Chinese Robot Maker AgiBot Plans Hong Kong IPO Next Year Valued Up to $6.4 Billion

- AgiBot

- AgiBot

- IPO

Chinese Robot Maker AgiBot Plans Hong Kong IPO Next Year Valued Up to $6.4 Billion

- AgiBot

- AgiBot

- IPO

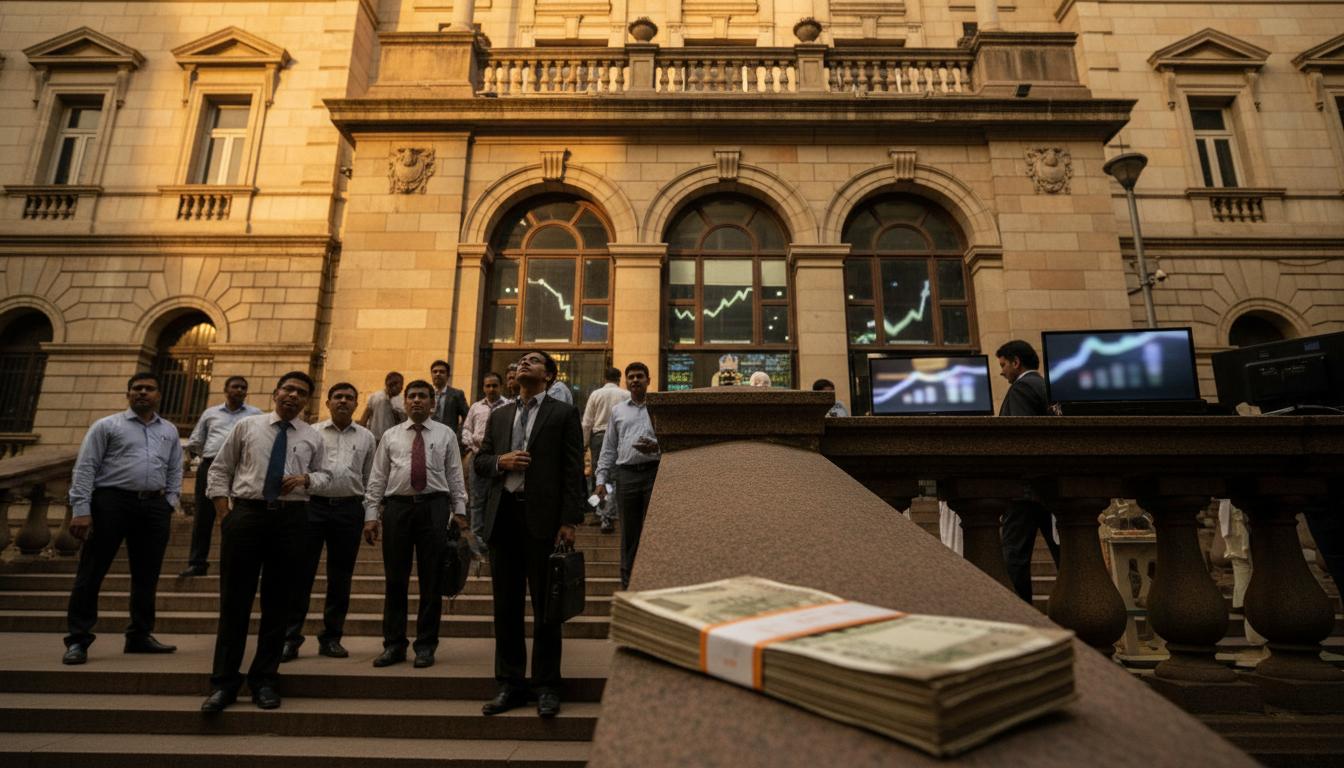

AgiBot gears up for a major Hong Kong IPO next year with a multi-billion dollar valuation, marking a milestone in AI robotics market expansion.

- AgiBot

- AgiBot

- IPO

- AgiBot

- IPO

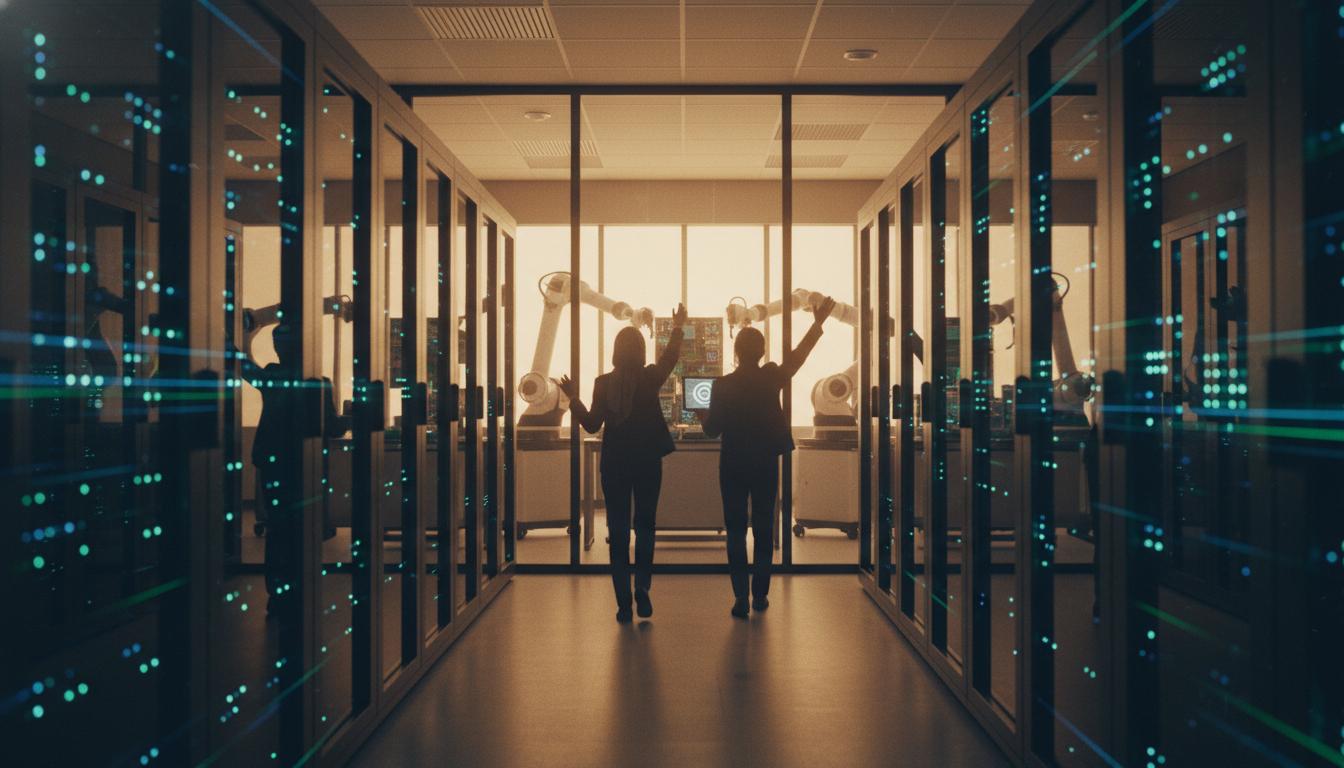

- robotics

- AI

- automation

- Hong Kong stock market