Investing in mutual funds can be an effective way to grow your wealth. However, understanding the tax implications of these investments is crucial for maximizing returns and managing your financial future. Taxes on mutual funds are typically based on the fund's earnings and the investor’s holding period, among other factors.

Understanding mutual fund tax implications helps investors plan redemptions better and avoid unexpected tax liabilities.

How Mutual Funds Are Taxed

Mutual funds are subject to taxes in two main areas: dividends and capital gains. The tax treatment of each type of income varies based on factors like the type of mutual fund, the holding period, and your overall tax bracket. Before you invest or redeem, you should check mutual fund tax implications to choose the most tax-efficient option for your portfolio.

1. Capital Gains Tax

Capital gains are the profits you make when you sell an investment for more than you paid for it. In the context of mutual funds, capital gains can be realized in two ways:

Short-Term Capital Gains (STCG): If you sell mutual fund units within three years of purchasing them, the profit is classified as short-term capital gains. STCG is taxed at a higher rate, which is 15% in India (for investments in equity funds). For other funds (like debt funds), the rate may be higher.

Long-Term Capital Gains (LTCG): If you hold your mutual fund units for more than three years, any profit from selling them is considered long-term capital gains. For equity mutual funds, LTCG is taxed at 10% (for gains exceeding ₹1 lakh in a financial year). For debt funds, the tax rate is 20% with indexation benefits, which can help reduce your tax liability.

It's essential to consider the capital gains tax when deciding whether to sell your mutual fund units, as the timing of the sale can have a significant impact on the tax rate you pay.

2. Dividend Tax

Mutual funds that distribute dividends pay out a portion of the income earned from the fund's investments, usually in the form of interest or stock dividends. These dividends are taxable and are subject to tax based on your income tax slab. The tax rate depends on whether the fund is equity-oriented or debt-oriented:

Mutual funds that distribute dividends pay out a portion of the income earned from the fund's investments, usually in the form of interest or stock dividends. These dividends are taxable and are subject to tax based on your income tax slab. The tax rate depends on whether the fund is equity-oriented or debt-oriented:

Equity Mutual Funds: Dividends received from equity mutual funds are taxed at a rate of 10% (for individuals in India) if the total dividend exceeds ₹5,000 in a financial year.

Debt Mutual Funds: Dividends from debt funds are taxed according to the investor's tax bracket. The dividend distribution tax for debt funds is applicable at the rate of 25% for individuals (plus applicable surcharge and cess). This tax is levied on the fund before the dividend is paid out to investors.

It is important to note that tax on dividends from mutual funds is paid by the investor, which differs from the capital gains tax where the tax is paid at the time of the sale of the units.

3. Taxation of Dividends Reinvested

In some cases, you may choose to reinvest the dividends you receive from a mutual fund rather than taking them as cash. Even if you reinvest the dividends, they are still subject to tax in the year they are distributed. The reinvested dividends will increase the cost of acquisition of your mutual fund units, which can help reduce future capital gains taxes when you eventually sell the units.

