When you start planning your taxes, the first hurdle is usually the fear of locking your hard-earned money away for a decade or more. Most people hesitate to invest because they worry about liquidity, especially when traditional options like the Public Provident Fund (PPF) demand a 15-year commitment.

However, smart financial planning in 2026 allows you to reduce your taxable income while keeping your funds accessible. By choosing tax-saving investments with shorter horizons, you can balance your wealth creation goals with the need for emergency liquidity.

The focus of modern tax planning is no longer just about the deduction; it is about capital efficiency. Using a tax-saving without lock-in strategy, or at least the shortest possible lock-in, ensures that your money is not just "saved" but is also "available."

In the sections below, we will explore the highest-rated options that satisfy Section 80C requirements while offering the best liquidity profiles in the current market.

The Strategy Behind Tax Saving Without Lock-In Periods

Achieving a completely tax-saving without lock-in scenario under Section 80C is technically impossible because the law mandates a minimum holding period for all deduction-eligible instruments.

However, "short" is a relative term in finance. While a 15-year lock-in feels like a lifetime, a 3-year or 5-year window is often manageable for most working professionals. The goal is to avoid the "liquidity trap" where your net worth looks great on paper, but your bank balance is zero.

The secondary part of this strategy involves looking at the post-tax returns. A low lock-in is great, but if the tax on the gains is high, the investment loses its edge. In 2026, we see a clear divide between market-linked products like ELSS and fixed-income products like Tax-Saving FDs.

Understanding these nuances helps you build a portfolio that survives market volatility while providing the tax relief you need.

1. ELSS – Shortest Lock-In and Growth Option

ELSS is the most popular tax-saving investment for investors seeking equity-driven growth with the least lock-in. It combines market-linked returns with tax benefits, making it suitable for salaried individuals and long-term wealth builders who can tolerate short-term volatility while aiming to beat inflation efficiently.

ELSS is the most popular tax-saving investment for investors seeking equity-driven growth with the least lock-in. It combines market-linked returns with tax benefits, making it suitable for salaried individuals and long-term wealth builders who can tolerate short-term volatility while aiming to beat inflation efficiently.

Three-year lock-in is the shortest among all Section 80C instruments, allowing faster access to invested capital.

Minimum eighty percent equity exposure enables investors to benefit directly from long-term stock market growth.

Long-term return potential ranges between twelve to fifteen percent, historically outperforming most fixed-income tax-saving options.

SIP investments start from small amounts, promoting disciplined investing and reducing the impact of market timing.

Each SIP installment carries its own three-year lock-in period, influencing redemption flexibility and liquidity planning.

2. Tax-Saving Fixed Deposits – Capital Safety and Predictability

Tax-saving fixed deposits are designed for conservative investors prioritizing capital protection and certainty of returns. They offer guaranteed interest rates and simple execution, making them a preferred choice for risk-averse individuals who want tax benefits without exposure to market volatility or complex investment structures.

Fixed five-year lock-in enforces investment discipline but restricts early withdrawals under all normal circumstances.

Interest rates are fixed at investment, providing predictable returns and eliminating market-related uncertainty.

Deposits are regulated by the RBI and insured by DICGC, offering high safety for principal amounts.

Digital banking enables quick account opening without additional KYC or demat requirements.

Interest earned is fully taxable as per the income slab, reducing post-tax returns for higher-income investors.

