Inflation is often described as the silent thief of the Indian household. In a country where we take great pride in our saving habits, it is a hard reality to accept that the money tucked away in a traditional savings account or a cupboard is losing value every single day. For most of us, the goal of saving is to secure our future, but without understanding the impact of inflation on your savings, that security might be an illusion.

With the Indian economy experiencing various cycles of price rises in fuel, food, and services, the traditional middle-class strategy of relying solely on Fixed Deposits (FDs) is being challenged. To maintain your standard of living in cities like Mumbai, Delhi, or Bengaluru, you must recognize how inflation and purchasing power are directly linked to your long-term wealth.

The Reality of Rising Costs: Inflation and Purchasing Power

In the Indian context, inflation is most easily understood through the lens of the Consumer Price Index (CPI). When you hear that inflation is at 6%, it means that a basket of goods that cost ₹100 last year now costs ₹106. This is the core of the decline in purchasing power. Your numerical balance remains the same, but the "real" value of that money has shrunk.

Think back to the cost of a liter of petrol or a cylinder of LPG ten years ago compared to today. The price increase is not just a one-off event; it is a continuous process that eats into your monthly budget. If your income or your savings do not grow at a rate faster than these price hikes, you are effectively moving backward financially. This makes it vital to monitor the inflation impact on savings across all your bank accounts.

The Math of Real Returns in India

To truly grow your wealth, you need to look at "Real Returns." This is the interest you earn minus the rate of inflation. If your bank gives you 3% interest on a savings account but inflation is at 6%, your real return is -3%. You are losing money by keeping it "safe."

Investment Option | Typical Nominal Return | Average Inflation | Real Return (Actual Gain) |

Savings Account | 3.0% | 6.0% | -3.0% |

1-Year Fixed Deposit | 6.5% | 6.0% | +0.5% |

Public Provident Fund (PPF) | 7.1% | 6.0% | +1.1% |

Diversified Equity Mutual Funds | 12.0% | 6.0% | +6.0% |

As the table shows, many traditional Indian favorites barely keep your head above water. This is why financial experts suggest that you rebalance your investments to include assets that offer higher growth potential.

The Long-Term Inflation Impact on Savings

The inflation impact on savings is most dangerous when we look at long-term goals like retirement or a child’s marriage. In India, education and healthcare inflation often trend much higher than the general food or fuel inflation, sometimes hitting double digits.

The inflation impact on savings is most dangerous when we look at long-term goals like retirement or a child’s marriage. In India, education and healthcare inflation often trend much higher than the general food or fuel inflation, sometimes hitting double digits.

1. The Cost of Education

If a professional degree costs ₹10 lakhs today, at an education inflation rate of 10%, that same degree will cost approximately ₹26 lakhs in just 10 years. If you are saving based on today’s prices, you will face a massive shortfall. You must rebalance your investments frequently to ensure your corpus is growing fast enough to meet these specific inflated costs.

2. Retirement and Lifestyle Creep

Many Indians aim for a "crorepati" status for retirement. However, ₹1 crore twenty years from now will not have the same lifestyle value it has today. Because of the link between inflation and purchasing power, your retirement planning must account for a world where basic groceries and electricity cost three times as much as they do now.

3. The Vulnerability of Idle Cash

Keeping large amounts of cash at home for "emergencies" beyond a certain point is a strategy that guarantees a loss. The inflation impact on savings is most aggressive against cash. While it provides a sense of physical security, its ability to buy goods diminishes every month.

Strategies to Rebalance Your Investments for Growth

To protect your family's future, you cannot afford to be a passive investor. You need a portfolio that fights back against rising prices. This requires you to rebalance your investments toward assets that have a history of beating the inflation rate in India.

To protect your family's future, you cannot afford to be a passive investor. You need a portfolio that fights back against rising prices. This requires you to rebalance your investments toward assets that have a history of beating the inflation rate in India.

1. Moving Toward Equities and Mutual Funds

Historically, the Indian stock market has been one of the few avenues that consistently outpace inflation over the long term. By investing in diversified equity mutual funds, you are betting on the growth of Indian companies. These companies can raise their prices when their costs go up, which protects their profits and, by extension, your investment. This is a primary way to offset the inflation impact on savings.

2. The Role of Real Estate and Gold

Gold has a special place in Indian households, and for good reason. It is often seen as a hedge against a falling currency. Similarly, real estate usually sees price appreciation that keeps pace with or exceeds inflation. However, these are "illiquid" assets, meaning you can't sell them instantly. A balanced approach means you should rebalance your investments to have a mix of liquid stocks and solid assets like gold or property.

3. Debt Instruments and Tax Efficiency

When you invest in FDs or Bonds, you must also consider taxes. In India, interest from FDs is taxed at your income tax slab rate. If you are in the 30% bracket, a 7% FD actually gives you less than 5% after tax. When inflation is 6%, you are losing value. To fix this, you should rebalance your investments into more tax-efficient options like Debt Mutual Funds or tax-free bonds, where applicable.

