum-driven investors |

5. Regulatory & Policy Risk | Sector-focused funds are highly sensitive to government rules, taxes, and regulations. | A single rule change can wipe out profits across multiple portfolio companies. | Risk-averse and income-focused investors |

To capitalise on megatrends like AI or clean energy, actively invest in thematic mutual funds now, ensuring you use a Systematic Investment Plan (SIP) to average your purchase cost and mitigate timing risk.

Final Thoughts

Investing in thematic mutual funds offers a unique opportunity to capitalize on specific market trends and sectors that are expected to grow. These funds provide exposure to high-growth industries, offering potential for higher returns. However, it’s important to understand the risks, including sector volatility and concentration risk.

Unlike diversified funds, invest in thematic mutual funds to gain exposure to a broad, future-focused idea (e.g., consumption, digital transformation) that cuts across multiple traditional economic sectors.

Once you’ve selected a thematic mutual fund that aligns with your goals, log in to your investment platform to begin investing. Take the time to research, consult with a financial advisor, and ensure the fund fits your overall investment strategy.