Equity mutual funds are one of the most popular investment options for investors looking to grow their wealth over the long term. These funds pool money from multiple investors to invest in a diversified portfolio of stocks, offering potential for higher returns compared to more conservative investment options. However, to truly make the most of equity mutual funds, it’s essential to understand the strategies, risks, and benefits involved.

Many investors choose to buy equity mutual funds to participate in long-term market growth through professionally managed portfolios. In this blog, we will discuss how to make the most of your investment in equity mutual funds, covering key strategies, tips, and factors to consider to maximize your returns.

Why Invest in Equity Mutual Funds?

Equity mutual funds invest in the stock market, which offers higher growth potential than traditional investments such as bonds or savings accounts. You can buy equity mutual funds with small, regular contributions, making it easy to start building wealth consistently. The primary benefits of equity mutual funds include:

Diversification: By investing in a variety of stocks, equity mutual funds reduce the risk of putting all your money into one company or industry. This diversification helps protect your investment from market volatility.

Professional Management: Equity mutual funds are managed by professional fund managers who have the expertise and experience to analyze stocks, monitor market conditions, and adjust the fund’s holdings accordingly. This removes the need for individual investors to make all the decisions themselves.

Long-Term Growth: Equity markets tend to grow over the long term, and equity mutual funds allow you to capture this growth through capital appreciation and, in some cases, dividends. If you have a long-term investment horizon, equity mutual funds can help build wealth steadily.

Strategies to Maximize Returns with Equity Mutual Funds

Equity mutual funds offer strong long-term growth potential, but maximizing returns requires thoughtful planning and disciplined investing. By understanding market cycles, choosing the right fund categories, and maintaining a strategic investment approach, investors can enhance overall performance. With the right strategies in place, equity mutual funds can become a powerful tool for building wealth over time.

1. Choose the Right Type of Equity Mutual Fund

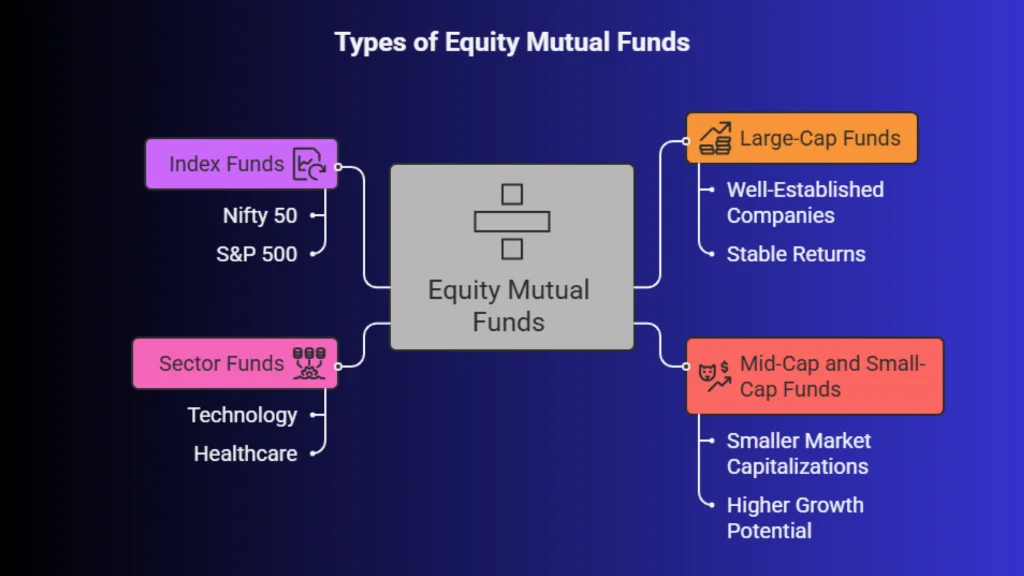

There are several types of equity mutual funds, each with its own investment focus. Before you buy equity mutual funds, evaluate the fund’s track record, risk level, and expense ratio to ensure it aligns with your goals. To make the most of your investment, it’s important to select the right type of equity fund based on your risk tolerance and financial goals.

Large-Cap Funds: These funds invest in well-established, financially stable companies with a large market capitalization. They tend to be less volatile and provide more stable returns, making them ideal for conservative investors.

Large-Cap Funds: These funds invest in well-established, financially stable companies with a large market capitalization. They tend to be less volatile and provide more stable returns, making them ideal for conservative investors.

Mid-Cap and Small-Cap Funds: These funds invest in companies with smaller market capitalizations, which have higher growth potential but also come with higher volatility. They’re ideal for investors willing to take on more risk for potentially higher returns.

Sector Funds: These funds focus on specific sectors of the economy, such as technology, healthcare, or finance. Sector funds can be riskier, but they offer the potential for higher returns if the sector performs well.

Index Funds: These funds aim to replicate the performance of a specific index, such as the Nifty 50 or S&P 500. Index funds typically offer lower fees and are a good choice for passive investors who want broad market exposure.

2. Start Early and Stay Consistent

One of the key strategies to maximize returns from equity mutual funds is to start investing early. The earlier you start, the more time your investments have to grow. Equity markets tend to increase in value over time, and long-term investors are more likely to benefit from this growth.