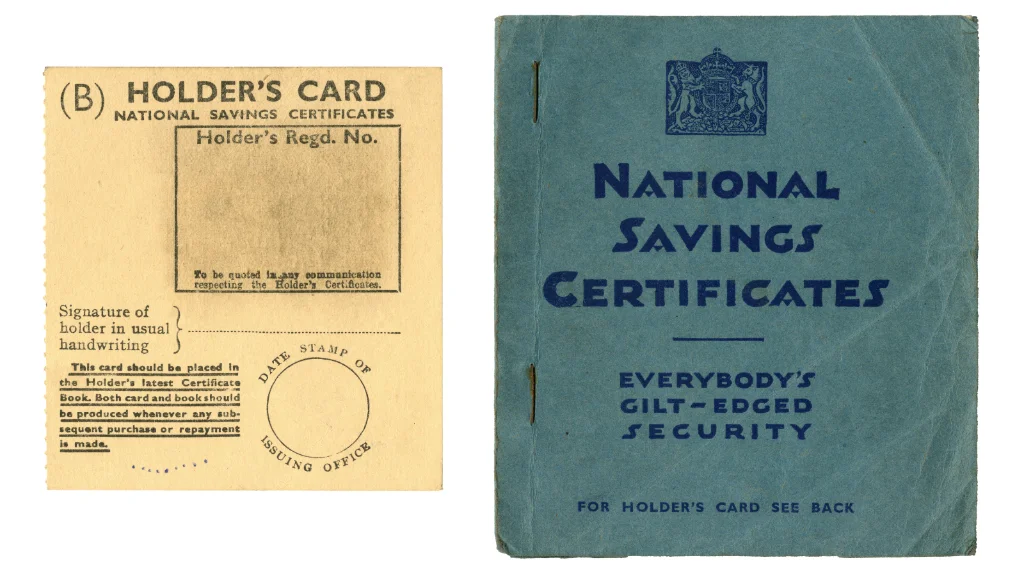

3. National Savings Certificate (NSC) – Government-Backed Stability

NSC is a government-supported savings instrument offering fixed returns with a sovereign guarantee. It suits investors seeking maximum safety and predictable growth, especially those uncomfortable with equity exposure. While returns are moderate, the assurance of capital protection and tax benefits makes NSC reliable for conservative tax planning.

NSC is a government-supported savings instrument offering fixed returns with a sovereign guarantee. It suits investors seeking maximum safety and predictable growth, especially those uncomfortable with equity exposure. While returns are moderate, the assurance of capital protection and tax benefits makes NSC reliable for conservative tax planning.

Five-year maturity provides medium-term commitment without market-linked risk or price fluctuations.

The Government of India's backing ensures zero credit risk and high trustworthiness of invested funds.

Interest compounds annually, enhancing returns through automatic reinvestment over the investment tenure.

Reinvested interest qualifies for Section 80C deduction, increasing effective tax-saving benefits annually.

No maximum investment limit allows parking surplus funds beyond tax-saving requirements safely.

4. ULIPs – Combined Investment and Insurance Solution

Modern ULIPs combine life insurance with market-linked investment under a single tax-saving structure. With improved transparency and lower charges, ULIPs suit investors seeking long-term financial planning, flexibility across asset classes, and tax-free maturity benefits alongside life cover protection.

Mandatory five-year lock-in ensures long-term commitment while discouraging premature withdrawals.

Allows switching between equity and debt funds without triggering any tax liability.

Tax-free maturity under Section 10(10D) applies when the annual premium remains within the prescribed limits.

Provides life insurance coverage, typically ten times the annual premium amount invested.

Best suited for disciplined investors seeking insurance and investment integration over long-term horizons.

5. Choosing the Right Option – Aligning Lock-In, Risk, and Tax Efficiency

Selecting a tax-saving instrument depends on individual goals, risk tolerance, income level, and liquidity needs. No single option fits everyone. The smartest approach balances growth, safety, and tax efficiency while aligning with long-term financial objectives rather than focusing only on immediate tax savings.

Selecting a tax-saving instrument depends on individual goals, risk tolerance, income level, and liquidity needs. No single option fits everyone. The smartest approach balances growth, safety, and tax efficiency while aligning with long-term financial objectives rather than focusing only on immediate tax savings.

Investors seeking growth and liquidity should prioritize equity-based instruments like ELSS.

Conservative investors should focus on guaranteed-return options such as FDs or NSCs.

Higher-income individuals benefit more from equity taxation advantages compared to fully taxable interest income.

ULIPs suit those wanting tax efficiency combined with long-term insurance protection.

Diversifying across multiple tax-saving options reduces risk and improves overall portfolio balance.

Feature | ELSS Mutual Funds | Tax-Saving FD | NSC | ULIP |

Lock-in Period | 3 Years | 5 Years | 5 Years | 5 Years |

Returns Type | Market-linked (High) | Fixed (Moderate) | Fixed (Moderate) | Market-linked (High) |

Risk Level | High | Low | Low | Moderate to High |

Tax on Returns | 12.5% (Gains > 1.25L) | As per the Tax Slab | As per the Tax Slab | Tax-Free (Conditions) |

Final Thoughts on Liquidity and Tax Planning

Choosing the right tax-saving tool is about matching the investment with your personal financial timeline. If you are young and can handle some volatility, ELSS is the undisputed winner due to its 3-year lock-in and high growth potential.

If you are nearing a major life event like a house purchase or a wedding in five years, the stability of a Tax-Saving FD or NSC might be more appropriate.

Ultimately, a tax saving without a lock-in mindset allows you to remain the master of your money. By avoiding 15-year traps when they aren't necessary, you ensure that your capital remains dynamic and ready for reinvestment.

As you refine your business and personal growth strategies, efficiency becomes essential. Just as you optimize taxes and capital allocation, discovery and liquidity should be equally strategic. With data-driven insights from discvr.ai, complemented by solutions like Loan Against Mutual Funds, you can identify new growth avenues and scale with precision while keeping long-term capital intact.