Neptune Insurance completes NYSE IPO

- Neptune Insurance Holdings

- ipo

- markets

Neptune Insurance completes NYSE IPO

- Neptune Insurance Holdings

- ipo

- markets

- Neptune Insurance Holdings

- ipo

- markets

- ipo

- markets

- stocks

- startups

- economy

25 financial news articles • 0 videos

Bitcoin and major altcoins reach new peaks, propelled by strong ETF flows and heightened market activity.

DeepSeek’s R1 AI model intensifies competition in cost-efficient, high-performance language models globally.

eBay’s AI adoption aims to level the playing field for smaller sellers and enhance operational efficiency.

eBay’s AI adoption aims to level the playing field for smaller sellers and enhance operational efficiency.

India’s central bank upgraded the GDP outlook, signaling robust domestic demand and investment momentum.

US equity markets reached record levels amid government shutdown worries, boosted by anticipation of continued AI-driven growth.

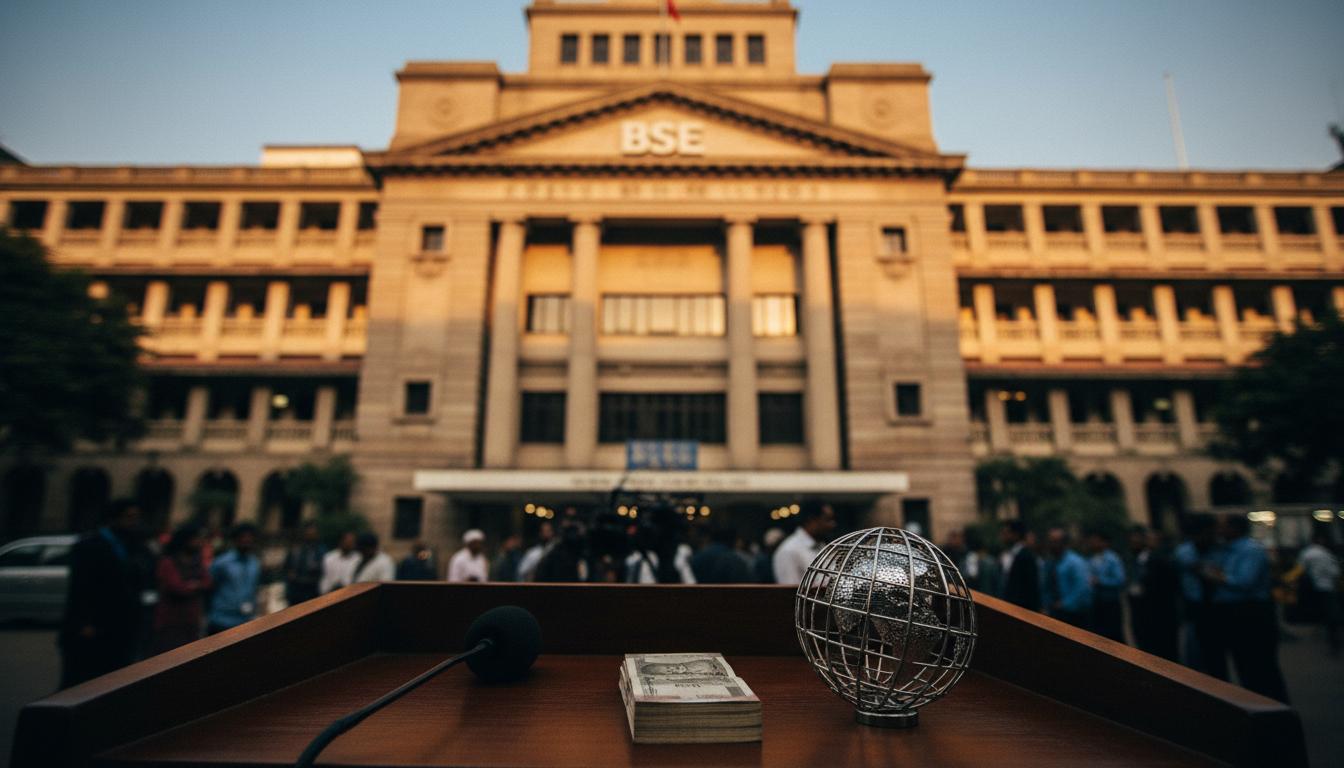

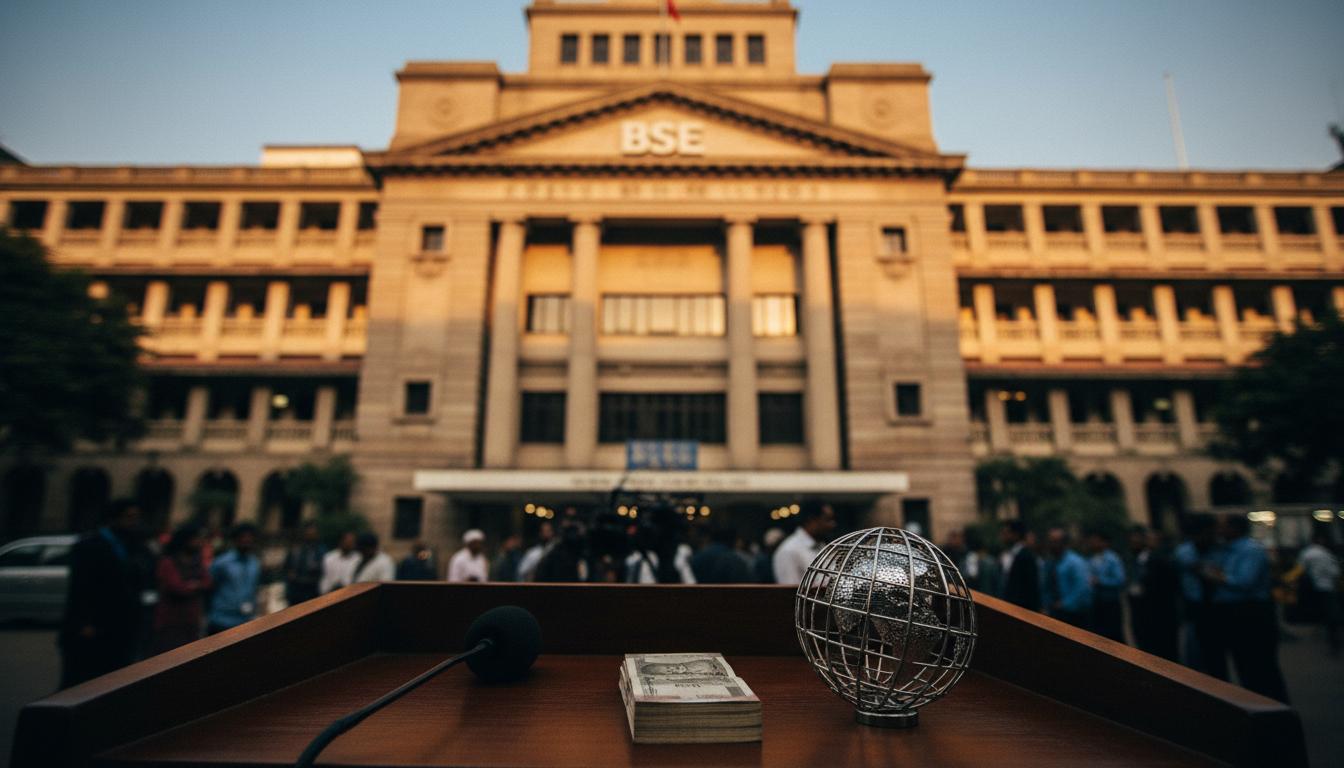

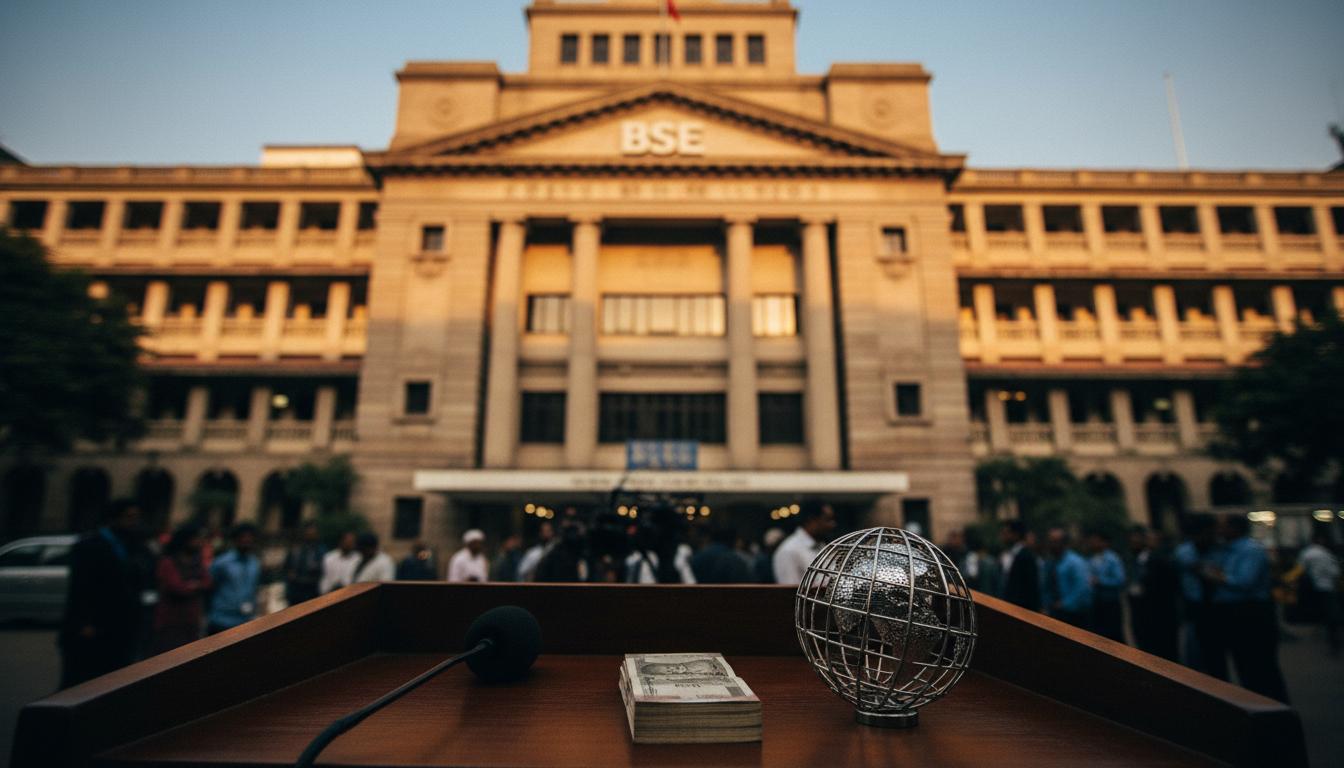

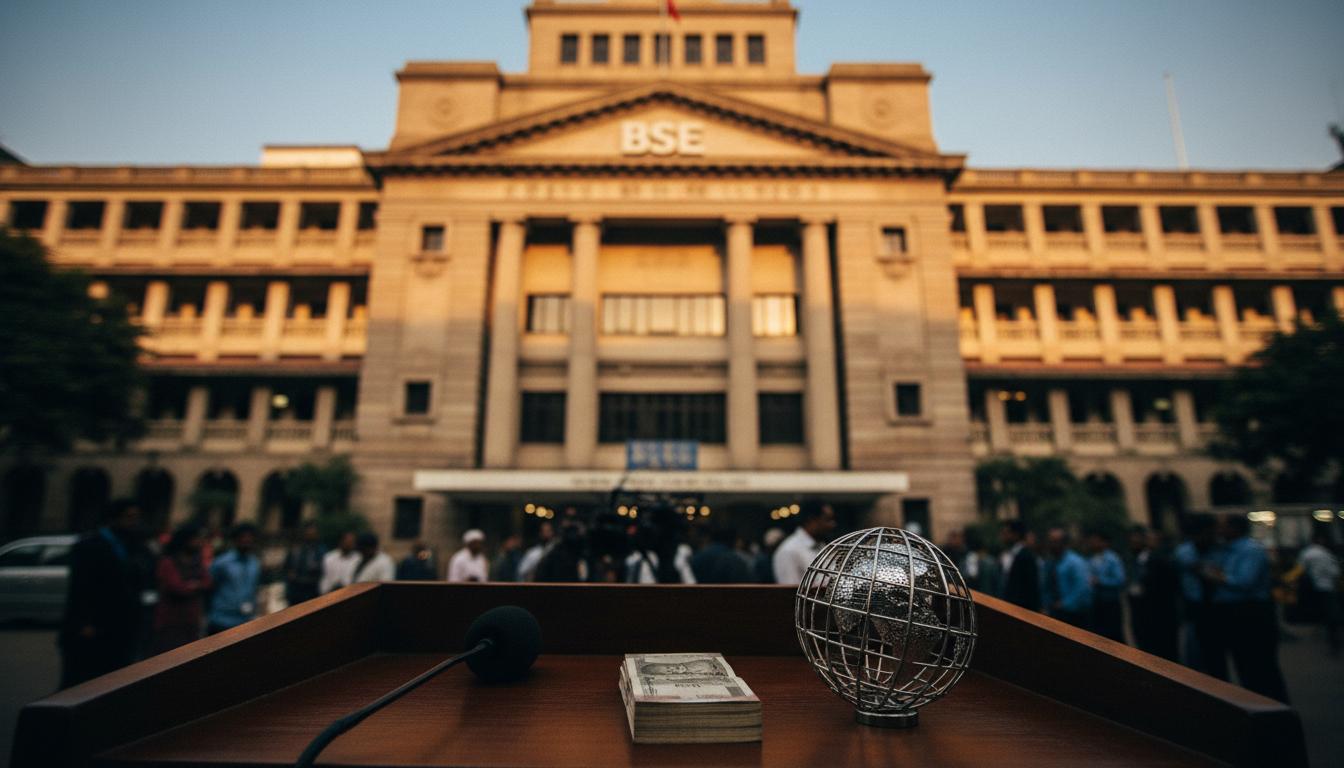

Indian stock exchanges reopened following a holiday break, with market sentiment buoyed by the RBI’s positive outlook and unchanged rate stance.

EPFO is simplifying international fund transfers, supporting mobile Indian professionals working abroad and returning to India.

EPFO’s digital push streamlines service delivery and access for India’s workforce, improving efficiency and member satisfaction.

EPFO maintains attractive returns and stability, with improved surplus positions powering steady 8.25% interest for members.

