The digital asset landscape in 2026 looks vastly different from the speculative frenzy of the early 2020s. We have officially entered the Institutional Era, where digital assets are no longer just a hobby for tech enthusiasts but a core component of professional portfolios. If you are a business leader or investor looking to diversify, this Bitcoin vs Ethereum investment guide 2026 is designed to help you understand where to put your money for the long haul.

The primary shift this year is the end of the traditional four-year cycle. Instead of wild booms and busts, we are seeing a sustained bull market supported by massive institutional inflows from spot ETFs and corporate treasuries. In this environment, the most effective way to manage your wealth is to invest regularly through SIPs. This approach allows you to ignore daily noise and focus on building a robust cryptocurrency investment that grows alongside the global transition to digital finance.

When we look at Bitcoin vs Ethereum, we are no longer looking at competitors. We are looking at two different types of digital infrastructure. Bitcoin acts as a digital vault, while Ethereum functions as the operating system for global finance. Balancing these two requires a strategy where you contribute regularly through SIPs, ensuring exposure to both long-term value storage and utility-driven growth.

Bitcoin in 2026: The Global Reserve Asset

Bitcoin has cemented its position as Digital Gold in 2026. With nearly 20 percent of the total supply now held by institutions and corporations such as MicroStrategy, available supply on exchanges has dropped to record lows. This Bitcoin vs Ethereum investment guide 2026 highlights that Bitcoin has become less volatile than many high-growth technology stocks, making it a reliable anchor for any cryptocurrency investment portfolio.

The macroeconomic environment of 2026, defined by high sovereign debt and cooling interest rates, has made Bitcoin’s fixed supply more attractive than ever. It is increasingly viewed as a hedge against currency debasement. However, with prices significantly higher and many analysts seeing a long-term floor above $100,000, the best way for new investors to enter is to invest regularly through SIPs. This removes the psychological pressure of waiting for a dip that may never arrive.

The macroeconomic environment of 2026, defined by high sovereign debt and cooling interest rates, has made Bitcoin’s fixed supply more attractive than ever. It is increasingly viewed as a hedge against currency debasement. However, with prices significantly higher and many analysts seeing a long-term floor above $100,000, the best way for new investors to enter is to invest regularly through SIPs. This removes the psychological pressure of waiting for a dip that may never arrive.

In the ongoing Bitcoin vs Ethereum debate, Bitcoin stands out for simplicity. It has a single purpose: to remain scarce and secure. As the network matures, Bitcoin Layer 2 solutions are expanding functionality, enabling smart contracts and faster settlement while preserving security. This adds a layer of value to long-term cryptocurrency investment strategies.

Ethereum in 2026: The Global Settlement Layer

If Bitcoin is digital gold, Ethereum is the infrastructure powering modern finance. Following the successful Pectra and Fusaka upgrades in late 2025 and early 2026, Ethereum achieved dramatic improvements in scalability and transaction costs. Fees have dropped to near-zero levels through Layer 2 rollups, positioning Ethereum as the backbone for tokenization, stablecoins, and real-world asset settlement.

For serious cryptocurrency investors, Ethereum offers something Bitcoin does not: native yield. Through proof of stake, holders can earn approximately three to five percent annually by securing the network. This yield component has made Ethereum especially attractive for institutional investors and corporate treasuries. Investing regularly through SIPs into Ethereum means accumulating both capital appreciation and network rewards.

The Bitcoin vs Ethereum decision in 2026 often comes down to stability versus growth. Ethereum’s ecosystem continues expanding into real-world assets, decentralized identity, and global payments. SIP-based investing allows investors to participate in this growth without having to track every protocol upgrade or market cycle.

The Bitcoin vs Ethereum decision in 2026 often comes down to stability versus growth. Ethereum’s ecosystem continues expanding into real-world assets, decentralized identity, and global payments. SIP-based investing allows investors to participate in this growth without having to track every protocol upgrade or market cycle.

Why You Should Invest Regularly Through SIPs

Market timing remains a losing strategy, even for professionals. In 2026, crypto markets operate continuously, and as traditional financial systems move toward extended trading hours, the line between crypto and equities continues to blur. This Bitcoin vs Ethereum investment guide 2026 strongly recommends investing regularly through SIPs to benefit from cost averaging.

A SIP-based cryptocurrency investment strategy turns volatility into an advantage. Fixed contributions buy fewer units when prices rise and more units when prices fall. Over long periods, this approach typically lowers the average purchase cost compared to lump-sum investing. Whether choosing Bitcoin or Ethereum, discipline matters more than short-term predictions.