Why You Must Rebalance Your Investments Every Year

Financial planning is not a "set it and forget it" task. The economy changes, and so should your portfolio. When you rebalance your investments, you are essentially doing a health check on your money.

Correcting Asset Drift

Suppose you started with 50% in stocks and 50% in FDs. If the stock market has a great year, your portfolio might now be 70% stocks. This makes your savings too risky. Conversely, if stocks underperform, inflation and purchasing power risks increase because your money isn't growing fast enough. By choosing to rebalance your investments, you sell some of what has grown too much and buy what is undervalued.

Adapting to Life Stages

As you get closer to your goals, your ability to take risks changes. A person at age 30 can handle the volatility of stocks to beat the inflation impact on savings. However, someone at 58 needs to protect their capital. Even then, you cannot move entirely to cash because you might live another 25 years in retirement. You must rebalance your investments to find a "sweet spot" that offers both protection and a little bit of growth.

Protecting Your Inflation and Purchasing Power

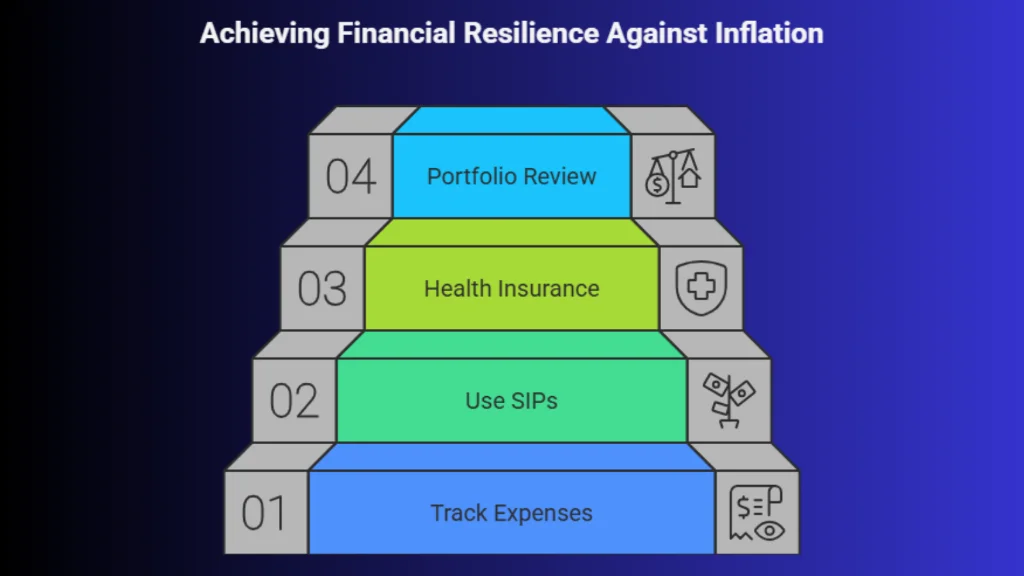

To stay ahead of the curve, you need to be proactive. Here is a simple roadmap to ensure the inflation impact on savings doesn't ruin your financial dreams:

To stay ahead of the curve, you need to be proactive. Here is a simple roadmap to ensure the inflation impact on savings doesn't ruin your financial dreams:

Step 1: Track Your Expenses

Don't just look at the national inflation numbers. Look at your own bills. Are your school fees going up? Is your health insurance premium rising? This is your "Personal Inflation Rate," and it is the real hurdle your savings need to clear.

Step 2: Use Systematic Investment Plans (SIPs)

SIPs are a great way to fight the inflation impact on savings because they allow you to buy more units when prices are low and fewer when prices are high. This "rupee cost averaging" is a powerful tool for the Indian investor.

Step 3: Don't Ignore Health Insurance

Medical inflation in India is significantly higher than general inflation. A single hospital stay can wipe out years of savings. Having a robust health insurance policy ensures that you don't have to dip into your investments, allowing them to continue growing and maintaining your inflation and purchasing power.

Step 4: Annual Portfolio Review

Make it a habit to rebalance your investments every April at the start of the financial year. Check if your current mix of gold, cash, stocks, and FDs is still capable of beating a 6% or 7% inflation rate.

Summary: Building an Inflation Proof Future

The journey to financial freedom in India is paved with disciplined saving and smart investing. While the inflation impact on savings is a constant challenge, it is not an unbeatable one. By staying informed about how inflation and purchasing power affect your daily life, you can make better choices about where your money lives.

Avoid the trap of "safe" investments that lose value in real terms. Instead, be bold enough to rebalance your investments toward growth-oriented assets. This is the only way to ensure that the lakhs you save today will still have the power to buy your dreams tomorrow.

To protect savings and rebalance portfolios against inflation, investors can consider Loan Against Mutual Funds (LAMF) as a way to access liquidity without disrupting long-term investment strategies.