Compounding Benefits: Starting early allows your investments to benefit from the power of compounding. By reinvesting dividends and capital gains, you can accelerate the growth of your portfolio.

Systematic Investment Plan (SIP): Consider using SIPs to invest in equity mutual funds. SIPs allow you to invest a fixed amount regularly, regardless of market conditions. This strategy not only helps you build wealth consistently but also reduces the risk of market timing, as you buy more units when prices are low and fewer when prices are high.

3. Focus on Fund Performance and Expense Ratios

When selecting equity mutual funds, it’s important to look beyond just the returns. While past performance is not a guarantee of future results, it can provide valuable insights into the fund's consistency and ability to perform in different market conditions. Look for funds with a solid track record of delivering competitive returns over the long term.

Review Historical Performance: Analyze the fund’s performance over 3, 5, and 10 years. Compare its performance with the relevant benchmark index and its peers to gauge its effectiveness.

Check the Expense Ratio: The expense ratio represents the annual fees that the fund charges for managing the investments. Lower expense ratios are generally preferable, as they reduce the costs of investing. High fees can erode your returns over time.

4. Diversify Your Equity Mutual Fund Portfolio

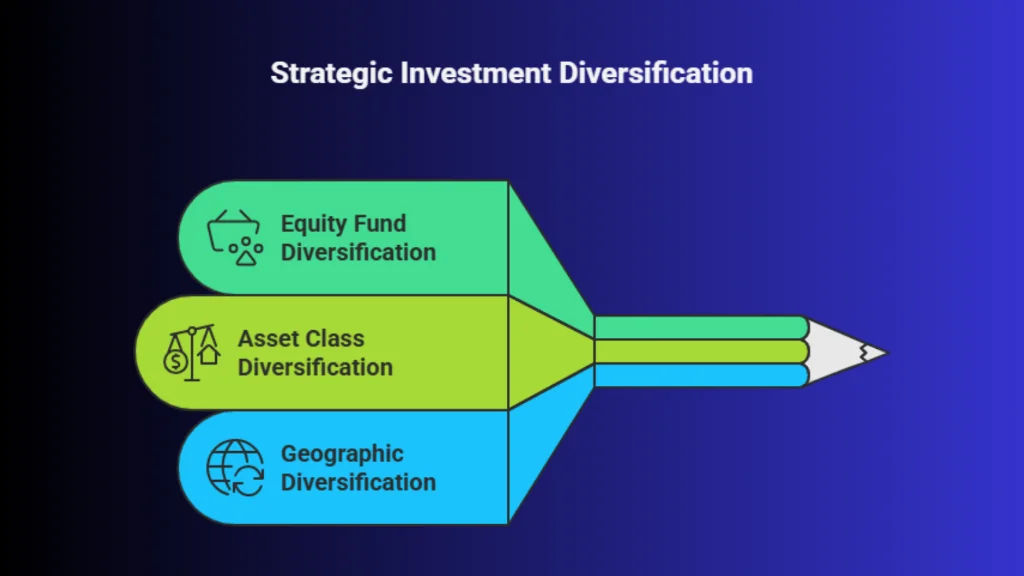

Even within equity mutual funds, diversification is key. Avoid putting all your money into one type of fund or a single sector. Diversifying across different types of equity funds, such as large-cap, mid-cap, and sector-focused funds, helps reduce the risk of your portfolio being too exposed to one market segment.

Across Asset Classes: Along with diversifying within equity funds, consider diversifying across asset classes by including other investments like debt mutual funds or real estate. A well-balanced portfolio can reduce overall risk while still offering growth potential.

Across Asset Classes: Along with diversifying within equity funds, consider diversifying across asset classes by including other investments like debt mutual funds or real estate. A well-balanced portfolio can reduce overall risk while still offering growth potential.Geographic Diversification: Some equity mutual funds invest in international markets, allowing you to gain exposure to global economic growth. Geographic diversification helps mitigate the impact of any one country’s economic fluctuations on your overall portfolio.

5. Review and Rebalance Your Portfolio Regularly

While equity mutual funds are generally long-term investments, it’s important to review your portfolio periodically to ensure it aligns with your financial goals. Rebalancing your portfolio involves adjusting the asset allocation to keep it in line with your desired risk level and objectives.

Monitor Fund Performance: Track the performance of your funds regularly to see if any underperform or no longer fit your goals. If necessary, replace them with better-performing funds.

Adjust for Life Changes: As your financial goals change over time, adjust your asset allocation accordingly. For example, as you near retirement, you may want to shift to more conservative investments.

Conclusion

Equity mutual funds are a powerful tool for building wealth over time, offering the potential for higher returns and greater diversification than many other investment options. By choosing the right funds, starting early, diversifying your portfolio, and staying consistent with your investments, you can maximize your returns and work toward achieving your financial goals.

Most investment apps now allow you to buy equity mutual funds instantly through SIPs or lump-sum investments, providing a fast and convenient experience. If you’re looking to invest in equity mutual funds, now is a great time to explore your options and start building your portfolio. Log in today to browse top equity mutual funds and start making the most of your investments.