Key Benefits of SIP Investing

Emotional discipline by removing the stress of daily price tracking

Lower volatility impact through consistent accumulation

Compounding growth through Ethereum staking rewards

Alignment with institutional accumulation strategies

Flexibility to start with small, affordable monthly contributions

Bitcoin vs Ethereum Portfolio Allocation for 2026

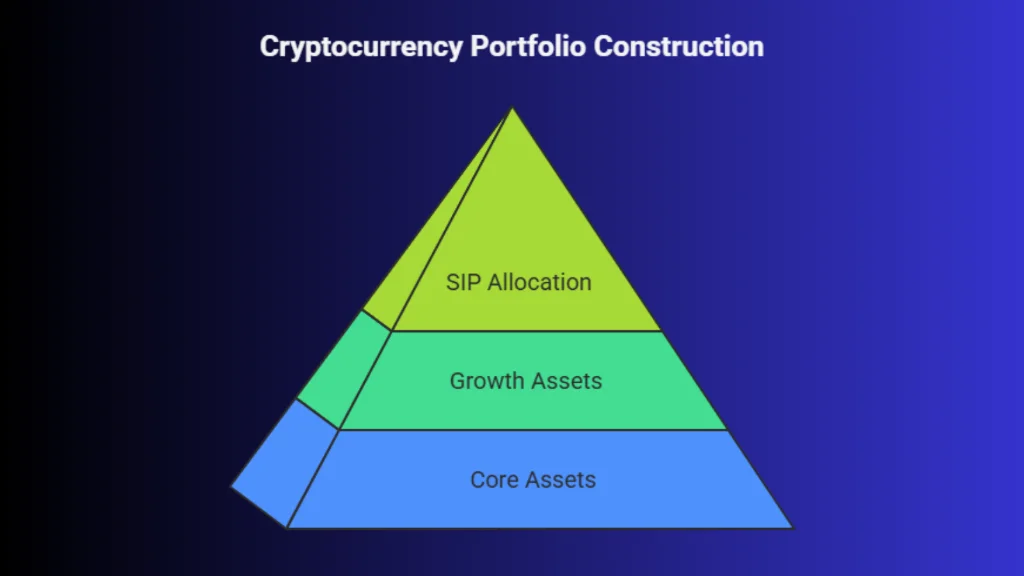

In 2026, cryptocurrency portfolio construction has matured beyond speculative bets into a structured, institutional-style approach. Investors are increasingly adopting a core and satellite model, where stability and liquidity form the foundation while growth-oriented assets provide upside.

Within this framework, Bitcoin and Ethereum serve distinct but complementary roles. Bitcoin acts as the core defensive asset, while Ethereum functions as the primary growth and yield engine. A disciplined SIP-based allocation across both allows investors to participate in long-term digital asset adoption while managing risk effectively.

Within this framework, Bitcoin and Ethereum serve distinct but complementary roles. Bitcoin acts as the core defensive asset, while Ethereum functions as the primary growth and yield engine. A disciplined SIP-based allocation across both allows investors to participate in long-term digital asset adoption while managing risk effectively.

Factor | Bitcoin (Core Asset) | Ethereum (Growth Satellite) |

Suggested Allocation | 50-60% of portfolio | 30-40% of portfolio |

Primary Role | Long-term store of value | Growth and income-generating asset |

Investment Thesis | Digital gold and macro hedge | Global settlement layer for finance |

Risk Profile | Lower relative volatility | Higher volatility with higher upside |

Liquidity | Highest liquidity in crypto markets | High liquidity with growing depth |

Institutional Adoption | Widely held by ETFs, funds, and treasuries | Increasing adoption by corporates and asset managers |

Yield Generation | No native yield | 3-5% annual staking yield |

Use as Collateral | Globally accepted digital collateral | Accepted but less standardized |

Ecosystem Exposure | Limited but secure | Expanding ecosystem including RWAs, DeFi, and stablecoins |

Best SIP Use Case | Portfolio stability and capital preservation | Compounding growth and income |

Investor Profile | Risk-aware, long-term allocators | Growth-oriented, yield-seeking investors |

Final Verdict: Which Is the Better Investment?

There is no single winner in the Bitcoin vs Ethereum debate. Bitcoin excels as a long-term store of value, while Ethereum offers participation in the future of decentralized applications and on-chain finance. Both play essential roles in a modern investment portfolio.

The most important lesson from this Bitcoin vs Ethereum investment guide 2026 is that execution matters more than prediction. Waiting for perfect entry points often leads to missed opportunities. Setting up automated SIPs and staying consistent is the strategy that compounds over time.

As traditional finance and digital assets continue to converge, cryptocurrency investments are likely to become a core part of global portfolios. Staying invested, diversified, and disciplined will matter far more than short-term price fluctuations. While the Bitcoin vs Ethereum choice is personal, LAMF provides a structured way to participate in this new era of digital investing.