The market of 2026 feels a bit like a high-speed train navigating dense fog. On one hand, you have the AI Lift, a surge in productivity and earnings driven by the broadening AI ecosystem. On the other hand, you have the Economic Drift, characterized by sticky inflation around 3% and a Federal Reserve that is taking a very shallow path to interest rate cuts.

If you are managing a portfolio today, you have likely noticed that market concentration has reached historic highs. The top tech giants now represent a staggering portion of global equities, making stock portfolio risk management more than just a buzzword; it is a survival skill. In this blog, we will break down exactly how to protect your gains and stay resilient through the next market cycle.

Why 2026 Requires a New Hedging Playbook

The old rules of diversification are not dead, but they have certainly changed. For years, investors relied on the 60/40 split (60% stocks and 40% bonds) to balance risk. But in 2026, the correlation between these two asset classes has tightened. When stocks drop, bonds do not always provide the cushion they once did.

Instead, institutional managers are shifting toward a Total Portfolio Approach. This means looking at how every single asset, from your tech stocks to your gold holdings, interacts under stress. To effectively hedge your investments, you need to think about active risk. This isn't just about owning different things; it is about owning things that behave differently when the market hits a bump.

The 2026 Macro Checklist

Before you pick a hedging tool, you need to know what you are hedging against. Current research from major global firms points to three main triggers:

The AI Normalization: A potential creative destruction phase where the market realizes that AI valuations have outpaced actual earnings.

Sticky Inflation: Persistent price pressures that keep the Fed from cutting rates as fast as the market hopes.

Geopolitical Trade Shifts: The lingering aftershocks of global trade wars and shifting supply chains.

Strategic Techniques for Stock Portfolio Risk Management

To successfully achieve portfolio hedging, you need a toolkit that can handle both a paper cut (a 5% dip) and a broken bone (a 20% crash). Most investors fail because they use the same tool for every problem.

To successfully achieve portfolio hedging, you need a toolkit that can handle both a paper cut (a 5% dip) and a broken bone (a 20% crash). Most investors fail because they use the same tool for every problem.

1. The Power of Equity Long-Short Strategies

One of the most effective ways to manage stock portfolio risk management in 2026 is through Equity Long-Short (ELS) strategies. Instead of just betting that the whole market goes up, you go long on high-quality companies with strong fundamentals and short on those with weak earnings or overstretched valuations.

This market-neutral approach is particularly valuable right now because equity dispersion is at its highest in years. By going short on the losers, you generate a profit that offsets losses in your main holdings during a downturn.

2. Using Protective Puts and Index Options

Think of options as an insurance policy for your stocks. If you are worried about a correction in the tech sector, you can purchase out-of-the-money put options on the Nasdaq 100 (QQQ).

The Benefit: If the market drops 15%, your put option increases in value, covering a significant portion of your portfolio’s decline.

The Cost: You pay a premium for this insurance. In 2026, smart investors are laddering these options by buying them at different expiration dates to keep the costs manageable.

Strategy | Ideal Scenario | Risk Level |

Protective Puts | Targeted protection for a specific stock or sector. | Low (Limited to premium paid) |

Inverse ETFs | Quick, liquid hedge against broad market drops. | Medium (Daily rebalancing issues) |

Gold ETFs | Hedge against currency debasement and geopolitical risk. | Low to Medium |

Market Neutral Funds | Profit from stock picking regardless of market direction. | Medium (Manager dependent) |

Broadening Your Horizon: Portfolio Hedging Beyond Stocks

If 2025 taught us anything, it is that US exceptionalism has its limits. To truly hedge your investments, you must look outside the US borders and the traditional stock exchange.

The Renaissance of Real Assets

In 2026, secular winners are found in physical infrastructure. Data centers, cell towers, and even senior housing are providing stable, inflation-linked returns that traditional stocks cannot match. Because these assets are driven by long-term trends like digitalization and demographics, they don't always move in sync with the S&P 500.