Utilize regulated products and gradual exposure, maintain strict compliance, and monitor global-economic factors to optimize US stock investments.

The Indian Economic Survey 2025 highlights that high participation of Indian investors in US markets may amplify the effects of a US stock correction domestically.

Investing in US stocks allows Indian investors to diversify globally, hedge against rupee depreciation, and gain ownership in leading multinational companies across key sectors.

Taxation for US assets includes US withholding and Indian capital gains taxes, with strict RBI remittance limits and annual reporting necessary for compliance.

Indians can invest in US equities via overseas brokerage accounts or SEBI-approved mutual funds and ETFs, offering multiple options across cost and compliance levels.

GST-led consumption growth is rising, but so is reliance on credit, creating both economic gains and financial risks for households and policymakers.

Navratri auto sales soared up to 100%, led by Maruti Suzuki’s 1.65 lakh deliveries and record growth from Mahindra and Tata Motors, boosted by GST cuts and festive offers.

GST cuts across 375 items triggered the highest Navratri sales in over a decade, lowering prices on vehicles and appliances and driving strong consumer upgrades.

Refund delays in 2025 are largely due to stricter verification, filing errors, and high-value claims. Ensuring accuracy and quick responses helps speed up processing.

Refund tracking is now fully digitized, allowing quick verification via the official income tax or NSDL platforms.