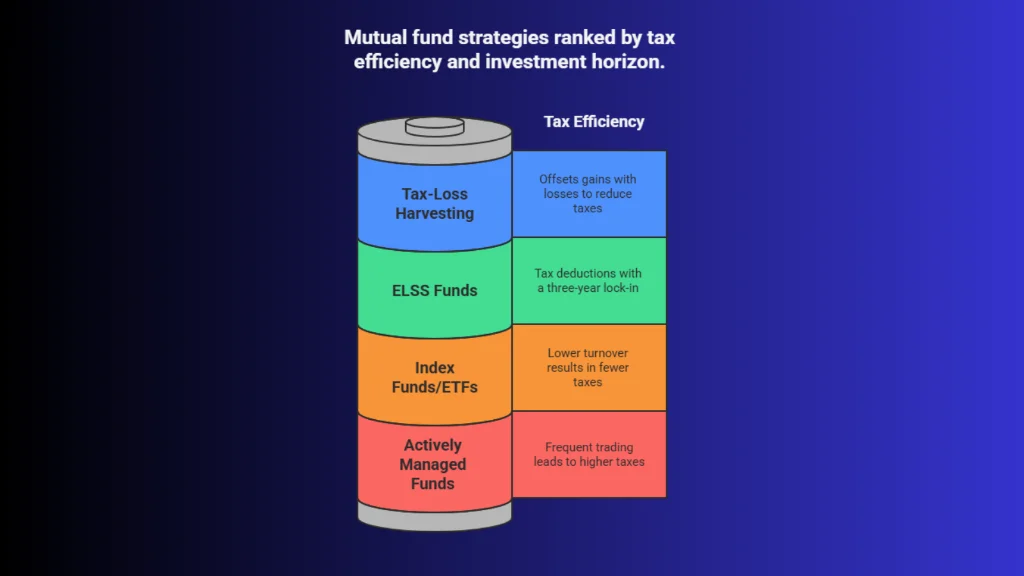

Tax-Efficient Mutual Fund Strategies

While taxes are a significant consideration when investing in mutual funds, there are strategies you can use to minimize your tax liabilities:

While taxes are a significant consideration when investing in mutual funds, there are strategies you can use to minimize your tax liabilities:

1. Invest for the Long Term

One of the most effective ways to reduce taxes on mutual fund investments is by holding them for the long term. By holding investments for more than three years, you qualify for long-term capital gains tax, which is usually lower than short-term capital gains tax. Additionally, long-term investing allows you to benefit from compounding, which can increase your wealth over time.

2. Invest in Tax-Saving Mutual Funds (ELSS)

Equity-linked savings schemes (ELSS) are a type of mutual fund that not only provides the potential for capital appreciation but also offers tax benefits under Section 80C of the Income Tax Act. By investing in ELSS funds, you can claim deductions of up to ₹1.5 lakh per year on your taxable income, which can reduce your overall tax liability.

ELSS funds typically have a three-year lock-in period, meaning that your investment cannot be redeemed before that time, ensuring that you stay invested for the long term.

3. Utilize Index Funds or Exchange-Traded Funds (ETFs)

Index funds and ETFs typically have lower turnover rates than actively managed funds. This means that there are fewer buy and sell transactions, resulting in lower capital gains distributions. Since fewer transactions occur, these funds tend to be more tax-efficient, especially for long-term investors. If you are looking for tax efficiency, index funds or ETFs may be a better option than actively managed funds, which often have higher turnover.

4. Offset Gains with Losses (Tax-Loss Harvesting)

Tax-loss harvesting is a strategy in which you sell mutual fund units that have incurred a loss to offset the capital gains from other investments. By realizing capital losses, you can reduce your taxable income and potentially lower your overall tax liability. This strategy can be especially useful if you have significant capital gains in other parts of your portfolio.

Strategy | How does it help reduce tax | Best suited for |

Choose growth over the dividend option | Growth plans are taxed only at redemption, while dividends are taxed immediately at your slab rate | Long-term wealth builders in higher tax brackets |

Use separate folios for different goals | Makes it easier to plan redemptions and control tax impact year-wise | Investors with multiple goals like retirement, house, and education |

Systematic withdrawal planning (SWP) | Spreads capital gains over multiple years, reducing yearly tax burden | Retirees and income-focused investors |

Stagger redemptions across financial years | Helps stay within lower tax slabs or exemption limits | High-value investors planning large exits |

Prefer debt funds for short-term parking | Can be more tax-efficient than FDs for some investors | Conservative and short-term investors |

Track grandfathered equity gains (pre-2018) | These gains remain tax-free under equity LTCG rules | Long-term equity investors |

Use family member portfolios smartly | Helps reduce the overall family tax outflow legally | HNIs and family-based planning |

Conclusion

Understanding the tax implications of mutual fund investments is crucial for making informed decisions and maximizing your returns. By learning about mutual fund tax implications early, you can protect more of your returns and build long-term wealth more efficiently. Whether it’s managing capital gains tax, minimizing dividend taxes, or investing in tax-efficient funds, being proactive about taxes can help you keep more of your investment gains.

By incorporating tax-efficient strategies into your investment plan, you can optimize your portfolio for both growth and tax savings. Log in to your investment platform today to explore mutual funds that align with your financial goals and tax strategies.