Gold: The Ultimate Disaster Policy

Gold has seen record inflows in late 2025, and for good reason. As central banks navigate fiscal deficits and currency volatility, gold remains the primary tool for portfolio hedging. In a world where trade wars can erupt overnight, holding an asset that isn't someone else's liability is common sense. Many analysts are eyeing $3,000+ per ounce as a realistic target for 2026 if inflation remains sticky.

Pro Tip: Don't just buy gold bars. Consider Gold Overlay strategies where you use currency hedging to protect your gold gains from fluctuations in the US Dollar.

Step-by-Step: Implementing Stock Portfolio Risk Management

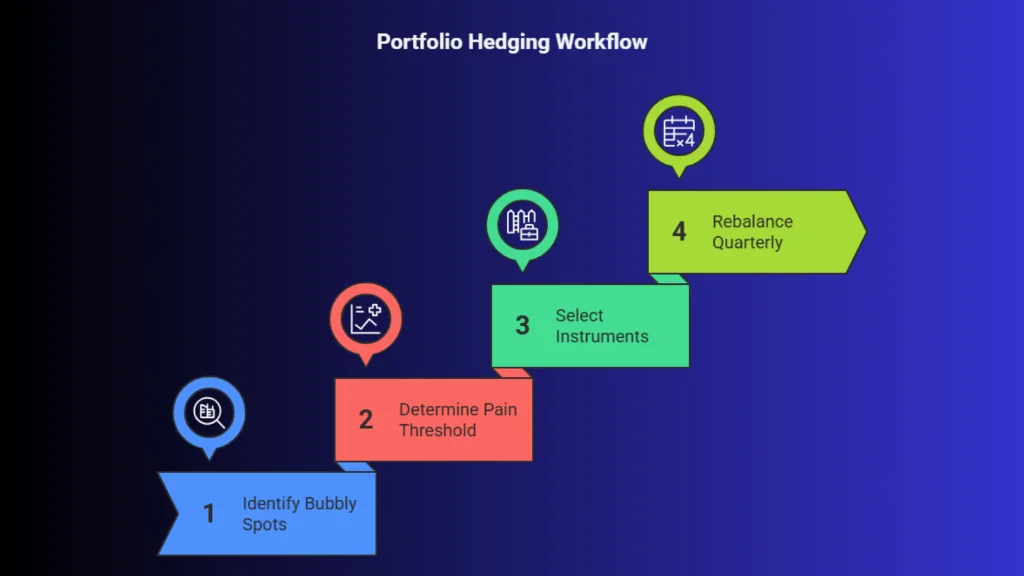

If you are ready to shore up your defenses, follow this professional workflow to portfolio hedging:

If you are ready to shore up your defenses, follow this professional workflow to portfolio hedging:

Identify the Bubbly Spots: Look at your holdings. Are you 30% in AI-related stocks? That is a concentration risk.

Determine Your Pain Threshold: How much of a drop can you handle before you panic-sell? If it's 10%, you need to hedge your investments starting at that level.

Select Your Instruments: Choose a mix of liquid diversifiers (like Active ETFs) and hard hedges (like Put Options).

Rebalance Quarterly: A hedge that worked in January might be useless by June. 2026 is a year for nimble management, not set it and forget it.

Staying Resilient in a Volatile Year

The 2026 market doesn't have to be scary; it just requires a shift in mindset. Moving from a growth-at-all-costs strategy to a disciplined stock portfolio risk management approach is what separates the veterans from the amateurs. By understanding the macro drivers, from the AI normalization to sticky inflation, you can position yourself to capture the upside while sleeping soundly through the volatility.

Remember, the goal of portfolio hedging is not to be right about the crash; it is to be prepared for it. Whether you use protective puts, increase your gold allocation, or diversify into specialized real estate, the most important step is to act before the volatility spikes. Start by auditing your concentration today, and you will find that the ability to hedge your investments is your greatest competitive advantage.

If you’re looking to hedge your investments and rebalance your portfolio for 2026, explore how Loans Against Mutual Funds can help protect your equity exposure while positioning your portfolio for long-term growth.