U.S. shutdown delays data, makes economy look like emerging market: Bloomberg

- U.S. economy

- shutdown

U.S. shutdown delays data, makes economy look like emerging market: Bloomberg

- U.S. economy

- shutdown

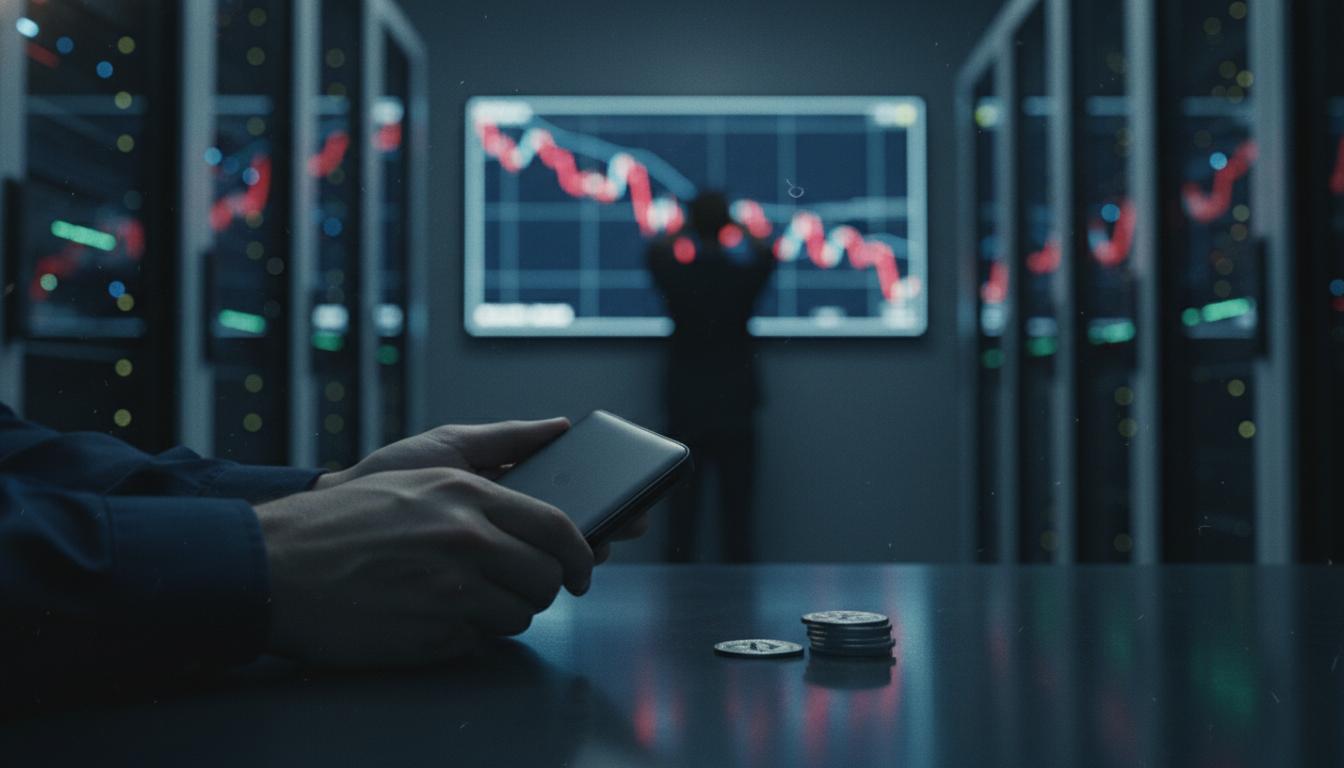

Bloomberg analysts said the shutdown’s data delays and fiscal standoffs are hurting U.S. credibility, comparing it to emerging-market instability.

- U.S. economy

- shutdown

- U.S. economy

- shutdown

- Bloomberg Economics

- credit spreads

- fiscal policy